3 Reasons to Buy Costco Stock Like There's No Tomorrow

Key Points

Shoppers flock to Costco for dirt cheap prices on a variety of items, and this has pushed earnings higher over time.

This earnings performance has driven the stock higher, with gains of 80% over the past three years.

- 10 stocks we like better than Costco Wholesale ›

Costco (NASDAQ: COST) is a company many of us know very well, as it's at the heart of our daily lives -- with more than 600 warehouses throughout the U.S. We run to Costco for deals on everything from groceries to gasoline for our cars, and the company is known for keeping prices low on longtime favorites such as $4.99 rotisserie chicken.

Why is Costco so successful? The company buys products in bulk, benefiting from low prices, so that it can, in turn, offer them to customers for a steal. Though Costco's margins on these sales are low, the company scores a win by generating profit from membership fees.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

All of this has made Costco a great investment, too -- investors love the track record of earnings growth and have steadily picked up shares of this retail powerhouse. That's helped Costco stock advance more than 80% over the past three years. But don't worry -- it's not too late to get in on this top stock. Check out these three reasons to buy Costco stock like there's no tomorrow.

Image source: Getty Images.

1. Membership renewals

Costco's membership renewal rate has remained high quarter after quarter -- in the U.S. and Canada, renewals have consistently surpassed 90%. This is key because more than 700 of the company's 923 warehouses are in the U.S., Puerto Rico, and Canada, meaning that a great deal of its membership base is located here. All of this offers us visibility regarding the company's earnings prospects ahead.

As mentioned above, Costco counts on membership fees to drive profitability. The membership business is high-margin for Costco as it only involves processing applications and offering customers membership cards. The company offers two membership levels -- the Gold Star at $65 and Executive at $130, and it's seen an increase in upgrades from the lower level to the higher one. In the recent quarter, Costco also said executive memberships increased more than 9% from the year-earlier period.

All of this could lead to higher net income for Costco in the coming years.

2. Strength in any market environment

Costco's business model makes it a winner in any market environment. The company, as I mentioned above, offers customers essentials at rock-bottom prices -- this is something that's always appreciated, but it could be particularly important during tough economic times.

So, even during rough periods, customers may consider paying the membership fee worthwhile, as overall, they're spending less than if they were to drop the membership and shop elsewhere. At the same time, the fact that they're paying a membership fee should prompt them to do as much of their shopping as possible at Costco to maximize their gains.

All of this means that even during market downturns, Costco's earnings -- and potentially even the stock performance -- may continue to advance, or at least resist major declines.

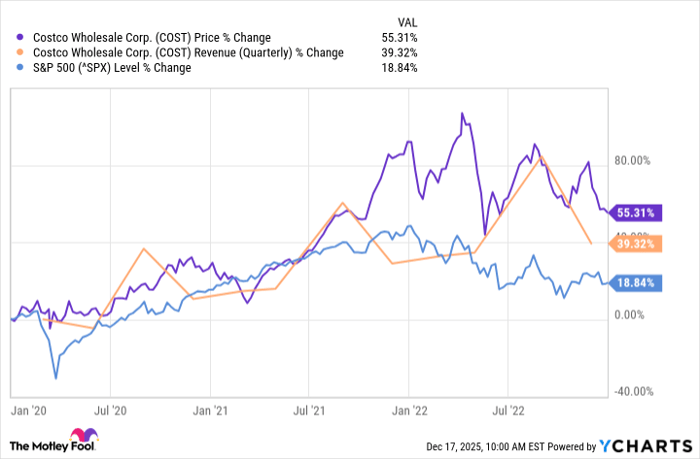

We can see that in the chart below, showing Costco's stock performance and quarterly revenue during the rough patches from 2020 through 2022 -- this includes early pandemic days and times of high inflation.

COST data by YCharts

3. A chance to buy on the dip

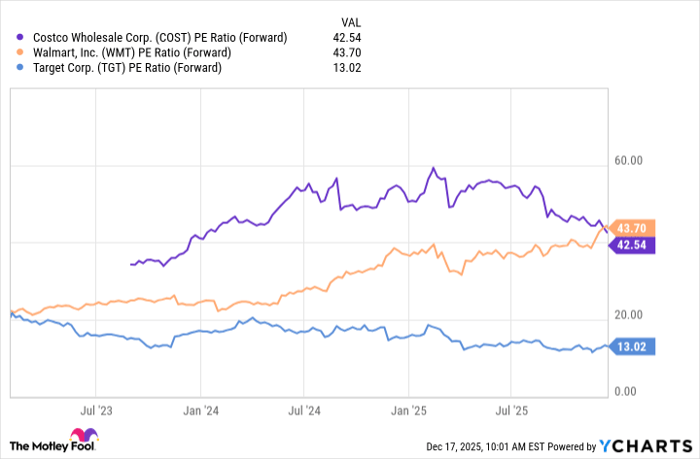

Costco isn't known to be a cheap or bargain stock. It's always traded at premium levels compared to other food retailers such as Walmart or Target. But it's important to keep in mind that its warehouse structure, with a focus on buying in bulk, and its membership program set it apart. These elements make it worth a premium as they help bolster earnings, as mentioned above, in any environment.

Today, though, Costco stock is offering us a deal as valuation has declined from its highs and actually is trading around the same level as Walmart.

COST PE Ratio (Forward) data by YCharts

Costco has slipped 6% in 2025, and that's left the stock trading for 42x forward earnings estimates, down from about 58x earlier in the year.

So now, on the dip, is the perfect time to buy Costco stock like there's no tomorrow.

Should you buy stock in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,955!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,089,460!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 17, 2025.

Adria Cimino has positions in Target. The Motley Fool has positions in and recommends Costco Wholesale, Target, and Walmart. The Motley Fool has a disclosure policy.