BoC set to hold interest rate amid steady inflation, solid labor market

- The Bank of Canada is expected to keep its interest rate at 2.25%.

- The Canadian Dollar remains firm, dragging USD/CAD to yearly lows.

- Markets pencil in around 10 bps of hiking by the BoC this year.

The Bank of Canada (BoC) is widely expected to leave its benchmark rate unchanged at 2.25% at Wednesday’s meeting, extending the pause it signalled back in December.

At its last decision, the central bank made clear it sees policy as roughly where it needs to be to keep inflation close to the 2% target, so long as the economy behaves as expected. Still, officials were keen to underline that they’re not locked in and stand ready to respond if the outlook deteriorates or inflation risks re-emerge.

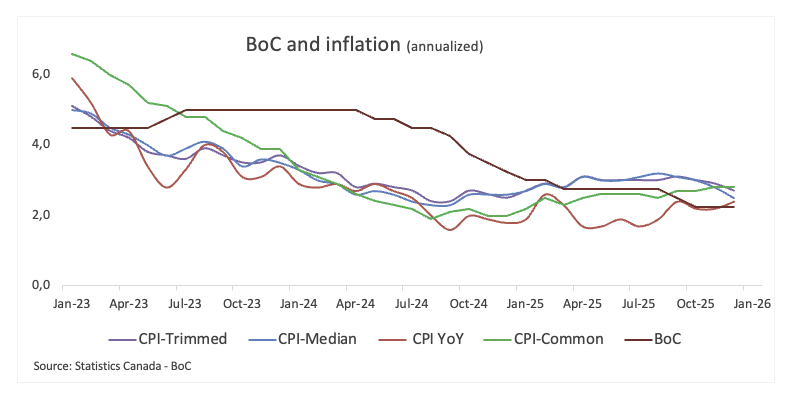

On inflation, the message remains cautiously reassuring. Headline CPI is projected to hover near the target as spare capacity in the economy helps offset cost pressures tied to trade reconfiguration. Even so, underlying inflation is still running a little hot, suggesting the disinflation process isn’t complete.

The growth picture is also uneven: Q4 GDP is expected to come in soft, with firmer domestic demand likely to be outweighed by a drag from net exports. That follows a surprisingly strong Q3, which the BoC has largely put down to trade-related volatility rather than a genuine pickup in momentum. The labour market offers a slightly brighter note, with early signs of improvement reinforcing the Bank’s wait-and-see approach.

Inflation, however, remains the key watchpoint after the headline CPI edged up to 2.4% YoY in December, while core inflation eased to 2.8% YoY. The bank’s preferred measures, CPI-Common, Trimmed and Median, also ticked lower, but at 2.8%, 2.7% and 2.5% respectively, they remain comfortably above target.

Previewing the BoC’s interest rate decision, analysts at the National Bank of Canada (NBC) noted, “The Bank of Canada is set to leave its overnight target unchanged at 2.25%, a decision widely expected by forecasters and OIS markets. This would mark the second consecutive hold after policymakers declared in October that policy is at ‘about the right level’ to keep inflation near target and support the economy’s transition”.

When will the BoC release its monetary policy decision, and how could it affect USD/CAD?

The Bank of Canada will announce its policy decision on Wednesday at 14:45 GMT alongside the Monetary Policy Report (MPR), followed by a press conference with Governor Tiff Macklem at 15:30 GMT.

Markets anticipate the central bank will maintain its current stance, with a projected tightening of approximately 10 basis points by the end of 2026.

Pablo Piovano, Senior Analyst at FXStreet, points out that the CAD has been appreciating steadily against the Greenback since its yearly lows past the 1.3900 barrier recorded earlier in the month. He adds: “Indeed, USD/CAD has recently broken below the 1.3700 support to hit new 2026 lows, exposing a potential test of the December 2025 floor at 1.3642 (December 26). South from here sits the weekly trought at 1.3575 (July 23), ahead of the July 2025 base at 1.3556 (July 3) and the 2025 bottom at 1.3538 (June 16).”

From here, Piovano says a return of bullish momentum could prompt USD/CAD to initially reclaim its key 200-day SMA at 1.3833 prior to the 2026 ceiling at 1.3928 (January 16). Up from here comes the key 1.4000 threshold seconded by the November top at 1.4140 (November 5).

“Momentum favours extra declines,” he adds, noting that the Relative Strength Index (RSI) approaches the 33 level and the Average Directional Index (ADX) near 27 is indicative of a pretty firm trend.

Bank of Canada FAQs

The Bank of Canada (BoC), based in Ottawa, is the institution that sets interest rates and manages monetary policy for Canada. It does so at eight scheduled meetings a year and ad hoc emergency meetings that are held as required. The BoC primary mandate is to maintain price stability, which means keeping inflation at between 1-3%. Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Canadian Dollar (CAD) and vice versa. Other tools used include quantitative easing and tightening.

In extreme situations, the Bank of Canada can enact a policy tool called Quantitative Easing. QE is the process by which the BoC prints Canadian Dollars for the purpose of buying assets – usually government or corporate bonds – from financial institutions. QE usually results in a weaker CAD. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The Bank of Canada used the measure during the Great Financial Crisis of 2009-11 when credit froze after banks lost faith in each other’s ability to repay debts.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Bank of Canada purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the BoC stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Canadian Dollar.

Economic Indicator

BoC Interest Rate Decision

The Bank of Canada (BoC) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoC believes inflation will be above target (hawkish), it will raise interest rates in order to bring it down. This is bullish for the CAD since higher interest rates attract greater inflows of foreign capital. Likewise, if the BoC sees inflation falling below target (dovish) it will lower interest rates in order to give the Canadian economy a boost in the hope inflation will rise back up. This is bearish for CAD since it detracts from foreign capital flowing into the country.

Read more.Last release: Wed Dec 10, 2025 14:45

Frequency: Irregular

Actual: 2.25%

Consensus: 2.25%

Previous: 2.25%

Source: Bank of Canada