Bitcoin Retail Exhausted? Small-Transfer Volume Shows Long-Term Decline

On-chain data shows the Bitcoin volume associated with retail traders is in a long-term decline, despite the fact that the BTC price has been rising.

Small Bitcoin Transactions Have Been Going Down

As pointed out by CryptoQuant author Axel Adler Jr in a new post on X, small Bitcoin transactions have seen their volume follow a downtrend over the past year. “Small transfers” in this context refer to the moves involving a value of $1,000 or less.

Such transactions correspond to a portion of the activity from the retail investors, but doesn’t make up for all of the retail volume. Generally, retail transfers are considered to go up to $10,000 in value. Thus, the transactions up to $1,000 would only represent the activity from the smallest among the retail cohort.

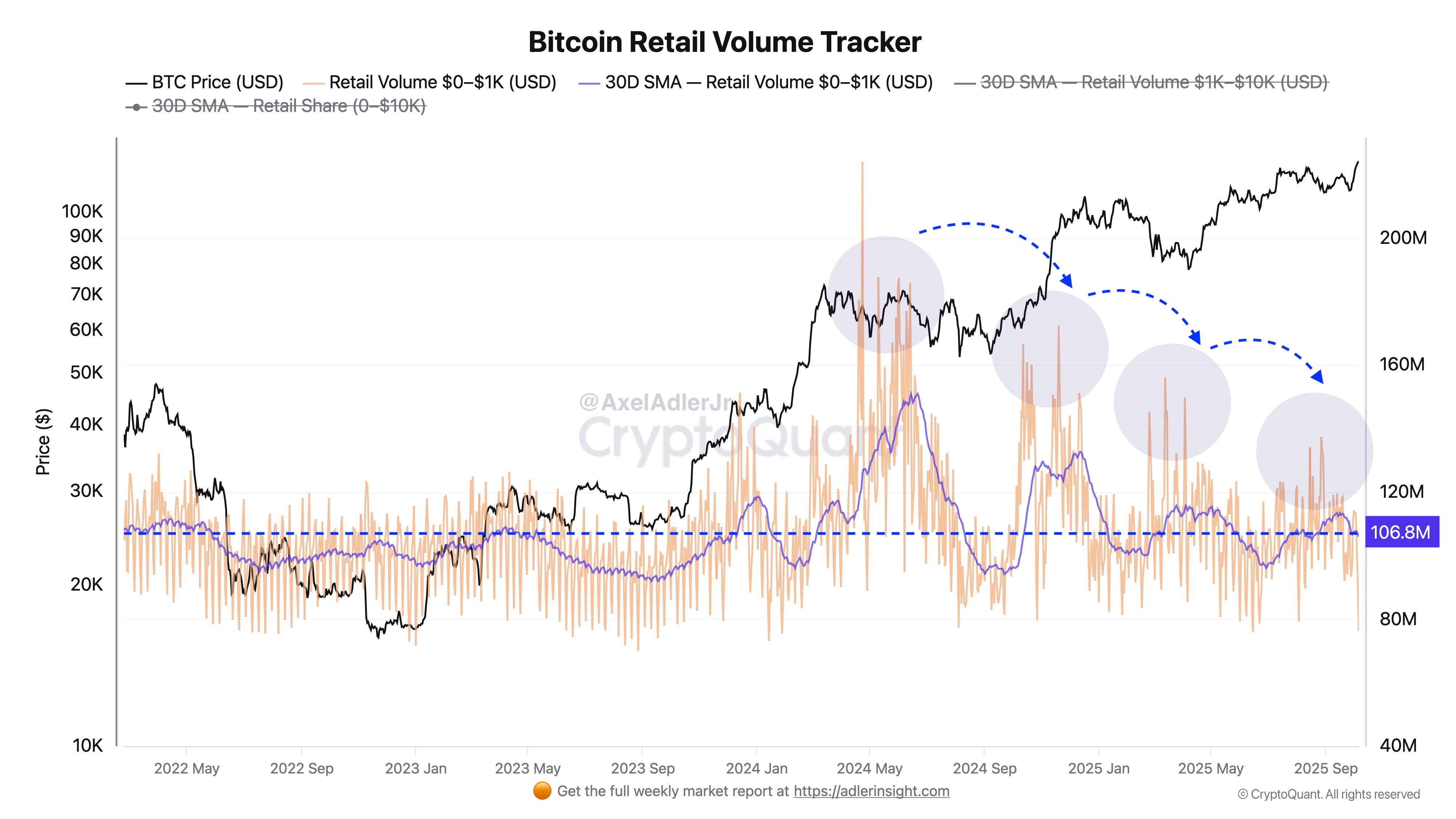

Now, here is the chart shared by the analyst that shows the trend in the Bitcoin volume of transactions valued at $1,000 or less over the last few years:

As displayed in the above graph, the Bitcoin volume associated with the small retail hands has seen a few different phases with high levels since Spring 2024. These peaks in activity from the smallest of investors have followed an interesting pattern, however; they have progressively been getting smaller with each high in activity.

The pattern has maintained despite the fact that the cryptocurrency’s price has seen a major jump in this period. Currently, the 30-day simple moving average (SMA) value of the indicator is sitting at $106.8 million, which is notably lower than some of the earlier peaks.

