Ethereum Holds Steady Amid Market Drop—but $4,500 Remains the Key Reversal Zone

Ethereum has seen a period of sideways movement over the last ten days, despite the broader cryptocurrency market experiencing significant price drops.

It has managed to hold steady, a sign of resilience, but ETH still hasn’t reached its absolute reversal point. This point is critical for triggering a broader price shift.

Ethereum Has A Long Way To Go

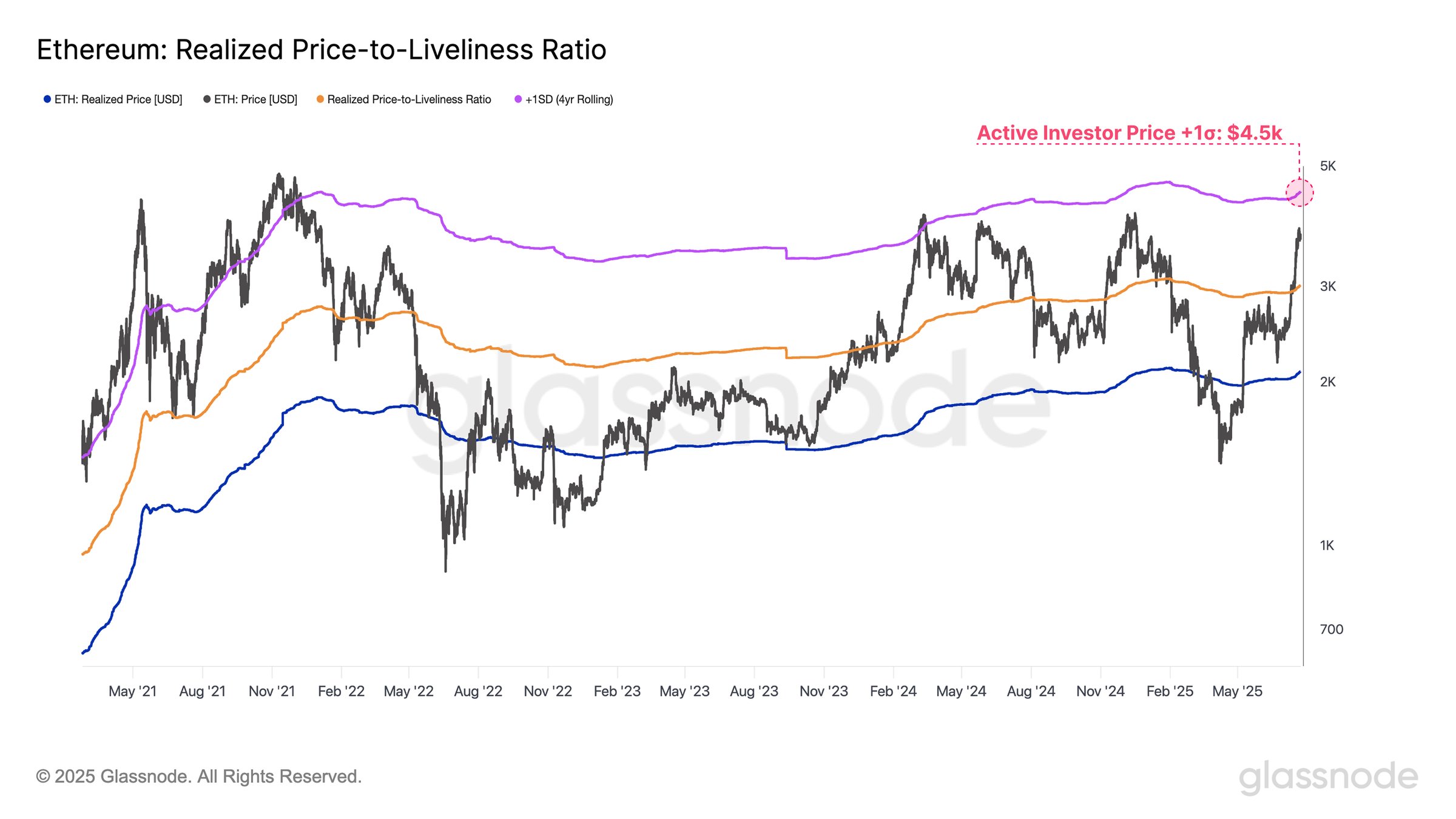

Ethereum’s Realized Price to Liveliness ratio is showing signs of an important threshold for the current rally. The ratio indicates that the current upside resistance for Ethereum is at $4,500, a level that has acted as a significant barrier in past market cycles. Notably, this price point acted as resistance in March 2024 and during the 2020–2021 market cycle.

