UK CPI expected to rise in September, supporting BoE’s hawkish stance

The United Kingdom’s Office for National Statistics will publish the September CPI data on Wednesday.

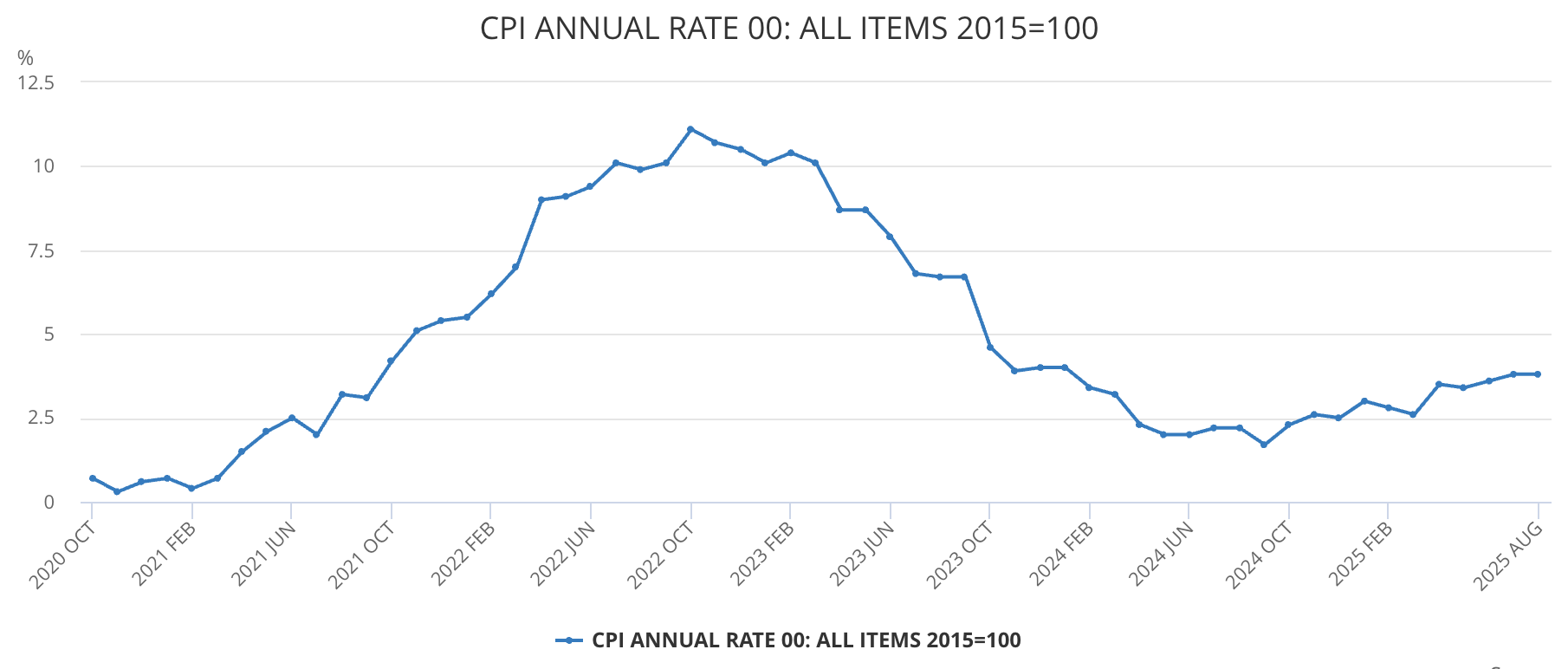

The annual UK headline inflation is expected to hit 4%, its highest level since early 2024.

Core inflation and retail prices are also seen increasing, which might curb hopes of BoE rate cuts in the near term.

The United Kingdom (UK) Office for National Statistics (ONS) will publish the highly relevant Consumer Price Index (CPI) data for September on Wednesday at 06:00 GMT, with markets expecting an uptick in inflationary pressures.

UK consumer inflation is a key release for the Bank of England (BoE) and has a significant impact on the Pound Sterling (GBP). The central bank’s Monetary Policy Committee meets on November 6, and Wednesday’s inflation readings will be the last ones ahead of the interest rate decision.

What to expect from the next UK inflation report?

The UK headline Consumer Price Index is forecast to have accelerated to a 4% annual rate in September* from the 3.8% YoY seen in August. If these figures are confirmed, it will be the strongest inflation reading since January 2024, and twice as high as the BoE’s 2% target for price stability.

Source: National Statistics

The UK core CPI, considered more relevant for the central bank, as it strips off the seasonal impact of food and energy prices, is also expected to have heated, although at a milder pace. The UK’s core inflation is seen at 3.7% YoY in September, from the previous month’s 3.6% reading.

Monthly inflation is expected to have risen 0.2%, both headline and core CPI, following 0.3% advances in August.

Together with consumer inflation, National Statistics is expected to release the Retail Prices Index numbers, which are also expected to have picked up to a 4.7% YoY growth last month, from 4.6% in August. The Bank of England’s Chief Economist, Huw Pill, has endorsed this view, affirming that the bank “needs to recognise CPI stubbornness as more pressing,” and that “a more cautious pace of withdrawing monetary policy restrictions than seen over the past year may be appropriate.”

How will the UK Consumer Price Index report affect GBP/USD?

A 4% inflation reading, as the market consensus anticipates, is likely to trigger a significant repricing of the Bank of England's monetary easing prospects, which might provide some support to the British Pound.

Data released in previous weeks revealed that the UK labour market is stabilising, following declines in payrolls and vacancies earlier this year. National Statistics numbers showed that the Unemployment Rate ticked up to 4.8% in the three months to August, and net employment increased by 91K, following a 232K increment in July.

Beyond that, Gross Domestic Product (GDP) bounced up to 0.1% in August, buoyed by a 0.7% growth in Manufacturing Production. This reading partly reverses the 1.1% contraction seen in July and beats expectations of a 0.4% growth.

All in all, the figures reflect a solid economy that copes well in the face of an uncertain global trade scenario, allowing the Bank of England to hold rates at the current levels for some time.

At their latest monetary policy meeting in September, the UK central bank left its benchmark interest rate at 4%, with two dissenting members voting for a further rate cut. The meeting minutes already highlighted a more cautious approach to monetary easing amid persistent inflation risks.

In this context, a strong CPI, 4% or higher, would curb hopes of further rate cuts in the coming months and might give the Pound an additional impulse. Softer-than-expected data, on the contrary, might keep hopes of further monetary easing alive and add pressure on the GBP.

GBP/USD 4-hour chart

Regarding the GBP/USD pair, FXStreet analyst Guillermo Alcalá sees price action correcting lower after peaking at 1.3470 last week: “The GBP/USD recovery has been capped at the 1.3470 area, and the pair has been trading lower ever since, with the 61.8% Fibonacci retracement of the mid-October rally, at 1.3335 emerging as a plausible target for a bearish correction.”

On the upside, Alcalá sees a significant resistance area between 1.3470 and 1.3490: "Bulls, on the contrary, have remained capped below 1.3445, but the key resistance remains in the area between October 17 and 7 highs at 1.3470 and 1.3490, respectively."

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.