“There’s now an obvious divergence in the retail market: price going up, retail activity falling,” notes Adler Jr. “Essentially, this indicates retail player exhaustion.” It now remains to be seen whether interest will continue to decline from these small hands, or if the cryptocurrency will eventually grab attention from the cohort again.

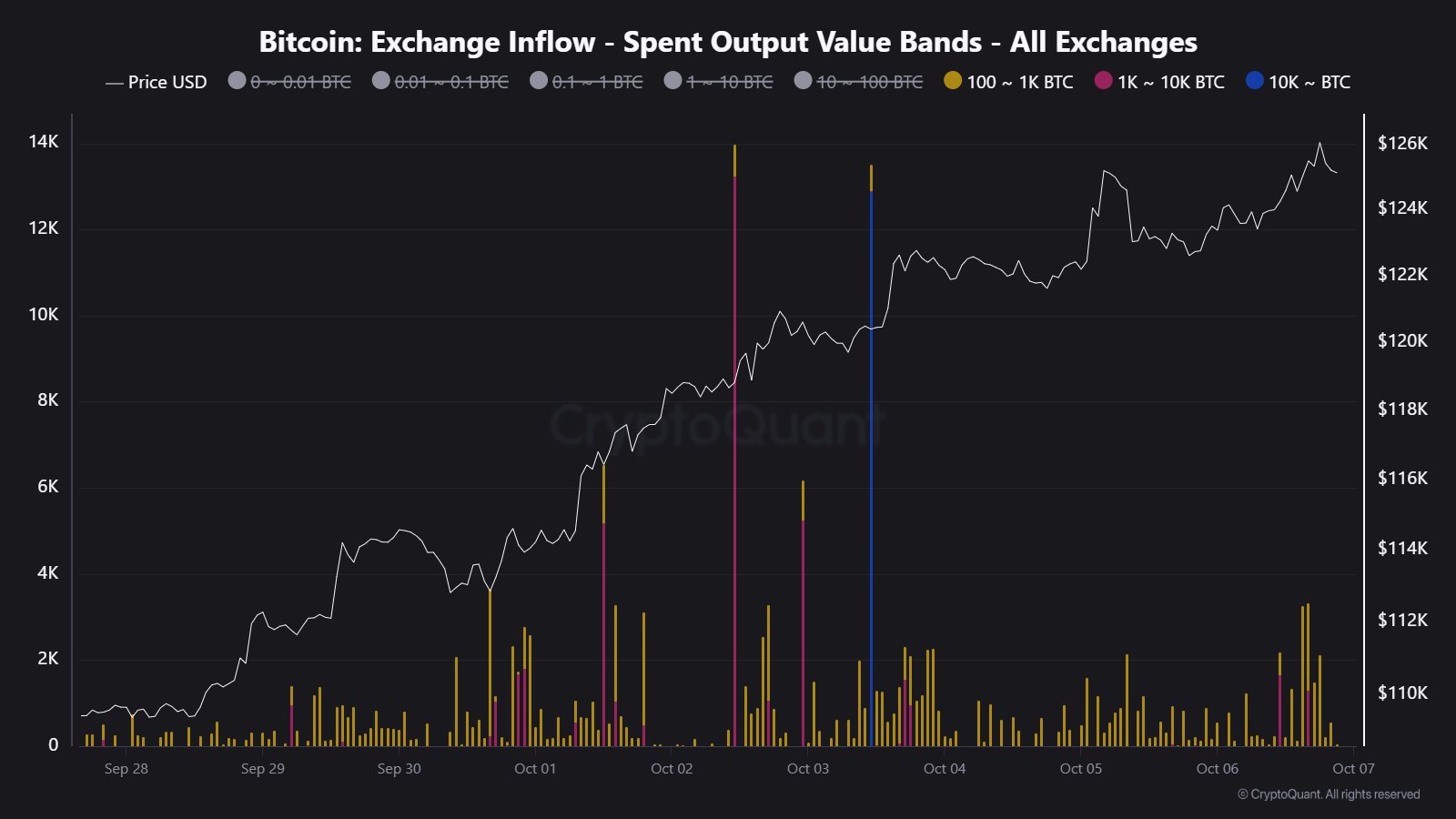

In some other news, the large players in the market have deposited a massive amount of Bitcoin to exchanges during the past day, as CryptoQuant community analyst Maartunn has explained in an X post.

In the above chart shared by Maartunn, the Exchange Inflow data of only the 100 to 1,000 BTC, 1,000 to 10,000 BTC, and 10,000+ BTC investors is shown. From this graph, it’s apparent that there have been some spikes in the metric recently, suggesting these humongous investors have been transferring to exchanges.

The majority of the latest inflows have come from the 100 to 1,000 BTC cohort, popularly called the “sharks.” The 1,000 to 10,000 BTC investors, the “whales,” have contributed to the remaining part of the inflows. In total, the groups have deposited 15,054 tokens to the centralized exchanges.

BTC Price

At the time of writing, Bitcoin is trading around $120,600, down more than 3.5% over the last 24 hours.