Bitcoin Could Be Sub-$50,000 By 2028 Without Quantum Fix, Warns Capriole Founder

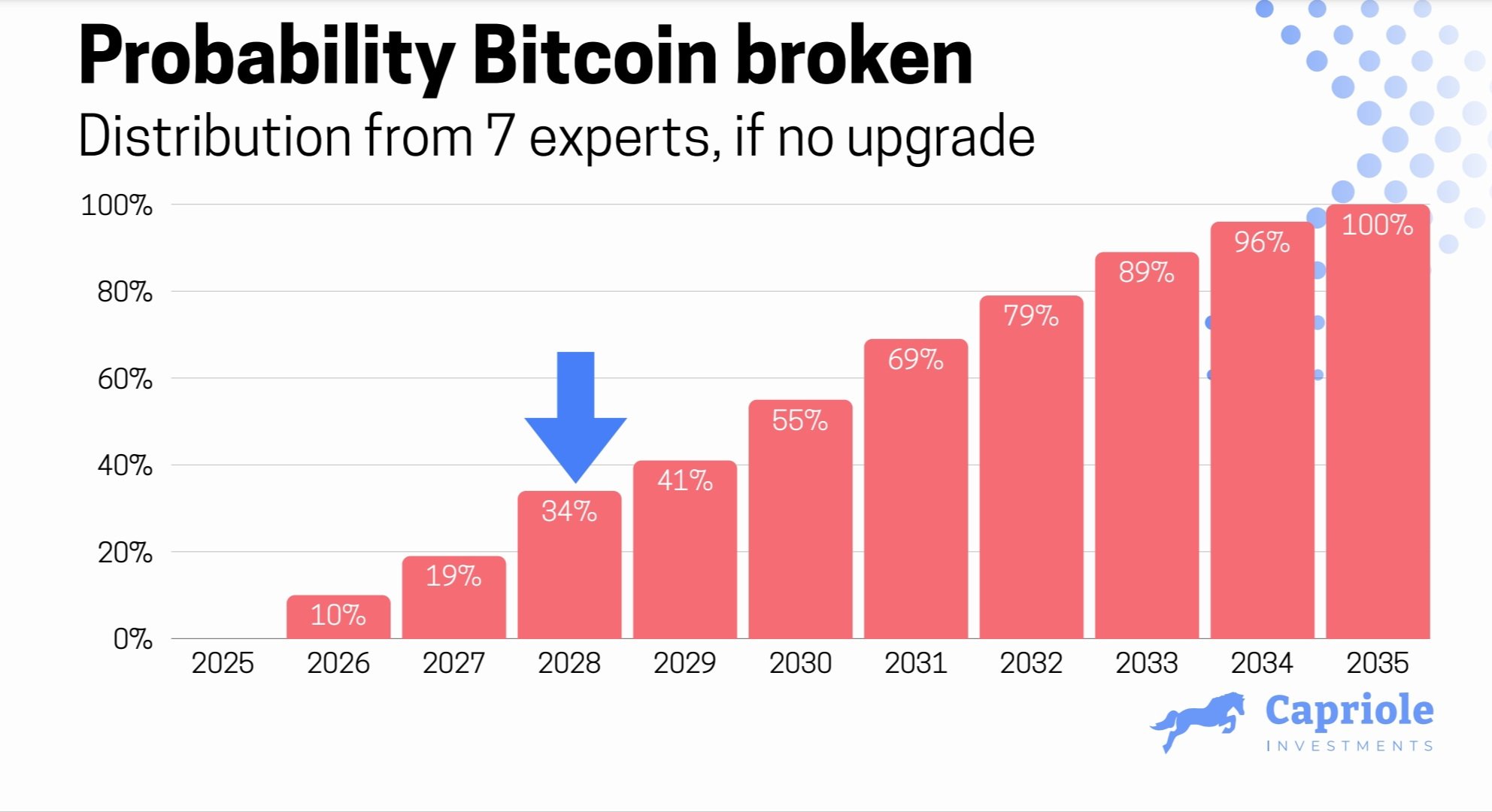

The founder of Capriole Investments has warned about the Quantum risk to Bitcoin, saying there’s a 34% chance it breaks BTC in the next three years.

Bitcoin Could Trade At A Discount If No Quantum Fix Is Deployed

As Quantum Computing continues to advance, many in the Bitcoin community have been raising concerns about what a breakthrough could mean for the cryptocurrency. Capriole Investments founder Charles Edwards has been one of those voices.

Last week, Edwards gave a presentation on the Quantum threat to Bitcoin at the Global Blockchain Show in Abu Dhabi. The analyst has also shared some insights on X.

According to Edwards, there’s a 34% chance that Quantum will undermine BTC’s cryptography in the next three years. Based on this, the Capriole founder has assigned a 34% discount to BTC today. “Given a 2-3 yr timeline to deploy fix, this is the current discount rate,” noted Edwards. “And it is growing. Every. Single. Day.”

The probability has been estimated using seven different sources providing timelines for Quantum Computing breakthroughs. If Capriole’s calculations are to go by, the Quantum threat has a chance of more than 50% to affect blockchain technology by 2030.

What will happen in the scenario that Quantum Computing does end up unlocking Bitcoin’s cryptography? Even if wallets today are secured properly, there are still old wallets that can be vulnerable. A chunk of the BTC supply has been dormant for years, and with a Quantum breakthrough, it could potentially find its way back into circulation.

The most popular example of dormant holdings is, of course, the ones attributed to the cryptocurrency’s pseudonymous creator, Satoshi Nakamoto. Satoshi’s wallets hold a total of 1,096,354 BTC, worth a whopping $95 billion at current prices. All these coins possibly being dumped on the market would naturally have a negative effect on the Bitcoin price. Not just because of the scale involved, but also because of the loss of confidence that such an event would result in.

Considering the threat, Capriole has repeatedly stressed that a fix needs to be implemented as soon as possible. So far, the community hasn’t reached a consensus on when or what the solution should be.

In an X post, Strategy co-founder and chairman Michael Saylor has also chimed in on the topic. “Quantum computing won’t break Bitcoin—it will harden it,” wrote Saylor. “The network upgrades, active coins migrate, lost coins stay frozen.” In this scenario, the coins attached to Satoshi and other early miners will forever become inaccessible.

Edwards has warned that if a solution isn’t implemented in time, the coin may face its biggest bear market in history. “If we haven’t deployed a fix by 2028, I expect Bitcoin will be sub $50K and continue to fall until it’s fixed,” said the Capriole founder.

BTC Price

At the time of writing, Bitcoin is trading around $86,500, down 5.7% over the last week.