Vornado Realty Trust Could Soar If These 2 Things Go Right

Key Points

Vornado Realty Trust has battled headwinds from higher interest rates and challenging office market conditions.

While short-term interest rates have started to fall, longer-term rates haven't declined as much.

The office market is showing signs of a recovery.

- 10 stocks we like better than Vornado Realty Trust ›

Vornado Realty Trust (NYSE: VNO) has lost 30% of its value over the past year. The real estate investment trust (REIT) has battled a barrage of headwinds, including persistently high interest rates and challenging office market conditions.

While the office REIT has been under pressure over the past year, it could soar if its two main headwinds turn into tailwinds.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

Long-term interest rates start to fall

REITs are highly sensitive to changes in interest rates. Higher rates increase borrowing costs, reducing their cash flows and restricting their ability to fund acquisitions and development projects. Higher rates also make lower-risk fixed-income investments, such as bonds, more attractive to investors. As a result, the value of commercial real estate investments falls, boosting their income yields to make them more enticing to income-focused investors. Meanwhile, lower rates have a positive impact on REITs by reducing their borrowing costs and increasing the value of their real estate holdings.

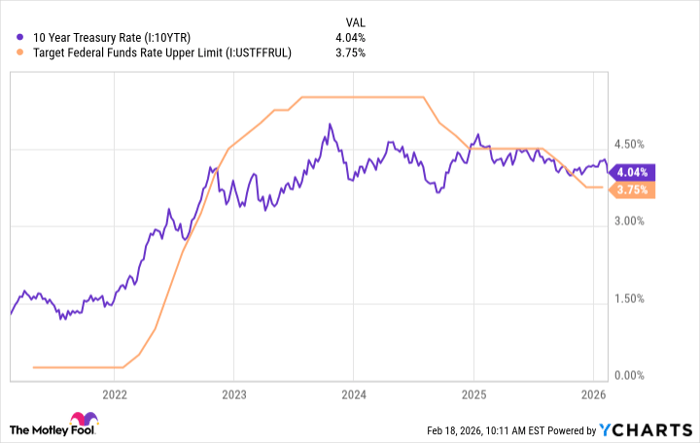

While short-term interest rates have fallen over the past year as the Federal Reserve cut the Federal Funds Rate, longer-term rates, such as the 10-year Treasury, haven't fallen as much:

10 Year Treasury Rate data by YCharts

This interest rate benchmark has a greater impact on REIT values. If it starts to meaningfully decline, which could happen if the inflation rate finally dips below 2%, that would likely drive up Vornado's share price.

The office market continues to recover

Vornado owns a diversified real estate portfolio comprising office, retail, and residential properties in New York City, Chicago, and San Francisco. However, the bulk of its portfolio is office properties.

The office market has been under significant pressure since the pandemic. The rise of remote and hybrid work has caused uncertainty about demand for office space in recent years. However, the sector seems to be finally turning the corner, according to JLL's latest U.S. office market dynamics report. Leasing activity in the fourth quarter reached a new post-pandemic high, with annual leasing activity growing 5.2%. Companies are growing more confident in making significant office space commitments as large-scale transactions increased 15% year over year. Additionally, U.S. office sales volume has now increased for seven straight quarters, showing growing investor confidence in buying office properties. Meanwhile, the pipeline for new offices under construction is trending down toward a record low. These factors drive JLL's view that the office sector is entering a new growth cycle.

Vornado is seeing this recovery firsthand. The company leased 960,000 square feet of office space across its New York portfolio during the fourth quarter, with a weighted-average lease term of 9.9 years. Rents were up more than 7% on a cash basis compared to the prior lease rates on the same space. If demand for office space continues to grow, it could help drive a recovery in Vornado's share price.

Dual catalysts could send this office REIT soaring

Vornado Realty Trust has struggled due to higher interest rates and a challenging office market. However, those headwinds could soon shift into tailwinds. If that happens, the office REIT could stage a brisk recovery.

Should you buy stock in Vornado Realty Trust right now?

Before you buy stock in Vornado Realty Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vornado Realty Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 889% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 19, 2026.

Matt DiLallo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.