This Latin American E-Commerce Stock Could Be Worth $500 Billion in 10 Years

Key Points

MercadoLibre is an e-commerce and fintech leader in Latin America.

The company could keep growing aggressively for many years.

Taking the long view, MercadoLibre shares look cheap today.

- These 10 stocks could mint the next wave of millionaires ›

Many investors are biased toward stocks in their home country, especially the U.S. And who could fault them? The U.S. market has done phenomenally well over the last 40 to 50 years, producing huge winners for people who owned the likes of Microsoft and Apple, among many other stocks.

But as we sit here today in late 2025, the U.S. stock market is trading at a premium average price-to-earnings ratio (P/E) versus the rest of the world. And yet, some overseas stocks could now provide a great value to investors.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Consider MercadoLibre (NASDAQ: MELI). Shares of the Latin American e-commerce powerhouse have underperformed over the last five years, and it now trades at a discount when compared to its long-term potential. Here's why the stock -- with its current market cap of $100 billion -- could be worth $500 billion in 10 years.

A history of revenue growth

MercadoLibre operates as an e-commerce platform and financial services business in countries including Mexico, Brazil, and Argentina. Founded over 25 years ago, the company has taken inspiration from the Amazon model to build up a huge network of buyers, sellers, and delivery infrastructure across its operating markets.

On top of e-commerce, it has layered financial services from its Mercado Pago subsidiary, which now has 72 million monthly active users (MAUs) and grew revenue 65% year over year last quarter on a constant currency basis.

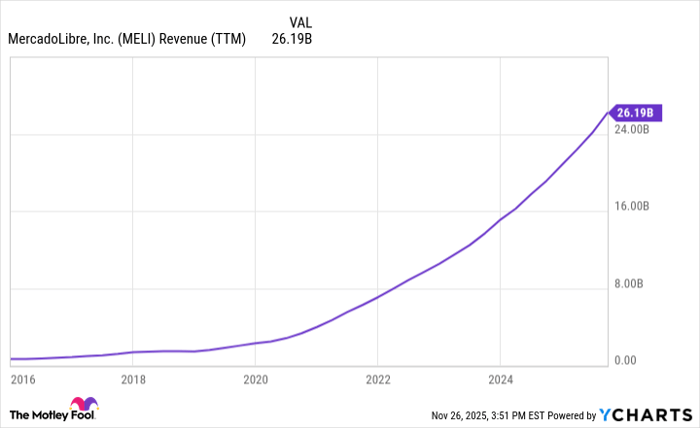

Its multipronged business has enabled the company to grow impressively for many years. Total revenue was up 49% in constant currency last quarter. In U.S. dollar terms, revenue is up close to 4,000% cumulatively in the last 10 years, driven by its dual engines of e-commerce and fintech.

Image source: Getty Images.

Opportunities in Argentina and long-term tailwinds

Even though MercadoLibre is the largest e-commerce operator in Latin America, it is still significantly smaller than peers like Amazon since it generates just $26 billion in trailing-12-month revenue.

E-commerce penetration in Latin America is much lower than other regions globally. This is due to a few reasons, including slower internet adoption, more difficult transportation routes, and poorer economies relative to places like East Asia and the U.S.

Over time -- as long as these Latin American economies keep growing -- these gaps will fill in and e-commerce should keep spreading in Mexico and Brazil, providing a long-term tailwind. And we are seeing a major economic recovery in Argentina, which is one of the company's largest markets. This could turn a headwind into a tailwind if the reforms in that nation keep bearing fruit.

MELI Revenue (TTM) data by YCharts; TTM = trailing 12 months.

Why MercadoLibre could be worth $500 billion in 10 years

When looking at MercadoLibre's stock today, it does not seem overly cheap considering its trailing earnings before interest and taxes of just over $3 billion. With a market cap of $100 billion, that would give the stock a trailing earnings multiple between 30 and 35, depending on where the stock is trading.

Anyone skeptical of the stock should zoom out and look at the long term. The company has grown impressively over the past two decades and should continue to do so in the years to come due to the factors discussed above. With higher-margin fintech revenue, its profit margin should be able to expand from the 10% level it sits at today.

At $100 billion in revenue and a 20% profit margin, MercadoLibre could be generating $20 billion in earnings 10 years from now. I believe that would deserve a market cap of $500 billion, or 25 times these forward earnings estimates, making it not only the largest e-commerce player in Latin America, but also one of the largest businesses in the world.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $459,064!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $53,048!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $580,171!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, available when you join Stock Advisor, and there may not be another chance like this anytime soon.

See the 3 stocks »

*Stock Advisor returns as of November 24, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, MercadoLibre, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.