GBP/USD nears 1.3400 as traders brace for BoE cut

- GBP/USD trades near 1.3400 as investors price in an almost fully discounted 25-bps BoE rate cut.

- Weak UK GDP and softer CPI strengthen the case for BoE easing before year-end.

- Dovish Fed comments contrast with pause signals, keeping Dollar gains capped ahead of key US data.

GBP/USD advances during the North American session up 0.28% amid a scarce economic docket but following the Federal Reserve’s last week’s monetary policy decision, in which the central bank hinted a possible pause loom. The pair trades at around 1.3400 as traders brace for the Bank of England (BoE) decision, this week.

Sterling edges higher amid thin data, markets focused on a likely BoE rate cut and dovish Fed rhetoric

Risk aversion capped the GBP/USD advance on Monday along with expectations that the BoE would cut rates on Thursday. Money markets show that investors had almost fully priced in a 25-basis point (bp) rate cut, and another one towards mid-2026.

The latest UK data showed that the economy continues to weaken, and October’s GDP shrank -0.1% MoM and in the three-month rollover (August-October). This and a surprising dip in the Consumer Price Index (CPI), which remains almost double the BoE’s 2% goal, are the two reasons that could push Bailey and Co. to end the year cutting rates.

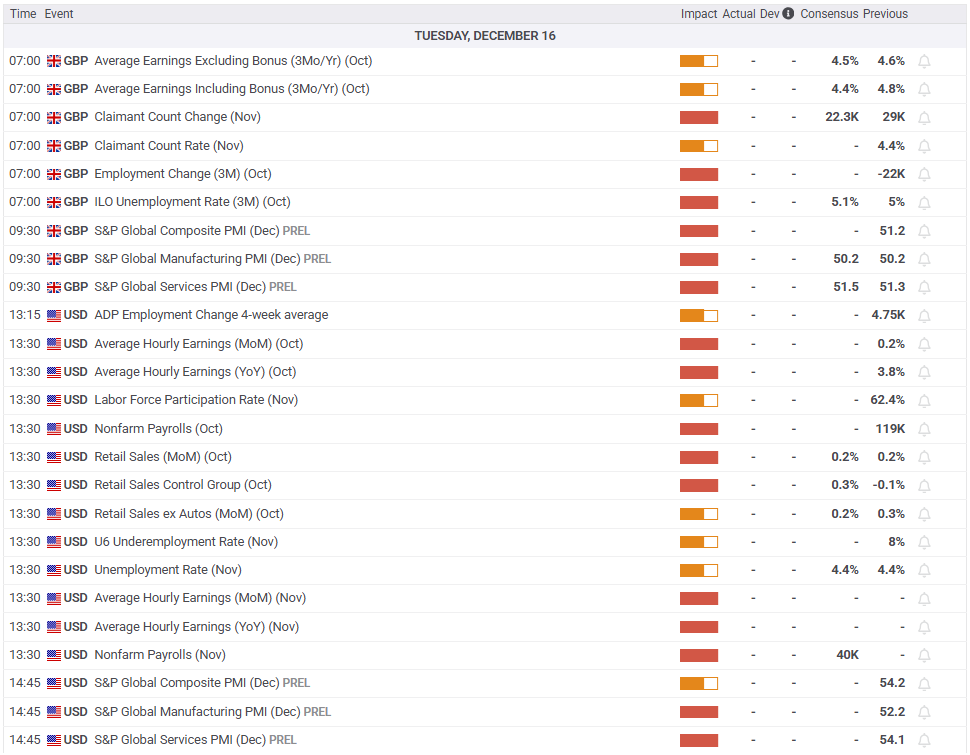

This week, the UK’s docket will feature CPI and BoE’s decision.

In the US, Fed officials continued to cross the wires led by Governor Stephen Miran reaffirmed its dovish stance, saying that he “expects a faster fall in PCE shelter inflation,” argued that tariffs are not driving goods inflation higher and that a faster pace of cuts would move the Fed closer to neutral.

Ahead of this week the US economic docket will feature Nonfarm Payroll figures, inflation figures on the consumer front and Retail Sales.

GBP/USD Price Forecast: Technical outlook

The technical picture shows GBP/USD struggling to decisively clear 1.3400 which could drive the exchange rate towards the October 17 high of 1.3471 ahead of challenging 1.3500. Once those levels are surpassed, the next stop would be October’s peak at 1.3527 before aiming to 1.3600. Conversely, if the pair tumbles below the 100-day Simple Moving Average (SMA) of 1.3357, expect a test of 1.3200.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.17% | -0.19% | -0.56% | 0.02% | 0.14% | 0.15% | -0.19% | |

| EUR | 0.17% | -0.01% | -0.44% | 0.19% | 0.31% | 0.32% | -0.01% | |

| GBP | 0.19% | 0.00% | -0.37% | 0.20% | 0.32% | 0.33% | -0.01% | |

| JPY | 0.56% | 0.44% | 0.37% | 0.62% | 0.74% | 0.75% | 0.42% | |

| CAD | -0.02% | -0.19% | -0.20% | -0.62% | 0.12% | 0.12% | -0.21% | |

| AUD | -0.14% | -0.31% | -0.32% | -0.74% | -0.12% | 0.00% | -0.35% | |

| NZD | -0.15% | -0.32% | -0.33% | -0.75% | -0.12% | -0.01% | -0.33% | |

| CHF | 0.19% | 0.01% | 0.00% | -0.42% | 0.21% | 0.35% | 0.33% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).