EUR/USD picks up on risk appetite with central banks' decisions looming

- The Euro keeps appreciating and reaches one-week highs above 1.1650.

- Hopes of a US-China trade deal and market expectations of a Fed rate cut on Wednesday keep risk appetite alive.

- EUR/USD bullish run remains frail with resistances at 1.1670 and 1.1730

EUR/USD is heading higher for the fifth consecutive day on Tuesday, trading just above 1.1650 at the time of writing, from 1.1580 lows last week. The first signs of de-escalation in trade tensions between the US and China, a rare earths agreement with Japan, and hopes that the Federal Reserve (Fed) will cut interest rates further on Wednesday, are buoying risk appetite and keeping the safe-haven US Dollar (USD) under pressure.

US President Donald Trump has signed an agreement with Japan to secure the supply of rare earths and has kept a positive tone towards China as he tours Asia, affirming that he is optimistic about signing a good deal with Chinese President Xi Jinping. Earlier this week. US Treasury Secretary Scott Bessent assured that the 100% tariff threat is off the table, as China has agreed to delay the restrictions on rare earths at their talks in Malaysia over the weekend.

Meanwhile, the softer-than-expected US inflation data seen last week has practically confirmed that the Fed will cut the Federal Funds Rate by 25 basis points on Wednesday. The central bank is lacking key macroeconomic data to sustain its decisions, as the US government shutdown enters its fifth week, but markets are expecting the bank to hint at a third rate cut in December. Failure to do so might trigger a significant recovery in the US Dollar.

Before that, the US Housing Price Index and Consumer Confidence data might provide some guidance for US Dollar pairs, although a significant US Dollar recovery seems unlikely as long as investors' appetite for risk remains alive.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.08% | -0.08% | -0.49% | 0.09% | 0.09% | 0.02% | -0.09% | |

| EUR | 0.08% | -0.00% | -0.35% | 0.17% | 0.18% | 0.08% | -0.01% | |

| GBP | 0.08% | 0.00% | -0.33% | 0.17% | 0.18% | 0.11% | -0.02% | |

| JPY | 0.49% | 0.35% | 0.33% | 0.52% | 0.53% | 0.45% | 0.33% | |

| CAD | -0.09% | -0.17% | -0.17% | -0.52% | 0.00% | -0.06% | -0.19% | |

| AUD | -0.09% | -0.18% | -0.18% | -0.53% | -0.01% | -0.07% | -0.19% | |

| NZD | -0.02% | -0.08% | -0.11% | -0.45% | 0.06% | 0.07% | -0.12% | |

| CHF | 0.09% | 0.01% | 0.02% | -0.33% | 0.19% | 0.19% | 0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The Euro remains buoyed by positive risk mood

- The positive market mood keeps buoying the Euro (EUR) at the detriment of the safe-haven US Dollar, offsetting the impact of downbeat Eurozone economic releases like the German GFK Consumer Confidence Index, which deteriorated beyond expectations in November.

- Data released by the German GfK research company revealed that consumer confidence in Germany dropped to -24.1 in November, its worst reading in the last seven months, from -22.3 in September, and against market expectations of a mild improvement to -22.0.

- US President Trump continues his tour through Asia. He has met Japanese Prime Minister Sanae Takaichi, while Treasury Secretary Bessent called for a "sound monetary policy" in Japan, putting some pressure on the Bank of Japan (BoJ) to continue its monetary tightening cycle.

- The US and Japan have signed a framework deal to secure the mining and processing of rare earths and other critical minerals and reduce their dependence on China. The news has contributed to lifting investors' mood.

