Gold rallies as US CPI is mixed, while Trump remarks fuel rate cut bets

- Gold rallies to $3,359 after Trump BLS nominee suggests suspending monthly NFP releases.

- July US CPI misses headline estimates, boosting odds of September Fed rate cut.

- Trump slams Powell, threatens lawsuit, reigniting Fed independence concerns.

Gold price recovered some ground on Tuesday, climbing 0.20% following the release of July’s inflation print in the United States (US). Although prices had risen, Bullion’s was supported by US President Donald Trump's remarks threatening the Federal Reserve’s (Fed) independence. The XAU/USD trades at $3,348 at the time of writing.

The US Consumer Price Index (CPI) for July missed estimates in its headline print YoY and increased the odds for a rate cut. However, the core CPI, which excludes volatile items, jumped above the 3% threshold YoY.

Initially, XAU/USD fell toward its daily lows but was boosted by Trump's comments on Jerome Powell, calling the Fed Chair too late at cutting rates and threatening to sue him regarding the renovation of the Fed buildings.

On the remarks, Bullion prices rose from around daily lows near $3,331 toward $3,347 before rising toward their daily high of $3,359.

Gold’s last leg up was courtesy of EJ Antoni, the economist nominated by Trump to head the Bureau of Labor Statistics (BLS), who suggested suspending monthly Nonfarm Payrolls (NFP)data. He argued that its underlying methodology, economic modeling, and statistical assumptions are fundamentally flawed. Instead, Antoni proposes quarterly data.

In the meantime, a slew of Fed officials crossed the wires, led by the Richmond Fed's Thomas Barkin and the Kansas City Fed's Jeffrey Schmid. It's worth noting that Trump’s Fed board nominee, Stephen Miran, also crossed the wires.

Traders will eye further data releases as the US schedule remains busy. Ahead awaits PPI data, Jobless Claims for the week ending August 9, Retail Sales, and the University of Michigan Consumer Sentiment index.

Daily digest market movers: Gold price buyers shrug off mixed US inflation data

- Mixed US inflation prints were not an excuse for traders to increase the chances for a rate cut by the Fed at the September 16-17 meeting. The US Bureau of Labor Statistics (BLS) revealed that CPI in July rose by 2.7% YoY, below forecasts of 2.8% and unchanged from June’s 2.7% print. Conversely, Core CPI rose by 3.1% YoY, up from 2.9% a month ago and above estimates of 3%.

- The Richmond Fed's Thomas Barkin said that Fed policy is well-positioned, adding that the central bank will face pressure on inflation and unemployment.

- The Kansas City Fed's Jeffrey Schmid said that retaining a modestly restrictive policy stance is appropriate for the time being. He supports a patient approach to rates and noted that the muted effect of tariffs on inflation is likely a sign that policy is appropriately calibrated.

- Trump’s Fed nominee Stephen Miran said, “the US central bank's independence was 'of paramount importance' but declined to elaborate further, citing his coming approval process in the Senate.” He added that “I do think that inflation has been well-behaved, particularly since the President took office.”

- Following CPI, traders will also eye PPI and the evolution of the labor market and consumer spending via Retail Sales, which are expected to dip from 0.6% to 0.5% MoM in July. The week will end with the release of US Consumer Sentiment, which is projected to improve from 61.7 to 62 in August’s preliminary reading.

- The US Dollar Index (DXY), which tracks the performance of the buck’s value against a basket of its peers, is down 0.45% at 98.05. The US Dollar’s drop has pushed Gold prices higher to near $3,350.

- The US 10-year Treasury note yield is up one basis point, sitting at 4.295%.

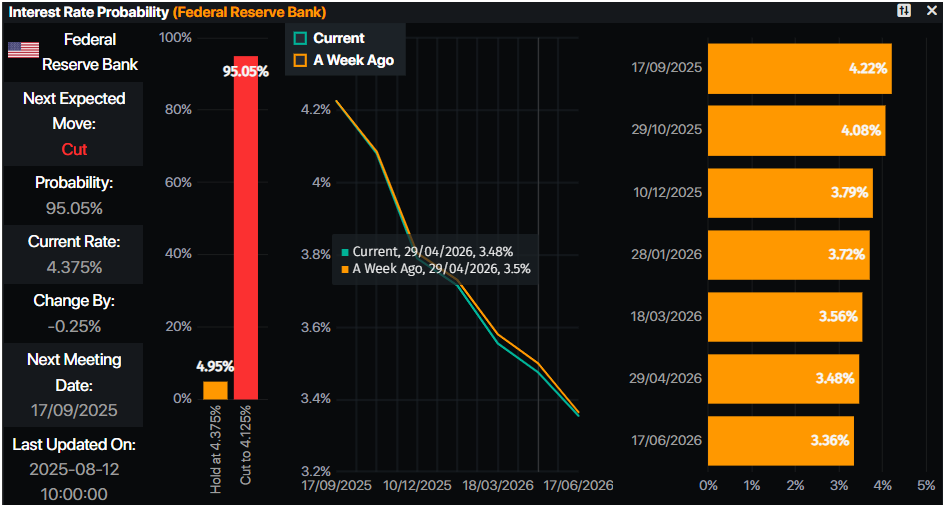

- Traders have priced in a 95% chance of a 25 bps rate cut at the September meeting, according to Prime Market Terminal data.

Source: Prime Market Terminal

Technical outlook: Gold price climbs but faces resistance at confluence of 20/50-day SMAs

Gold price fell to a daily low of $3,331 before prices pushed higher on Trump and Antoni’s remarks. Nevertheless, XAU/USD spot prices test the confluence of the 50-day and 20-day Simple Moving Averages (SMAs) near $3,356 to $3,349. Buyers are eyeing $3,380 once they clear the former area.

If XAU/USD climbs above $3,400, the next area of interest would be the June 16 peak at $3,452, followed by the record high of $3,500. Conversely, if Gold ends Tuesday below $3,350, Bullion could slide toward the 100-day SMA at $3,285.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.