Gold hits $3,791 record before easing as Powell speech lifts volatility

- Gold benefits from softer PMIs and cautious Fed stance, with focus shifting to US GDP and core PCE data.

- Fed Chair Powell says downside employment risks justified rate cut, but inflation remains somewhat elevated and policy is data-dependent.

- Fed officials split: Bowman sees three cuts in 2025, while Bostic warns inflationary pressure could persist longer than expected.

Gold price climbs during the North American session on Tuesday, up by 0.73% after reaching a record high at $3,791 following the release of US economic data and Federal Reserve (Fed) Chair Jerome Powell's speech. At the time of writing, the XAU/USD trades at $3,772 after bouncing off daily lows of $3,736.

XAU/USD extends gains despite Powell’s cautious tone

Fed Chair Powell's speech mentioned that “downside risks to employment shifted balance of risks, prompting to last week’s rate cut,” and that the rate cut moved policy to a more neutral stance. Despite acknowledging employment risks, he said that “two-sided risks mean there is no risk-free path.”

Powell added that inflation has risen, remaining somewhat elevated, and that “reasonable base case is that tariff-driven inflation effects will be relatively short-lived.” He added that policy is modestly restrictive and that they remain data dependent.

Other policymakers crossed the wires. Atlanta Fed President Raphael Bostic said that he is open to the use of an inflation target range and expects further inflationary pressure ahead. Fed Governor Michelle Bowman said that she is looking for three cuts total in 2025 to support the labor market, while the Chicago Fed' Austan Goolsbee noted that the Fed needs to get inflation to 2%.

Earlier, S&P Global revealed that business activity in the US slowed in September after revealing both the Services and Manufacturing Purchasing Managers Index (PMIs).

Ahead this week, the US economic docket will feature Durable Goods Orders, the final print of the Gross Domestic Product (GDP) for Q2 and the Fed’s preferred inflation gauge, the core Personal Consumption Expenditures (PCE) Price Index.

Daily market movers: Gold price advances amid neutral Powell stance

- The US Dollar (USD) falls following Powell, undermined also by falling US Treasury yields hinting that market participants are pricing in rate cuts. The US Dollar Index (DXY), which tracks the American currency value against a basket of six peers, tumbles 0.07% to 97.22.

- US Treasury yields are falling with the 10-year Treasury note down three bps at 4.114%. US real yields — which correlate inversely to Gold prices —dove nearly three-and-a-half bps to 1.744%.

- Chair Powell revealed that the policy path is difficult, noting that they must look at both inflation and employment goals “equally.” He added that he still sees downside risks in the labor market. Regarding inflation, he says it's coming into better balance and that the Fed Beige Book showed the economy is growing modestly.

- Earlier, US economic data revealed that manufacturing and services activity slowed down in September. The S&P Global Manufacturing PMI dipped to 52.0 from 53.0 reported in the previous print. Meanwhile, the Services PMI fell to 53.9 from 54.5 in August.

- S&P Global revealed that prices paid rose to 62.6 in September, up from 60.8 last month as business mentioned tariffs “as the principal cause of further cost increases.”

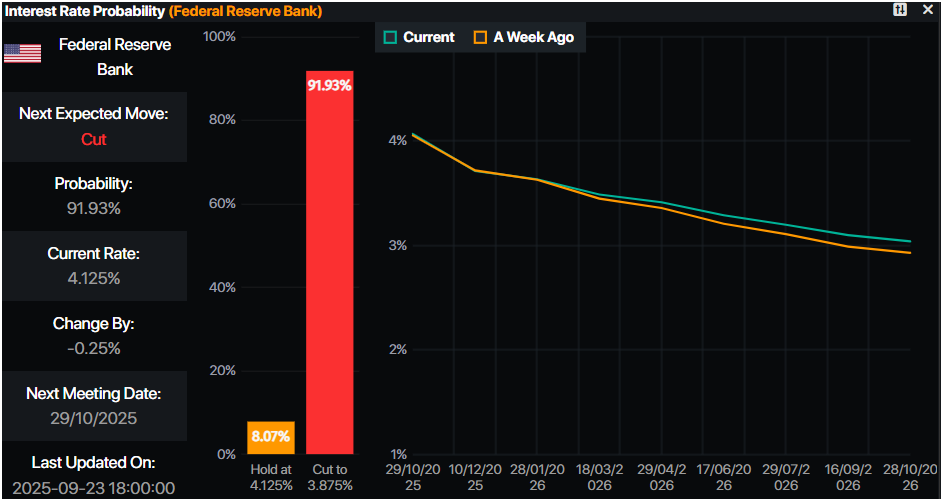

- The Fed is expected to cut rates 25 bps at the October 19 meeting, as revealed by data from Prime Market Terminal. Odds are at 91%.

Source: Prime Market Terminal

Technical outlook: Gold price reaches all-time high, target on $3,800

Gold price uptrend remains intact, but in the short term it seems that buyers are reluctant to drive XAU/USD spot prices toward $3,800. A daily close below $3,760 would pave the way for challenging $3,750, ahead of falling to $3,700.

The Relative Strength Index (RSI) suggests that bulls remain in charge, but that they’re losing some momentum.

Conversely, if buyers drive Bullion prices past $3,775 it clears the path to test the record high of $3,791. If breached, $3,800 is up next.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.