Historically, breakouts above $4,500 signal market euphoria and an increased risk of structural instability, making it a critical structural pivot for Ethereum. As a result, this price level is not just a resistance but also the potential absolute reversal point for Ethereum.

Ethereum Realized Price to Liveliness. Source: Glassnode

Ethereum Realized Price to Liveliness. Source: Glassnode

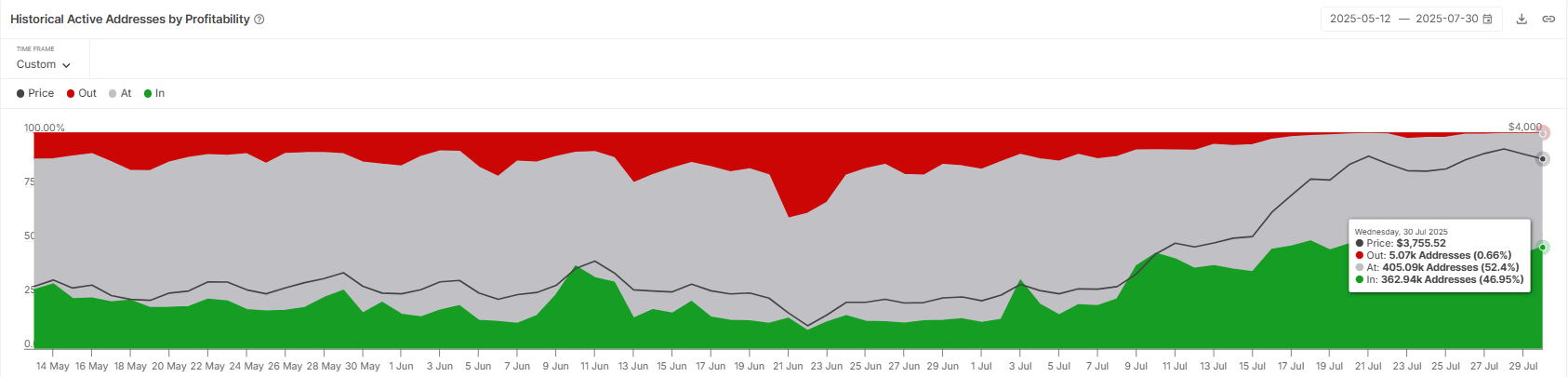

Ethereum’s macro momentum is influenced by the concentration of active addresses. Nearly 47% of these addresses belong to investors who are currently sitting in profit. While this may seem like a positive sign, it raises concerns in the short term.

Investors in profit are more likely to book their gains, which could lead to increased selling pressure on Ethereum. This could slow down Ethereum’s potential rise, preventing the altcoin from experiencing significant gains in the near future.

