Could Buying Pool Corp. Today Set You Up for Life?

Key Points

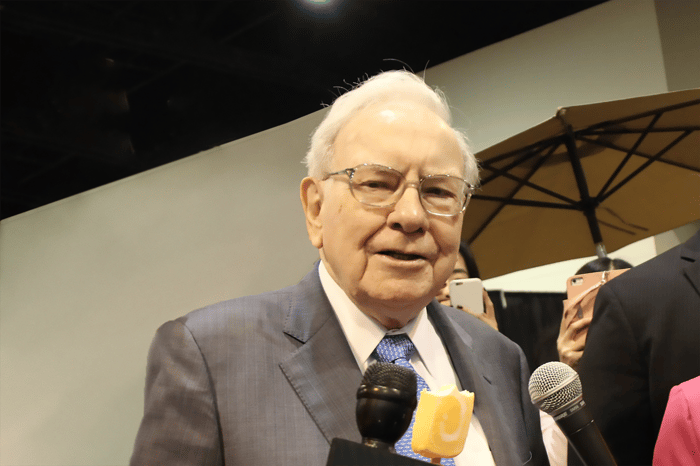

Warren Buffett likes to buy well-run businesses when they are attractively priced.

Berkshire Hathaway recently added specialty retailer Pool Corp. to its portfolio.

Pool Corp. has a built-in growth bias, even though short-term business performance can be a bit volatile.

- 10 stocks we like better than Pool ›

All of Wall Street watches Berkshire Hathaway's (NYSE: BRK.A)(NYSE: BRK.B) stock portfolio. That's because they want to see what CEO Warren Buffett is getting up to. One of Berkshire's recent buys was Pool Corp. (NASDAQ: POOL), a specialty retailer. Should you follow Buffett's lead on this one if you are looking for a lifetime investment?

Good company, good price, hold for the long term

Buffett doesn't really get into too many specifics about his investment approach. However, a top-level summary is that he likes to buy well-run businesses. He likes to buy these businesses when they are attractively priced. And he likes to hold his investments for years so he can benefit from the long-term growth of the business he's acquired.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: The Motley Fool.

All of those factors are important to consider when you look at Buffett's purchase of specialty retailer Pool Corp. From a big-picture perspective, the company sells the supplies needed to build, remodel, and maintain pools. It's not exactly a "sexy" business, but Buffett has a penchant for owning fairly simple companies. So, what's so special about Pool?

The first big item of note is the fact that Pool Corp.'s stock price has collapsed since hitting a high-water mark during the peak of the pandemic. The stock has lost roughly half of its value since late 2021. That drop, however, is likely driven more by emotion than long-term business developments.

During the pandemic, demand for new pools spiked as people were stuck at home (and interest rates were particularly low). Investors extrapolated that demand into the future, even though it was likely to be temporary. When the world opened back up and demand trends returned to normal, Pool's stock price fell as disappointed investors jumped ship. But there's an interesting twist to the pool business that Buffett and his team are well aware of.

POOL data by YCharts

You have to maintain your pool, or you get a swamp

Every new pool that gets built has to be maintained. That's an ongoing expense that requires people to buy supplies from retailers like Pool. If a person chooses not to maintain their new pool, they will have essentially bought themselves a nasty, green swamp in their backyard. So while the demand spike in new pool construction may have brought forward some future demand, it still increased the base of customers that Pool services.

Selling pool maintenance products makes up roughly two-thirds of the income statement's top line. This is the most important part of the business and the one that underpins its long-term growth story. That remains true even though new construction and remodeling can vary dramatically from year to year, pushing revenue and earnings around a little bit.

That said, there's another avenue for growth here. Pool is also opening new locations, which increases its geographic reach. That's normal business for a retailer, but it can't be ignored when looking at the stock as a long-term investment. This is an inherently growth-oriented business with two fundamental growth opportunities. No wonder Buffett stepped in to buy it after it sold off.

What's interesting here is that the company's trailing-12-month sales have risen by nearly two-thirds since the start of 2020 but the stock price is only up around 40% over that same span. The stock's trailing-12-month price-to-sales ratio is currently below both its five-year and seven-year averages. It looks like Pool is a good company that's trading at an attractive price.

Buy Pool for the long term

Buffett has stepped in to buy Pool Corp., but the key is likely to be the long-term growth bias. If you choose to own this specialty retailer you should look at it as a long-term holding, noting that there will be short-term business swings based on new pool construction trends. But if you take the Buffett approach here, the inherent growth bias to Pool's operations suggests it could help set you up for life.

Should you invest $1,000 in Pool right now?

Before you buy stock in Pool, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pool wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $669,449!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,110,486!*

Now, it’s worth noting Stock Advisor’s total average return is 1,076% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.