Amazon Q3 Earnings Preview: Can AWS Reacceleration and Advertising Strength Fuel a Rally?

- Gold Price Forecast: XAU/USD slumps to near $4,000 on US-China trade progress

- Gold tumbles as traders book profits ahead of key US inflation data

- Gold declines as traders brace for trade talks, US CPI inflation data

- US CPI headline inflation set to rise 3.1% YoY in September

- Australian Dollar maintains position due to US-China trade optimism

- Fed’s October Rate Cut: Easing Cycle Continues, Gold Likely to Keep Rising

TradingKey - Amazon (AMZN), the U.S. e-commerce leader and cloud giant, will report its Q3 2025 earnings after market close on Thursday, October 30. After being labeled an “AI laggard” following its Q2 report, Amazon may now rewrite that narrative with signs of AWS recovery and its unshakable market leadership. Combined with strong retail and advertising performance, Amazon could emerge as a dark horse in Q4, rising from the bottom of the Magnificent Seven.

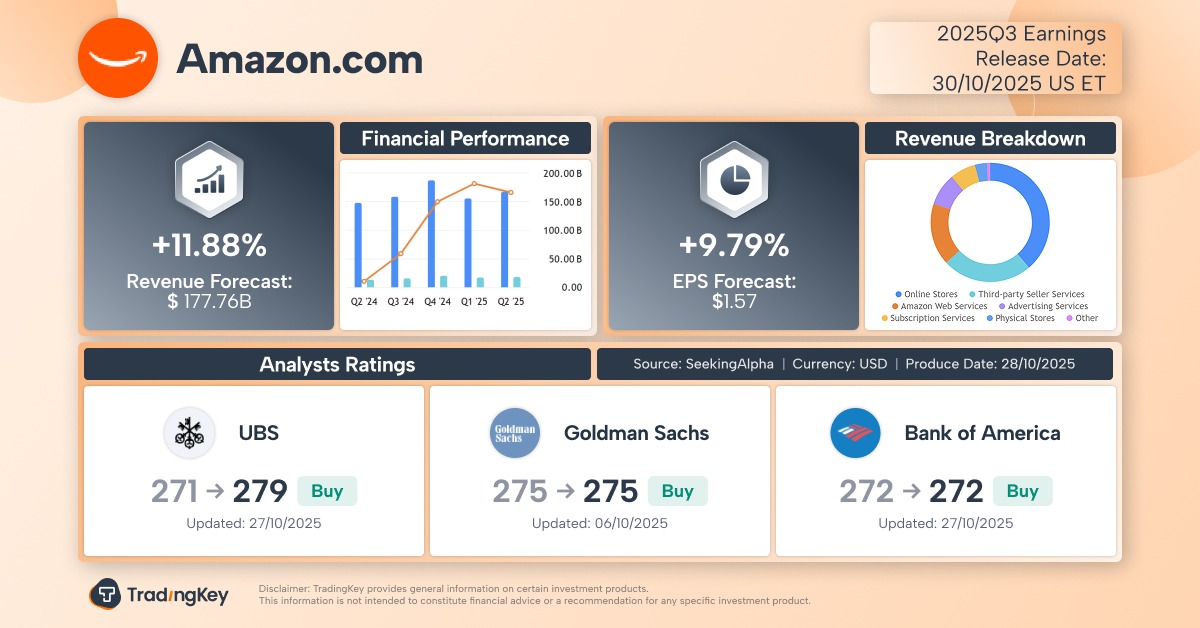

According to Seeking Alpha, Wall Street analysts expect:

Revenue: $177.76 billion, up 11.88% YoY from $158.88B

EPS: $1.57, up 9.79% YoY from $1.43

Amazon has beaten EPS estimates in 10 consecutive quarters — yet strong results haven’t translated into stock gains. The shares have declined after three of the last four earnings reports, including a >8% drop after Q2.

For this upcoming report, investors are focused on:

Can AWS growth accelerate?

How resilient are consumer spending and ads amid tariffs and macro headwinds?

Can Amazon balance profitability with cost-cutting measures like layoffs and rising capital expenditures?

AWS: Slower Growth, But Still Strong

Amazon Web Services (AWS) remains the global cloud market leader with ~30% share — nearly equal to Microsoft Azure (~20%) and Google Cloud (~12%) combined.

However, AWS’s 17.5% YoY revenue growth in Q2 lagged far behind Google’s 32% and Microsoft’s 39%, raising concerns about its long-term dominance. AWS’s global cloud share has fallen from 50% in 2018 to ~38% in 2024, and is expected to decline further this year.

Mark Shmulik, Bernstein analyst, noted that it’s hard to argue against AWS being the ‘weakest’ of the big three,” especially as Microsoft accelerates with OpenAI, Google benefits from a full-stack AI suite, and new entrants intensify competition — while Amazon faces supply constraints.

