Crypto Today: BTC, ETH, XRP recover ahead of US-China trade talks

- The second round of US-China trade talks is in focus as the two nations aim to expand the scope beyond tariffs.

- Bitcoin extends a short-lived bullish run over the weekend to its highest level since May 29.

- Ethereum resumes the uptrend above $2,500 after briefly retracing to $2,476.

- XRP edges down slightly, but the bullish outlook remains with the MACD indicator sustaining a buy signal flashed on Saturday.

The cryptocurrency market broadly edges up on Monday, extending a brief run over the weekend. Meanwhile, Bitcoin's (BTC) price increases above the pivotal $106,000 level, signaling a potential breakout toward $110,000 as investors await the second round of trade talks between the United States (US) and China.

Prices of major altcoins, including Ethereum (ETH) and Ripple (XRP), with the former increasing by more than 1% and the latter paring back some losses registered during Monday's Asian session.

Market overview: US-China trade talks in focus

Top US and Chinese officials are expected to meet at an undisclosed venue in London on Monday for the second round of trade talks aimed at de-escalating the high-stakes trade conflict that has morphed into a global economic dispute.

"The next round of trade talks between the U.S. and China will be held in the UK on Monday," a United Kingdom (UK) government spokesperson said on Sunday, as reported by Reuters. "We are a nation that champions free trade and have always been clear that a trade war is in nobody's interests, so we welcome these talks."

The two sides will attempt to extend the preliminary agreement reached during the May discussions in Geneva, which helped calm tensions between Washington and Beijing. Investors felt relief as markets regained strength following the April crash triggered by Trump's tariffs.

The officials expected to be at the discussion table include Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick and US Trade Representative Jamieson Greer, as well as a Chinese contingent led by Vice Premier He Lifeng.

Markets are abuzz with optimism, with Bitcoin holding steadily above $106,000, particularly since trade talks come after President Donald Trump talked with President Xi Jinping via a call last week.

