Ripple Price Forecast: XRP holds support as retail interest stabilizes, ETF inflows extend

- XRP pushes toward $1.40 immediate support, trading well below the 50-, 100-, and 200-day EMAs.

- XRP posts steady inflows into spot ETFs, signalling a potential shift toward risk-on sentiment.

- The XRP derivatives market remains weak, but futures Open Interest stabilizes at $2.5 billion.

Ripple (XRP) trades under pressure, with immediate support at $1.40 holding at the time of writing on Tuesday. A recovery attempt from last week’s sell-off to $1.12 stalled at $1.54 on Friday, leading to limited price action between the current support and the resistance.

Despite support at $1.52, XRP is down over 1.5% intraday. On the upside, institutional investors continue to lean into risk while the retail market exhibits potential stability.

XRP ETFs post modest inflows

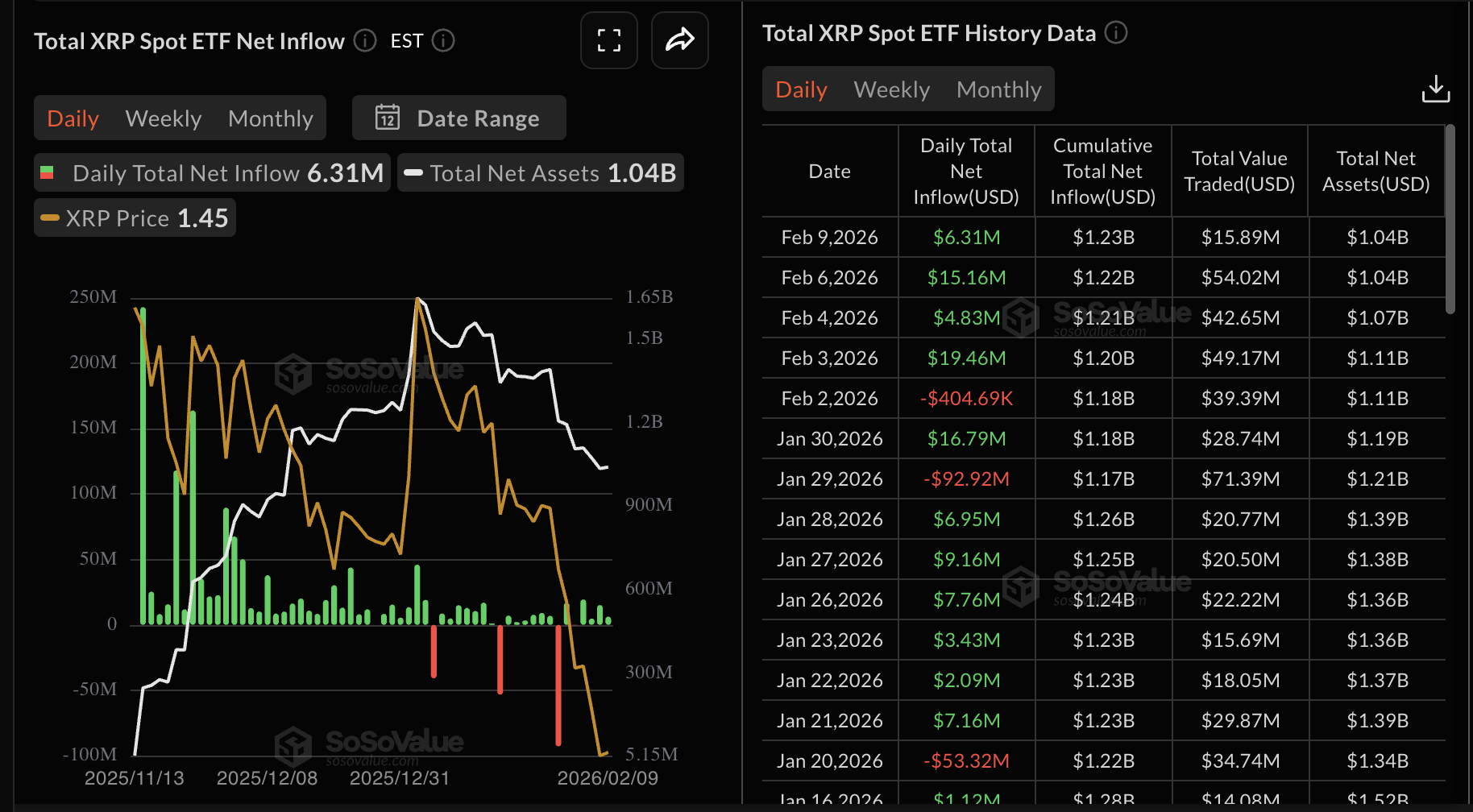

Inflows into US-listed XRP spot ETFs totaled $6.3 million on Monday, bringing the cumulative inflow to $1.23 billion, and net assets under management to $1.04 billion. Institutional investors have continued to lean into XRP ETFs, marking four consecutive days of inflows.