Technical Analysis: EUR/USD resistances are at 1.1670 and 1.1730

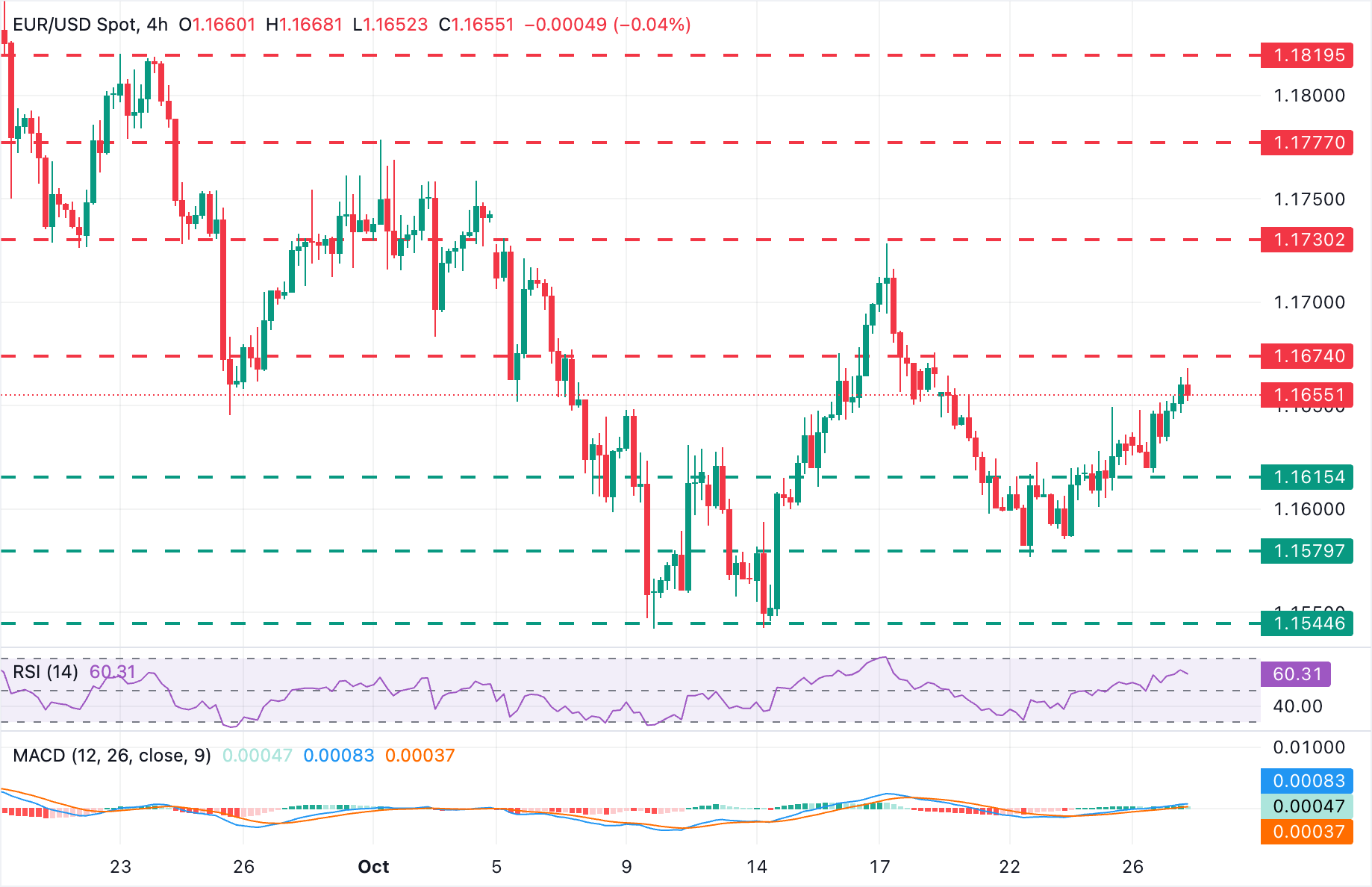

EUR/USD is on a short-term bullish trend from last week's lows at 1.1580. The pair has been appreciating over the last five trading days, yet with momentum indicators on the 4-hour chart suggesting a frail trend. The Relative Strength Index (RSI) is in bullish territory above 50, but the Moving Average Convergence Divergence shows short green histogram bars.

Price action remains within previous ranges, with the October 20 high, at 1.1675, closing the path towards the October 17 highs, in the area of 1.1730. The pair needs to breach this level to confirm the bullish trend and aim for the October 1 high, near 1.1780.

On the downside, Monday's low at the 1.1620 area is the prime support ahead of the October 22 low near 1.1575 and the key support level at the 1.1545 area (October 9 and 14 lows).

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.