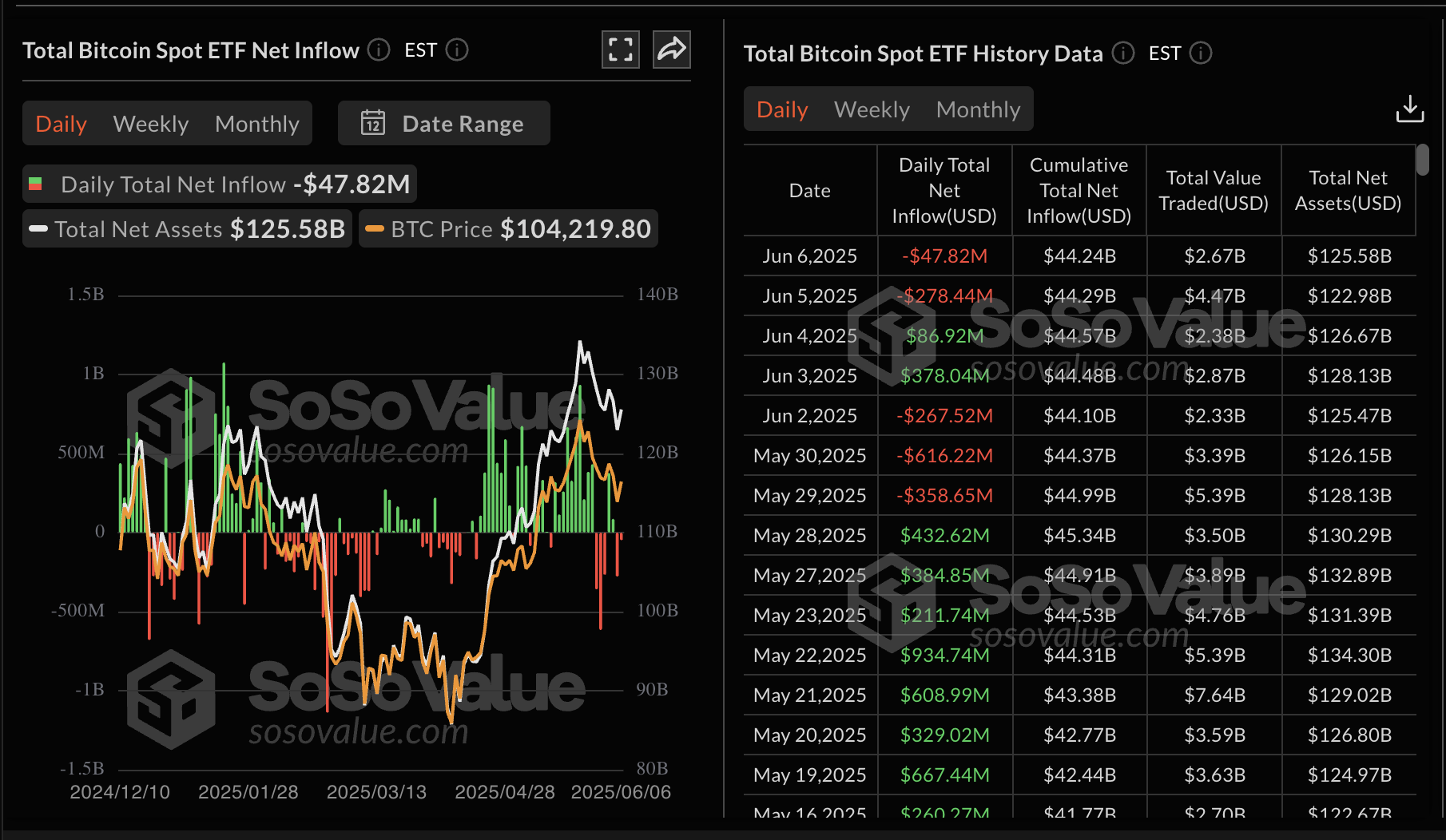

Data spotlight: Bitcoin gains momentum despite spot ETF outflows

Bitcoin spot Exchange Traded Funds (ETFs) recorded negative flows last week, with a net outflow of $129 million. Fidelity's FBTC ETF led the outflows with $168 million. According to SoSoValue, net outflows totaled $48 million on Friday, significantly lower than the $278 million posted on Thursday.

Bitcoin spot ETF stats | Source: SoSoValue

On the other hand, Ethereum spot ETFs continued to post net inflows last week, accruing to $281 million. Friday's $25 million net inflow volume marked 15 consecutive days of positive flows, underpinning the growing investor confidence in the largest smart contracts token following the Pectra upgrade in May.

Ethereum spot ETF stats | Source: SoSoValue

Chart of the day: Bitcoin extends gains, targeting $110,000

Bitcoin's price hovers at around $106,599 at the time of writing, holding above key moving averages, including a confluence established by the 50-period Exponential Moving Average (EMA) and the 100-period EMA, both at around $106,340.

The path of least resistance is upward, backed by several technical buy signals, including the Moving Average Convergence Divergence (MACD) indicator and the SuperTrend trend-following tool.

Traders often consider seeking exposure to BTC when the blue MACD line crosses above the red signal line. Moreover, the SuperTrend reinforced the bullish outlook when the BTC price moved above the indicator line, changing its color from red to green.

BTC/USD 4-hour chart

The uptrending Relative Strength Index (RSI) at 62 reinforces the bullish momentum, thereby increasing the likelihood of a breakout above the $110,000 level. However, caution would be advised as the RSI approaches the overbought territory. Overbought conditions, potential profit-taking, and changing market dynamics, especially in the macroeconomic environment, could result in a reversal targeting support at around $100,000.

Altcoins update: Ethereum and XRP show signs of recovery

Ethereum's price has reclaimed support at $2,500, trading at around $2,510 at the time of writing. This uptick, which follows a brief drawdown over the weekend to $2,476, exhibits a strong bullish potential, especially with the RSI approaching the 50 midline.

Traders would look for a daily close above $2,500 in the upcoming sessions to assess the strength of the uptrend. Key areas of interest as the price of ETH rebounds include the resistance at $2,600 and $2,700, respectively. If broken, traders will likely extend the bullish scope to $3,000, nearly 20% above the current market value.

ETH/USDT four-hour chart

Similarly, the XRP price shows signals of extending the rebound from support at around $2.22 while exchanging hands at $2.25 at the time of writing.

The cross-border money remittance token sits above the 50-period EMA and the 100-period EMA at $2.21 and $2.23, respectively. This position suggests XRP has a bullish bias, and with the MACD indicator sustaining a buy signal since Saturday, the path of least resistance could stay firmly upward.

XRP/USD 4-hour chart

A potential break and daily close above the 200-period EMA at around $2.25 would reinforce the bullish grip. Traders can also monitor the RSI movement toward the overbought region to validate the uptrend's strength and plan accordingly, especially with key levels at $2.40, $2.50 and $2.65 currently in focus.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.