Ethereum Active Addresses By Profitability. Source: IntoTheBlock

Ethereum Active Addresses By Profitability. Source: IntoTheBlock

ETH Price Is Holding Above Support

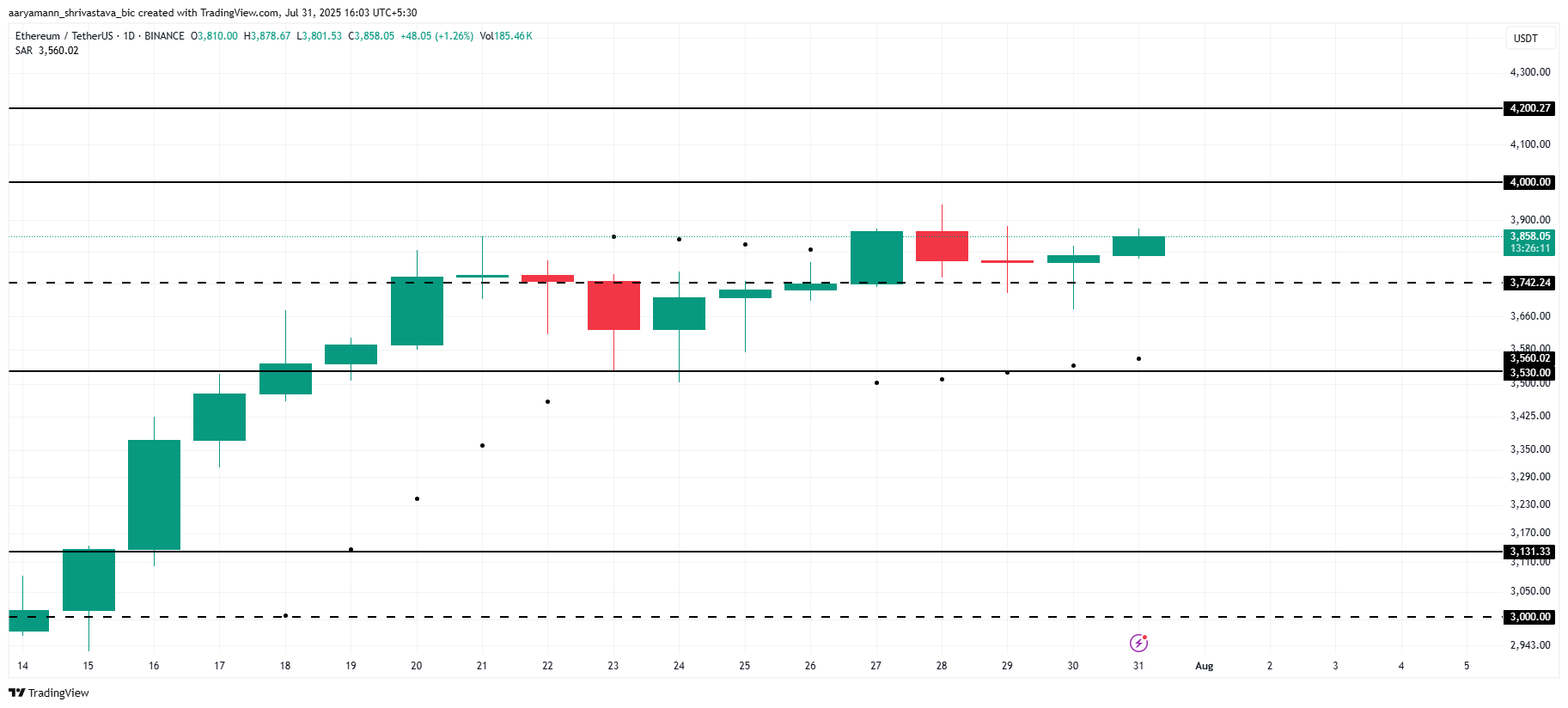

Ethereum is currently trading at $3,858, sitting comfortably above the local support level of $3,742. The Parabolic SAR indicator is positioned below the candlesticks, signaling an active uptrend.

This suggests that Ethereum is showing a moderately bullish trend at the moment, with the potential to rise further. Given the current market sentiment and price action, Ethereum could move towards the $4,000 level, with the potential to flip it into support and push higher to $4,200 in the near future.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

However, there’s a caveat. Should Ethereum experience intensified selling pressure, driven by investor profit-taking or broader market conditions, the price could slip down to the $3,530 support level. If Ethereum falls below this crucial support, it would invalidate the bullish thesis and indicate a reversal in market sentiment.