This concern triggered a sharp sell-off in July, and Amazon has since underperformed other tech giants YTD.

Before the “cloud trio” reported Q3 results, consensus forecasts were:

Amazon AWS: +18%

Microsoft Azure: +38.4%

Google Cloud: +30.1%

Microsoft and Google reported +39% and +34% cloud growth on Wednesday — potentially putting pressure on Amazon’s AWS update the next day.

Yet despite slower growth, analysts remain optimistic. Per Zacks Investment, AWS is expected to grow 17.8% YoY to $32.33 billion in Q3 — slightly below last year’s 19%.

Shmulik added that being last isn’t a death sentence. He highlighted progress, such as the AWS-Anthropic partnership, as a key growth catalyst.

JPMorgan analysts said AWS growth will continue to accelerate as AI supply bottlenecks ease. UBS expects Amazon’s cloud momentum to improve as capacity constraints and other headwinds fade.

Last week’s ~15-hour AWS outage, which disrupted industries globally, sparked debate: Did it prove the need for multi-cloud strategies — or underscore AWS’s irreplaceable role?

Some argue the outage validates multi-cloud adoption, pushing firms toward Microsoft and others. But others say it reinforces AWS’s dominance — given its deeply entrenched ecosystem and the high cost and complexity of migration. Most enterprises still hesitate to diversify.

Summit Research said challenges create opportunities: if AWS maintains chip supply and scales compute capacity, it can regain lost ground. AWS’s backlog now stands at $195 billion, up 25% YoY — exceeding cloud revenue growth. If supply catches up, this backlog could be a major engine for accelerated growth.

Retail & Ads: Potential Upside Surprise

The focus on AWS’s relative slowdown has overshadowed Amazon’s strong retail and ad growth. North American e-commerce alone accounts for ~60% of total revenue.

Analysts project:

Online stores: +8.3% YoY to $66.52B

Physical stores: +6.2% YoY to $5.55B

Advertising: +20.5% YoY to $17.27B

Justin Post, Bank of America analyst, sees 1–2 percentage points of upside in retail, projecting North America segment revenue up 10% YoY to $105.1B.

He cited credit/debit card data showing accelerating online spending on Amazon in Q3 — supported by Bloomberg’s consumer activity indicators.

UBS noted that Amazon’s expansion of “one- and same-day Prime delivery” could boost GMV and market share.

With tariffs threatening retail margins, advertising strength remains a key profit driver. Amazon Ads grew 23% YoY in Q2, outpacing Meta and Google.

Benchmark believes Amazon’s ad business and Prime video ecosystem will unlock even greater value — with ad growth and margins potentially surpassing AWS.

BofA projects GAAP operating profit of $20.4B, above consensus ($19.7B), driven by healthy retail sales, strong ad performance, and Q2 AWS job cuts.

Capex Surge to Overcome AI Bottlenecks

Amazon’s Q2 capex hit a record $31.4B, up 90% YoY. CFO Brian Olsavsky said this level reflects their spending pace for H2.

CEO Andy Jassy emphasized that AI advancements are improving user experience, innovation speed, operational efficiency, and business growth across Amazon.

Beyond the shift toward higher-margin businesses and sustained ad growth, Wedbush analysts are watching:

Capex demand for infrastructure and AI investments

AWS growth momentum

Monetization potential of new AI services

If Amazon continues expanding capex — particularly on AI infrastructure — it would signal confidence in overcoming its key bottleneck: supply constraints. This would be a bullish signal for the stock.

Is Amazon Undervalued?

Year-to-date, Amazon is up 5%, trailing the S&P 500 (+17%) and Nasdaq (+24%).

Per TradingKey, the average analyst target price is $267.08 — implying about 16% upside from current levels.

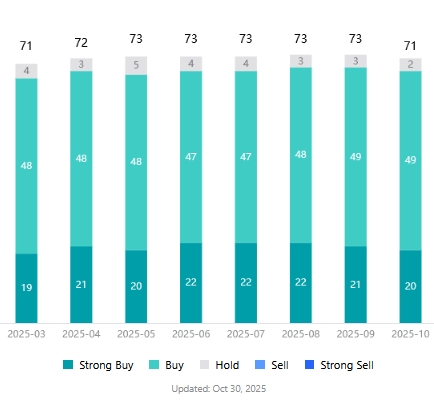

Despite the “laggard” image, among 71 analysts covering AMZN, none rate “Sell”, and 69 recommend “Buy.”

Analyst Ratings for Amazon Stock, Source: TradingKey

Scott Devitt, Wedbush analyst who recently raised his target from $250 to $280, said that strong cloud backlog and massive investment in new data centers keep Amazon’s long-term growth story intact.

He added that retail resilience and ad strength remain underappreciated.

Benchmark, which reiterated a Buy rating and $260 target, stated that AWS growth will accelerate, and operating margins have room to expand.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.