GBP/USD pulls back from 1.3868 highs as Dollar rebounds ahead of Fed

- GBP/USD retreats after printing four-year highs as the Dollar stages a corrective rebound.

- Markets expect the Fed to hold rates, shifting focus to Powell’s guidance on future easing.

- Equities rally to record highs, reinforcing a risk-on backdrop that caps Sterling gains.

The GBP/USD retreats after posting four-year highs of 1.3868 on Tuesday, edges below the 1.3800 mark as traders await the monetary policy decision of the Federal Reserve. At the time of writing, the pair trades at 1.3798, down 0.32%.

Sterling eases below 1.3800 as traders lock in profits, brace for Fed’s decision

Market mood is positive as the S&P 500 hits an all-time high past the 7,000-milestone boosted by a rise of technological shares. Greenback, which was battered on Tuesday, trims some of its earlier losses according to the US Dollar Index (DXY).

The DXY, which measures the Dollar strength against a basket of six currencies, is up 0.51%, following yesterday’s plunge.

On Tuesday, the US President Donald Trump embraced a weaker US Dollar after being asked about it, in Iowa. He said that its value was “great,” adding that it’s just seeking its own level.

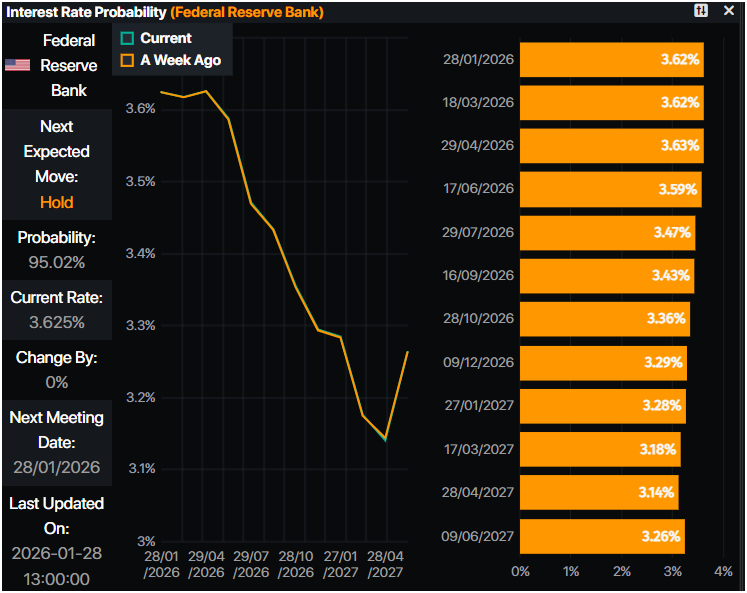

In the meantime, traders brace for the Federal Reserve’s decision, in which the Fed Chair Jerome Powell and Co. are expected to hold rates unchanged as depicted by data of Prime Market Terminal.

Money markets see a 95% chance of the US central bank keeping rates at the 3.50%-3.75% range, yet the swaps markets had priced in 44 basis points of easing.

After the release of the statement, investors focus will be on Powell’s words, who’s expected to lay the path of the future of interest rates.

According to Goldman Sachs, Powell is expected “to emphasize that the FOMC has just delivered three cuts that should help to stabilize the labor market and is well positioned for now while it assesses their impact.”

Economists at Danske Bank and ING project two 25 basis points of rate cuts by the Fed, each in March and June meetings. Contrarily, analysts at Goldman Sachs project two cuts, the first one in June, with a final at the September meeting.

GBP/USD Price Forecast: Technical outlook

The GBP/USD uptrend is still intact, despite retreating as the Dollar licks its wounds. Given the fundamental backdrop, the base scenario implies that the Fed would acknowledge the dual mandate, keeping the status quo. Consequently, further upside is seen.

If GBP/USD clears 1.3800, the next resistance would be the yearly peak at 1.3869, ahead of 1.3900.

Conversely, if the Fed revealed the labor market had stabilized, and does not mention policy as restrictive, the Dollar could appreciate sending the GBP/USD pair lower.

In that outcome, the GBP/USD first support would be 1.3700, followed by the January 26 daily low of 1.3643 ahead of 1.3600.

Pound Sterling Price This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.61% | -0.74% | -0.57% | -0.94% | -0.93% | -1.06% | -0.48% | |

| EUR | 0.61% | -0.13% | 0.07% | -0.35% | -0.31% | -0.46% | 0.12% | |

| GBP | 0.74% | 0.13% | -0.15% | -0.21% | -0.20% | -0.33% | 0.25% | |

| JPY | 0.57% | -0.07% | 0.15% | -0.37% | -0.35% | -0.46% | 0.10% | |

| CAD | 0.94% | 0.35% | 0.21% | 0.37% | -0.10% | -0.09% | 0.46% | |

| AUD | 0.93% | 0.31% | 0.20% | 0.35% | 0.10% | -0.14% | 0.44% | |

| NZD | 1.06% | 0.46% | 0.33% | 0.46% | 0.09% | 0.14% | 0.58% | |

| CHF | 0.48% | -0.12% | -0.25% | -0.10% | -0.46% | -0.44% | -0.58% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).