SKY Price Forecast: SKY record-high revenue sparks bullish potential

- Sky extends gains for a second straight day, bouncing from the 200-day EMA.

- Quarterly revenues have reached a record high so far in Q3.

- The upgrade from MKR also supports demand for SKY, as holders will face a penalty if they don't convert their tokens before September 22.

Sky (SKY), previously known as Maker DAO (MKR), edges higher by over 5% at press time on Wednesday, extending the rebound from the 200-day Exponential Moving Average (EMA), with bulls eyeing further gains. The demand surge is underpinned by the deadline for the MKR upgrade to SKY on Thursday, as well as the quarterly revenues reaching a record high of over $100 million so far in Q3.

Record high quarterly revenues, token upgrade deadline sparks demand for SKY

Token Terminal, an on-chain analytics platform, shared that the quarterly revenues of Sky protocol have surpassed the $100 million milestone so far in Q3. This will mark the strongest quarter based on revenue, driven by top performers such as Spark.Fi and Grove.Finance. If the Sky protocol holds steady growth, it is projected to make almost $470 million in revenue over the next 12 months.

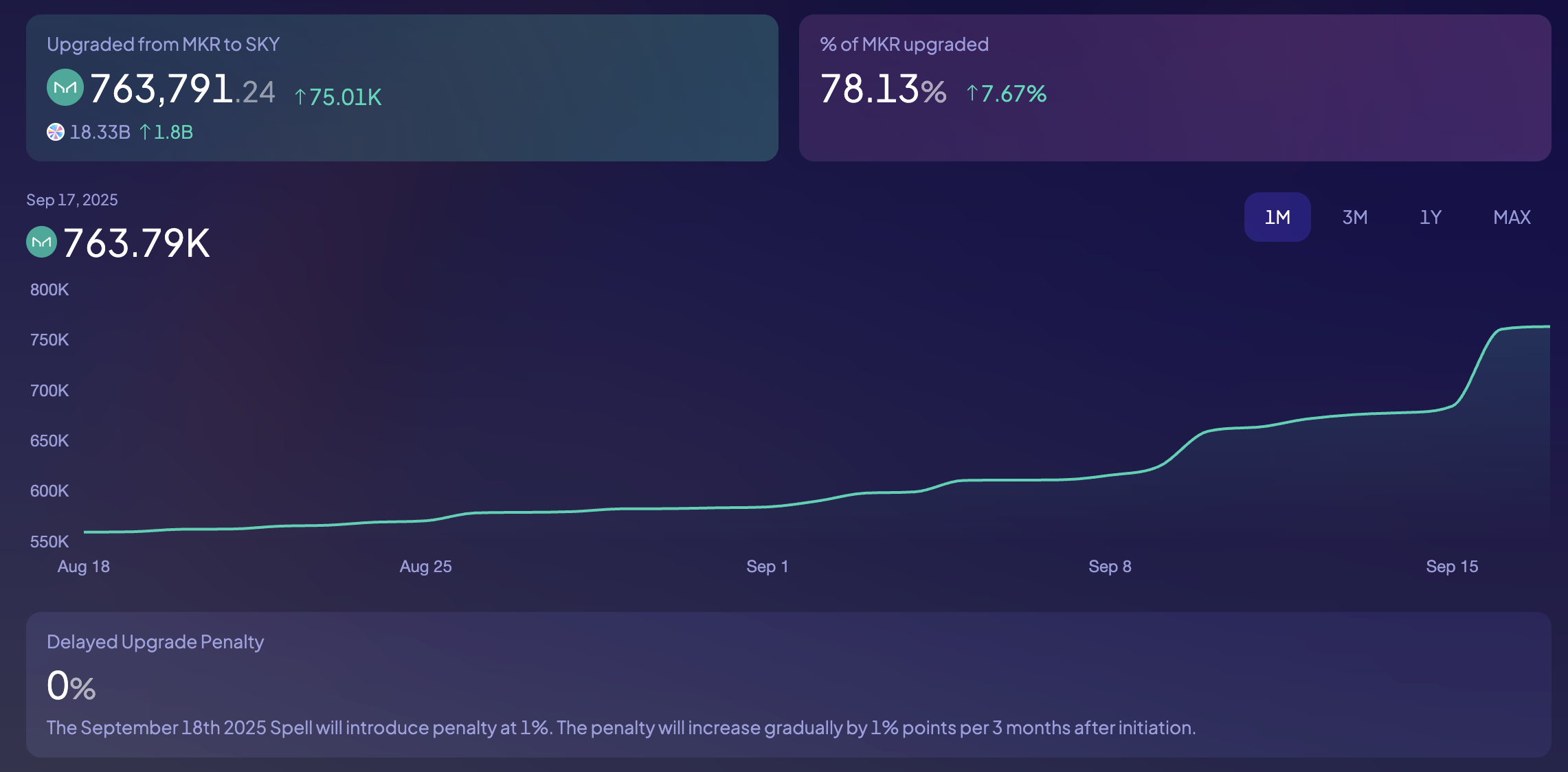

Adding to the demand surge, the deadline to convert the previously held MKR to SKY at no extra cost is on Thursday. However, a community voting on Thursday could impose penalty fees of roughly 1%, which would reduce the amount of SKY received for each converted MKR, taking effect on Monday. The delayed upgrade penalty would continue to increase by 1% every three months until it reaches 100% by 2050.

Currently, 78.13% of MKR tokens have been upgraded to SKY, representing a 7.67% increase over the last 24 hours.

MKR to SKY upgrade. Source: Sky ecosystem

SKY recovery run gains bullish momentum

Sky adds over 5% gains so far on Wednesday, building on the 1.64% rise from Tuesday. The short-term recovery from the 200-day EMA challenges the R1 pivot level at $0.08213, which is acting as the immediate resistance.

A decisive close above this level could flash the R2 pivot level at $0.10002 as the next potential target on the bullish radar.

SKY’s bounce back from the 200-day EMA marks a positive shift in momentum indicators on the daily chart. The Relative Strength Index (RSI) at 59 rises from the halfway line, suggesting an increase in buying pressure with more space to grow before reaching overbought conditions. Additionally, the Moving Average Convergence Divergence (MACD) and its signal line enter the positive territory above the zero line, which indicates a recovery in bullish momentum.

SKY/USDT daily price chart.

On the other hand, if SKY fails to hold above the 200-day EMA at $0.07191, it could test a long-coming support trendline, formed by connecting the lows of February 10 and April 7, below $0.06500.