Top Crypto Gainers: ZEC, PUMP, ATH start the week strong with double-digit gains

- Zcash hits a new annual high with bulls eyeing further gains.

- Pump.fun bounces off $0.005000 psychological support, targeting a key resistance.

- Aethir recovers within a consolidation range as momentum remains indecisive.

Zcash (ZEC), Pump.fun (PUMP), and Aethir (ATH) emerge as top performers over the last 24 hours by posting double-digit gains. ZEC, PUMP, and ATH position for further gains as the broader market recovery gains momentum amid increased interest from traders.

Open Interest surge points to risk-on sentiment

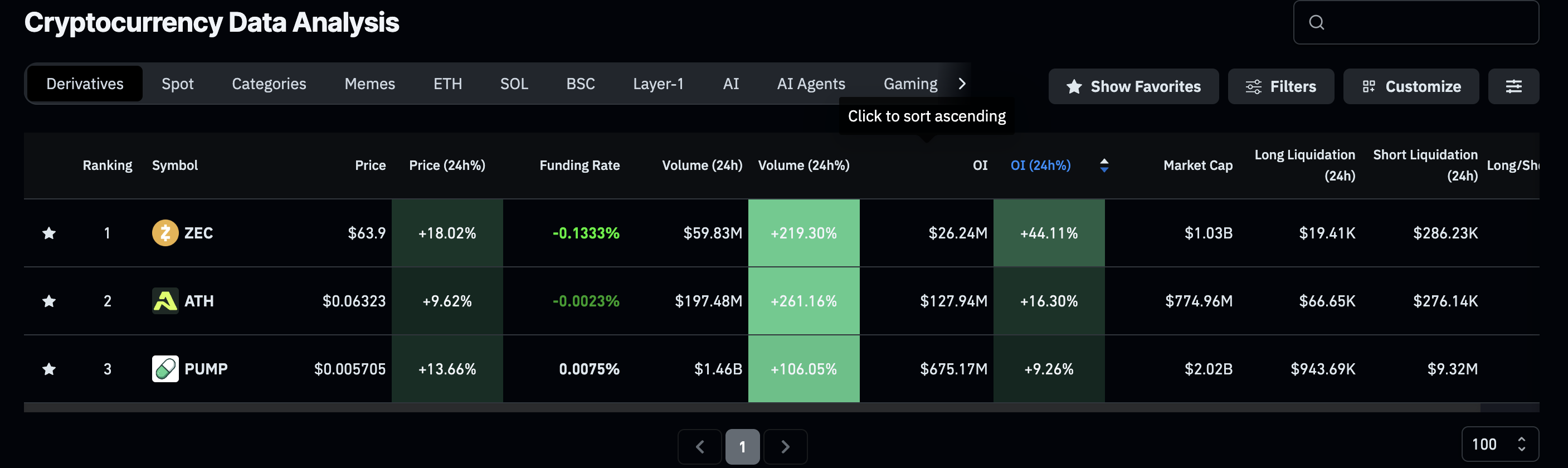

CoinGlass data shows a significant increase in Open Interest of Zcash, Pump.fun, and Aethir over the last 24 hours, indicating a risk-on sentiment among traders. The OI of ZEC, PUMP, and ATH has increased by 44%, 9% and 16% in the last 24 hours, reaching $26.24 million, $675.17 million, and $127.94 million, respectively.

Derivatives data. Source: CoinGlass

Zcash leads the crypto market recovery

Zcash edges higher by 8% at press time on Monday, advancing on the nearly 10% gains from the previous day. The uptrend in this privacy coin has reached an annual high and surpassed the 78.6% Fibonacci retracement level at $61.01, which is drawn from the $74.59 close of December 2 to the $29.17 close from March 10.

If ZEC marks a decisive close above this level, the rally could extend to the $74.59 peak.

The Relative Strength Index (RSI) currently reads 72 on the daily chart, indicating an entry into the overbought zone. Furthermore, the Moving Average Convergence Divergence (MACD) indicates a positive trend, with its signal line suggesting an increase in bullish momentum.

ZEC/USDT daily price chart.

On the flip side, if ZEC fails to hold above $61.01, it could extend the decline to the $52.11 support level, aligning with the 61.8% Fibonacci retracement level.

PUMP recovery faces key resistance

PUMP ticks down by 5% at press time on Monday, following the 15% jump on Sunday. The launchpad token marks a bounce back after a short consolidation above the $0.005000 psychological milestone on the 4-hour chart.

The recovery run faces resistance in reaching the $0.006162 level. Still, if the uptrend continues with a clean push above this level, PUMP could reach the $0.006788 level, last visited on September 21.

The RSI at 58 crosses above its halfway line, indicating a sudden spark in buying pressure. Furthermore, the MACD and its signal line maintain a steady uptrend, approaching the zero line.

PUMP/USDT daily price chart.

Looking down, if the intraday loss extends, PUMP could retest the $0.005000 psychological level.

Aethir takes a bullish shift from a consolidation

Aethir holds steady at the time of writing on Monday, following the 11% gains from Sunday. The recovery run in ATH targets the 78.6% Fibonacci retracement level at $0.06983, retraced from the $0.09326 high of December 12 to the $0.02413 low from April 7.

If Aethir surpasses this key resistance, it could reach the $0.09326 peak.

The momentum indicators on the same chart remain indecisive as the RSI steps below from the overbought zone to 63, maintaining a sideways shift. Additionally, the MACD holds near its signal line following a crossover on Tuesday.

ATH/USDT daily price chart.

On the downside, the 61.8% Fibonacci retracement level at $0.05565 remains a crucial support level.