1 Small-Cap Growth Stock Down 52% to Buy on the Dip

Key Points

Tenable is a specialist in the exposure management segment of the cybersecurity industry

The company offers a platform called Tenable One that aggregates many of its best products, including some powered by artificial intelligence.

Tenable stock trades at a very steep discount to some of its peers in the cybersecurity industry, which could spell opportunity for investors.

- 10 stocks we like better than Tenable ›

Cyber attacks are constantly on the rise, and they are increasingly difficult to thwart without the help of highly sophisticated cybersecurity solutions. Tenable (NASDAQ: TENB) is a specialist in the exposure management segment of the cybersecurity industry, which helps enterprises proactively patch vulnerabilities before they can be exploited.

With a market capitalization of just $3.5 billion, Tenable is much smaller than some of the leaders in the cybersecurity industry, like Palo Alto Networks and CrowdStrike, which are each valued at more than $100 billion. However, Tenable has a sizable addressable market, and management just increased its 2025 revenue forecast which signals momentum across the business.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Tenable stock remains 52% below its record high from 2022, but here's why it might be time to buy the dip.

Image source: Getty Images.

Tenable One is the ultimate exposure management platform

Tenable's Nessus platform is one of the cybersecurity industry's most accurate and most widely deployed vulnerability management solutions. It proactively scans operating systems, networks, and devices in search of potential weak points, so they can be fortified before hackers get the chance to exploit them.

Nessus has more than 2 million individual users, which is a massive customer base into which Tenable can cross-sell some of its other products. The company has developed an expanding suite of cybersecurity solutions to help enterprises protect employee identities, manage critical assets, and even safeguard all cloud networks whether they are hosted internally, or externally through a vendor like Amazon Web Services.

In fact, Tenable aggregated many of those products onto a platform it calls Tenable One, creating a comprehensive exposure management solution covering every facet of the enterprise. A feature called ExposureAI is at the heart of this platform, which uses artificial intelligence (AI) to identify potential attack paths, and offer guidance to human cybersecurity managers so they can proactively mitigate threats.

Tenable One accounted for 40% of all new business that flowed Tenable's way during the third quarter, so it has become a key driver of customer acquisition.

Tenable just increased its 2025 revenue forecast

Tenable generated $252.4 million in revenue during the third quarter of 2025 (ended Sept. 30), which was an 11% increase from the year-ago period. It cleared management's forecasted range of $246 million to $248 million by a wide margin.

The beat was driven by high-spending enterprises. Tenable had 2,156 customers with annual contract values of at least $100,000 at the end of the quarter, which was up 16% year over year. This highlights the growing need for sophisticated cybersecurity tools in larger, more complex organizations.

On the back of Tenable's strong third-quarter result, management increased its full-year revenue guidance for 2025 from $984 million to $990 million (at the midpoint of the respective forecasted ranges), which is a sign of growing demand.

But it gets better. During the third quarter, Tenable only increased its operating expenses by 5%, meaning its strong top-line result wasn't driven by a dramatic increase in growth-oriented spending on line items like marketing. Instead, the company appears to be experiencing solid organic demand.

With revenue growing much faster than costs, Tenable managed to generate a small profit of $2.2 million on a generally accepted accounting principles (GAAP) basis during the quarter, which was a big positive swing from its $9.2 million loss in the year-ago period.

On a non-GAAP basis, which excludes one-off and non-cash expenses like stock-based compensation, Tenable's third-quarter profit soared by 30% year over year to $51.4 million.

Tenable trades at a steep discount to other cybersecurity stocks

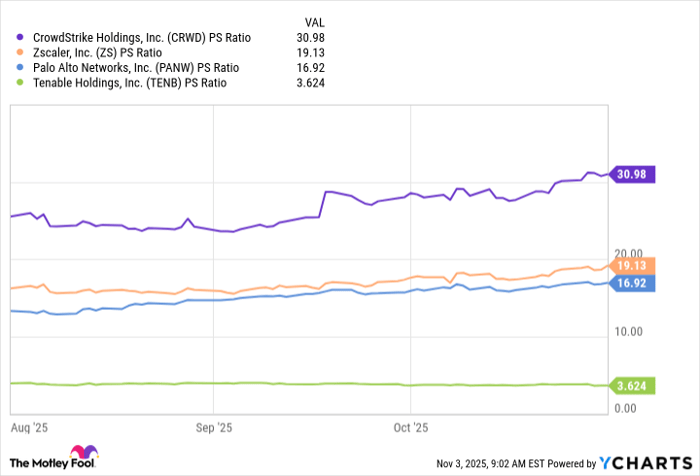

The 52% decline in Tenable stock since 2022, combined with the company's consistent revenue growth, has pushed its price-to-sales (P/S) ratio down to just 3.6. That is a steep discount to the valuations of some of the leading providers of AI-powered cybersecurity products:

CRWD PS Ratio data by YCharts

CrowdStrike, Palo Alto Networks, and Zscaler generate far more revenue than Tenable, and they are growing more quickly, so they deserve premium valuations. However, I think Tenable could chip away at the gap from here given the momentum in its business, driven by Tenable One and its AI features. Not to mention, the company values the exposure management cybersecurity market at $50 billion, so it has barely scratched the surface of the opportunity at hand.

Even if Tenable stock doubled from here, its P/S ratio would still be 67% cheaper than the average P/S ratio of the three companies I mentioned above. Therefore, this stock could be a bargain right now, particularly for long-term investors.

Should you invest $1,000 in Tenable right now?

Before you buy stock in Tenable, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tenable wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $589,424!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,217,942!*

Now, it’s worth noting Stock Advisor’s total average return is 1,054% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, CrowdStrike, and Zscaler. The Motley Fool recommends Palo Alto Networks. The Motley Fool has a disclosure policy.