Helius Takes First Step In Solana Treasury With $175 Million Purchase

Helius Medical Technologies has officially kick-started its Solana (SOL) treasury strategy with an initial acquisition of 760,190 tokens.

Helius Has Started Buying Solana With Its $500 Million Raise

As announced in a press release, Helius Medical Technologies has completed its first Solana purchase for its digital asset treasury strategy. In total, the company has acquired 760,190 SOL at an average price of $231 per token, spending about $175 million.

Originally a neurotech company, Helius Medical Technologies adopted a strategy focused on accumulating SOL earlier this month. Just a few days ago, the firm revealed that it had raised over $500 million for its digital asset treasury through a private placement offering.

Among the key backers were Pantera Capital, an American venture capital and hedge fund specializing in blockchain and digital assets, and Summer Capital, a Hong Kong-headquartered investment firm.

Joseph Chee, Executive Chairman at Helius, said:

It has been gratifying to receive shows of support from multiple stakeholders across the Solana ecosystem, including staking providers, DeFi protocols and others. We take our responsibility to maximize shareholder value seriously and are eager to execute against our plan.

With the latest purchase, Helius has begun deploying the raised capital into Solana. The company still has $335 million sitting in cash reserves for further treasury expansions, along with the potential to raise another $750 million if the stapled warrants from its private placement are exercised.

The press release noted that, besides SOL being among the top coins in on-chain activity-related metrics, it’s also financially productive by design, thanks to its 7% native staking yield.

Helius added:

As an independent treasury company, HSDT’s mission is to support the growth and security of tokenized networks by serving as a long-term holder of $SOL, in addition to continuing the development of its neurotech and medical device operations

The NASDAQ-listed neurotech firm isn’t the only one to pivot to a Solana treasury this month. Forward Industries, a company focused on design and manufacturing, also adopted a SOL strategy and closed a private investment in public equity (PIPE) earlier in September, raising $1.65 billion.

The financing was led by three key players in Galaxy Digital, Multicoin Capital, and Jump Crypto. Last Monday, the firm executed its first purchase worth $1.58 billion, instantly becoming the largest SOL treasury holder in the world.

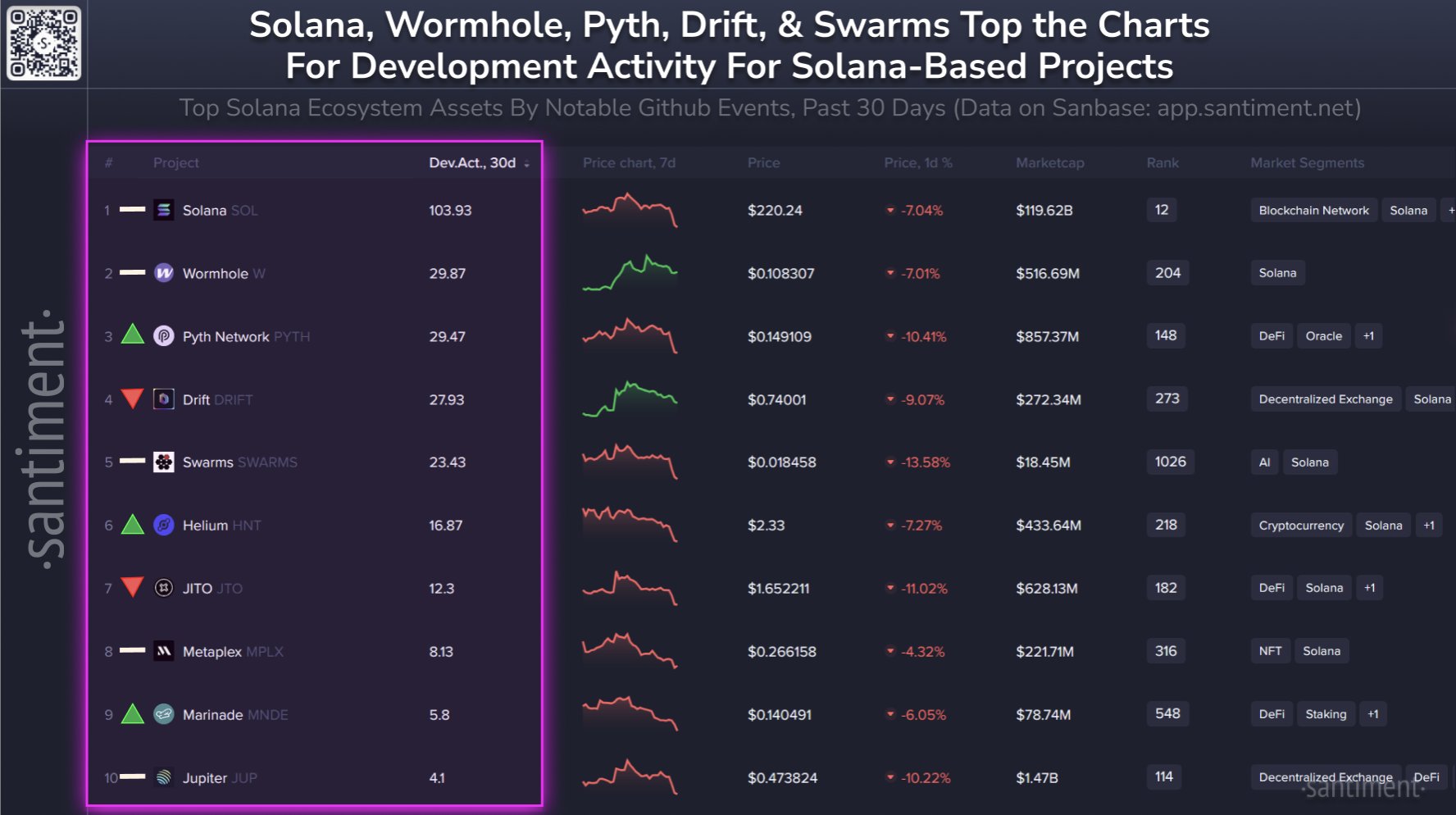

In some other news, analytics firm Santiment has shared an update on how projects in the Solana ecosystem compare against each other in terms of the Development Activity metric.

From the table, it’s visible that SOL continues to be the top-ranked coin with its developers putting in the most work on the project’s public GitHub repositories. Wormhole (W) and Pyth Network (PYTH) follow in second and third, respectively.

SOL Price

At the time of writing, Solana is trading around $218, down over 7% in the last week.