Solana Price Forecast: SOL eyes record high as Pantera Capital confirms $1.1 billion exposure

- Solana remains above $230 as the uptrend cools ahead of Wednesday's Federal Reserve interest rate decision.

- Pantera Capital CEO Dan Morehead confirms the firm's $1.1 billion exposure to SOL.

- Morehead says Solana is the fastest blockchain, outperforming Bitcoin over the past four years.

Solana (SOL) is down nearly 6% from its peak level of $250 last week, trading above $235 at the time of writing on Tuesday. The smart contracts token tested support at $230 the previous day, but growing institutional interest limits downside risks.

Meanwhile, participants in the broader cryptocurrency market have shifted their attention to the United States (US) Federal Reserve (Fed) interest rate decision anticipated this Wednesday.

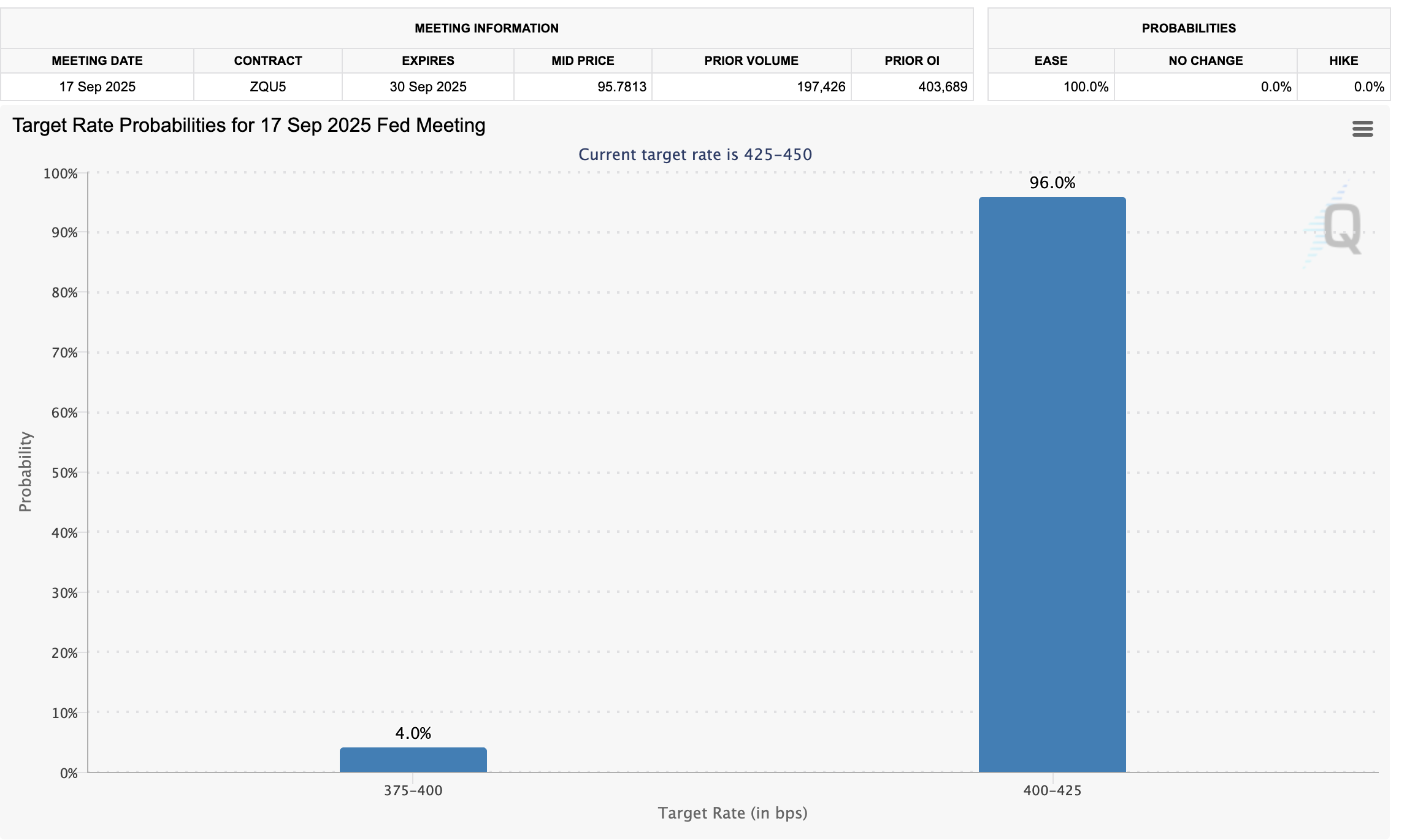

The CME Group's FedWatch Tool shows that market participants are 96% in favor of the Fed cutting rates to the range of 4.00% to 4.25%. The rest of the market participants are looking forward to a 50 bps cut.

Lower interest rates often encourage investment in riskier asset classes, such as cryptocurrencies and equities. Therefore, lower rates could boost investor interest in digital assets in the fourth quarter.

FedWatch tool | Source: CME Group

Pantera Capital CEO bullish on Solana

Pantera Capital CEO, Dan Morehead, appearing on CNBC on Tuesday, confirmed that Solana accounted for the firm's largest exposure to digital assets at $1.1 billion. Morehead argued that Solana is the fastest and most cost-effective protocol, and that it has outperformed Bitcoin over the past four years.

The CEO stressed the firm's commitment to providing normal investors "access to something that is not very well-known but actually has been outperforming […] Our biggest position is Solana, we have $1.1 billion of SOL on our books."

Institutional interest in Solana has skyrocketed, with various companies, including Forward Industries and Helius, launching treasury strategies. SOL Strategies, a Canadian publicly traded investment company with exposure to Solana, commenced trading on the NASDAQ stock exchange last week under the ticker STKE, affirming Solana as a maturing digital asset.

Retail interest in Solana remains relatively high despite the token increasing nearly 50% from its August 1 level of $155. CoinGlass data shows that the futures Open Interest (OI) averages $16.53 billion on Tuesday. The steady increase in OI indicates that more traders are betting on the Solana price increasing in the short term, with targets at $250 and its record high of $296, reached on January 19.

Technical outlook: Solana testing key support

Solana remains above the support level provided at $230 as bulls look forward to a swift recovery above the $250 near-term target. The token also sits significantly above key moving averages, including the 50-day Exponential Moving Average (EMA) at $201, the 100-day EMA at $187 and the 200-day EMA at $176, supporting the bullish outlook.

The same moving averages would serve as tentative support levels if the macro environment fails to support a bullish outcome and holders sell, realizing profits, following the uptrend over the past weeks.

SOL/USDT daily chart

The Relative Strength Index's (RSI) sharp decline from overbought territory to 61 indicates fading bullish momentum. If the decline continues in upcoming sessions, the price of SOL could extend the correction below $230 and perhaps toward the 50-day EMA at $201.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.