EUR/JPY Price Analysis: Euro pulls back near 163.00 but bullish trend remains intact

- EUR/JPY was seen around the 163.00 zone after retreating during Monday’s session.

- Broader bias stays bullish, with downside limited by upward-trending averages.

- Price holds above key supports, while resistance aligns with short-term recovery targets.

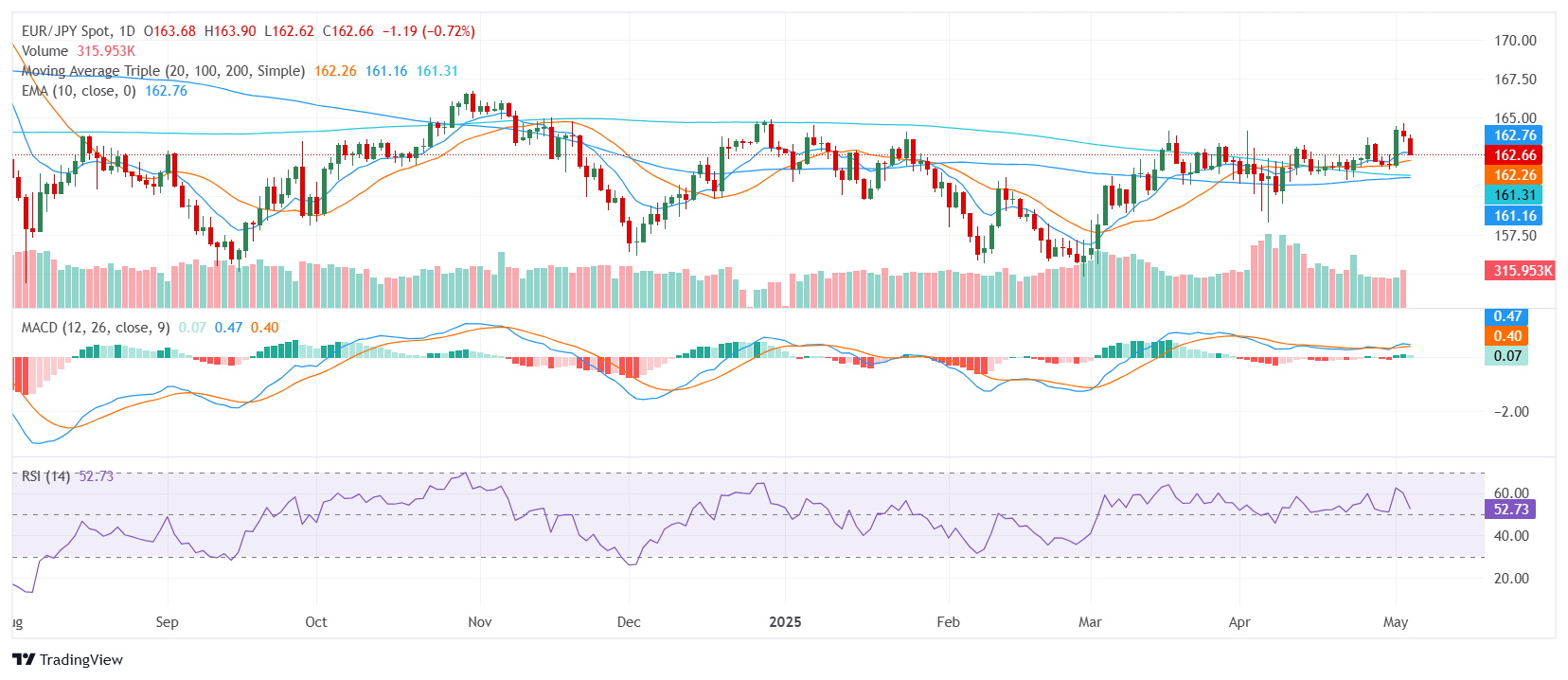

The EUR/JPY pair slipped lower on Monday, falling toward the 163.00 zone as the session closed and ahead of the Asian open. Despite the day’s decline, the broader setup remains constructive, with the pair still holding above critical trendline supports. Momentum readings appear neutral, but the underlying structure is sustained by bullish signals from longer-term indicators.

Technically, the pair maintains its bullish posture. The Moving Average Convergence Divergence signals continued buying interest, while the Relative Strength Index remains neutral near the midline around 53. Other tools such as the Awesome Oscillator and Bull Bear Power also print neutral readings, reflecting a short-term consolidation rather than a shift in directional momentum.

What reinforces the positive tone is the alignment of key moving averages. The 20-day, 100-day, and 200-day Simple Moving Averages are all rising and lie beneath current prices, providing a strong technical floor. The 30-day Exponential and Simple Moving Averages offer further dynamic support in the 162.10–162.15 area, helping contain deeper pullbacks.

Support levels are seen at 162.40, 162.26, and 162.14. Resistance is marked at 162.67, 162.76, and 163.60. A sustained bounce from current levels could see EUR/JPY test the upper end of its recent range, while a break below support would challenge the bullish case in the near term.

Daily Chart