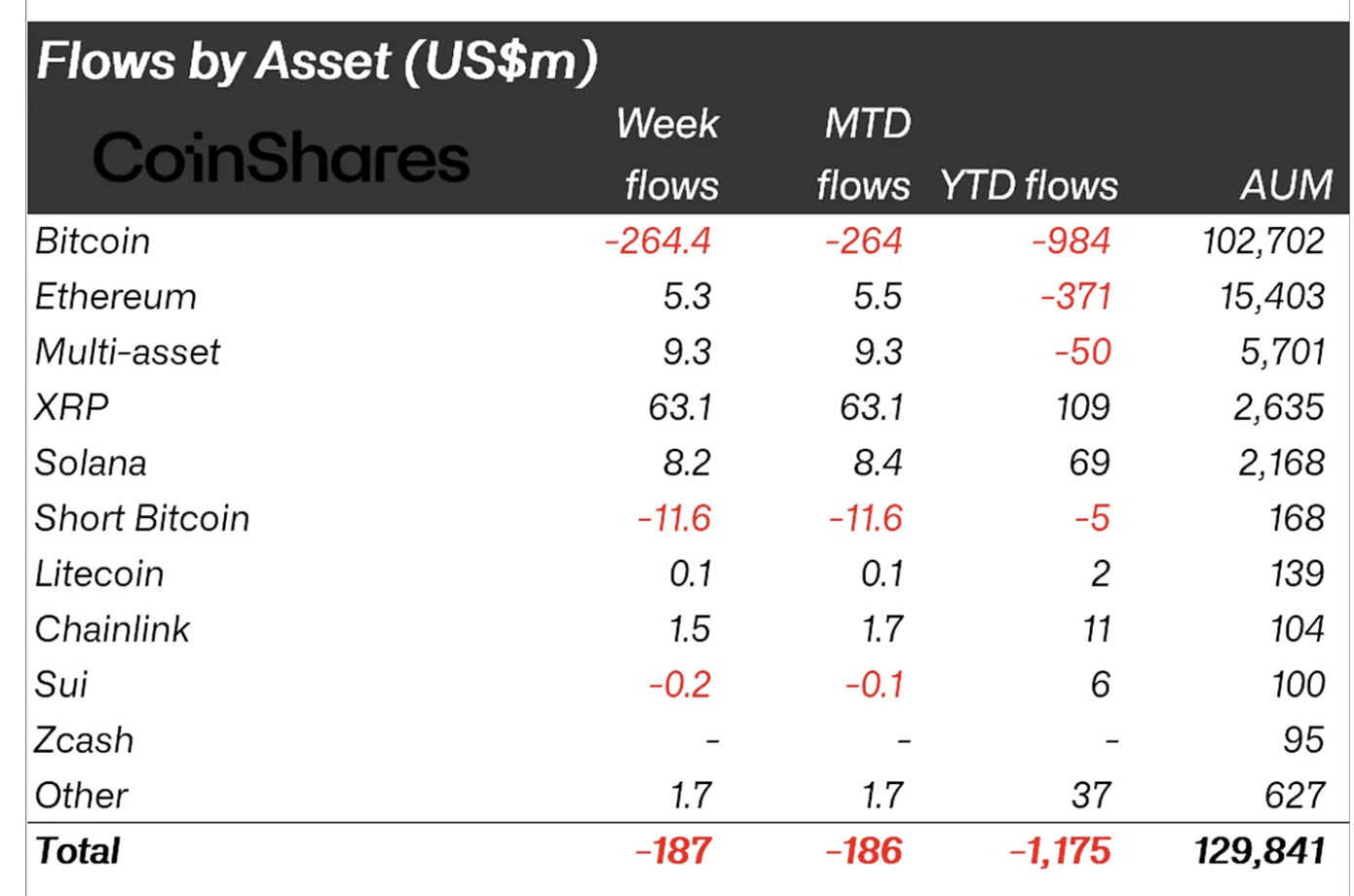

lat week, XRP ETFs accumulated $39 million in total inflows through Friday. As reported, total inflows into XRP-related investment products averaged $63.1 million last week. The cumulative assets under management stand at $2.6 billion as of Friday, according to CoinShares.

Meanwhile, the XRP derivatives market remains weak, as reflected in futures Open Interest (OI), which stabilised at $2.50 billion on Tuesday, up from $2.47 billion the previous day. Stability in the derivatives market suggests that traders are holding onto their open positions, while a steady increase would support a bullish outlook in XRP as investors lean into risk.

Traders are facing fewer liquidations of leveraged positions, as only $1.38 million in long positions and approximately $263,000 in shorts have been wiped out on Tuesday. For context, $59 million in long positions and $11 million in shorts were liquidated on Thursday as headwinds intensified across the crypto market. Fewer liquidations extend a breather for investors who may want to increase exposure at lower price levels, anticipating short-term rebounds.

Technical outlook: Assessing XRP’s short-term market structure

XRP is trading above $1.40 support, but holds below the 50-day Exponential Moving Average (EMA) at $1.81, the 100-day EMA at $2.00 and the 200-day EMA at $2.18. The downward-slopping moving averages align with the overall bearish trend that continues to cap rebounds.

At the same time, the Moving Average Convergence Divergence (MACD) stays below the signal line on the daily chart, prompting investors to reconsider seeking exposure. Meanwhile, the red histogram bars are contracting, suggesting that bearish momentum may be slowly easing. The Relative Strength Index (RSI) at 34 on the daily chart reflects subdued impulse without reaching oversold conditions.

For XRP to sustain recovery toward Friday's high at $1.54 and the 50-day EMA at $1.81, the RSI should steadily rise toward the midline.

Still, the descending trend line from $3.66 limits recoveries, with resistance at $2.15. As long as the price remains under these technical boundaries, the path of least resistance would stay lower, with targets at $1.25 (October 10 low) and Friday's low at $1.12.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.

(The technical analysis of this story was written with the help of an AI tool.)