XRP Rebounds From Channel Bottom, Analyst Says $2.60 Could Be Next

A cryptocurrency analyst has pointed out how XRP has bounced off the bottom level of a Parallel Channel and could be headed toward its midway line.

XRP Recently Found Support At The Lower Line Of A Parallel Channel

In a new post on X, analyst Ali Martinez has discussed about a technical analysis (TA) pattern forming in the 3-day price of XRP. The pattern in question is a “Parallel Channel,” appearing whenever an asset’s price consolidates between two parallel trendlines.

The upper level of the channel provides resistance to the asset, making tops probable at it. Similarly, the lower line can facilitate bottom formations by acting as a source of support. A breakout of either of these bounds can imply a continuation of the trend in that direction.

There are a few different types of Parallel Channels, but the one of interest here is the most basic version: a channel that’s parallel to the time-axis. This type corresponds to a phase of true sideways movement in the price.

Now, here is the chart shared by Martinez that shows the Parallel Channel that the 3-day price of XRP has been stuck inside for the past year:

As is visible in the above graph, XRP witnessed a failed breakout beyond the upper line of the Parallel Channel back in July. This kicked off a phase of downtrend for the cryptocurrency, which culminated in a retest of the channel’s lower line earlier in November.

The coin has since observed a rebound, a potential sign that the support level of the Parallel Channel is holding up. The analyst thinks that the cryptocurrency may now be heading toward the midpoint of the pattern, located at $2.60.

From the current price of the asset, a rally to this level would mean an increase of almost 20%. It now remains to be seen whether the coin’s surge will continue, or if it will retrace back to the support line again.

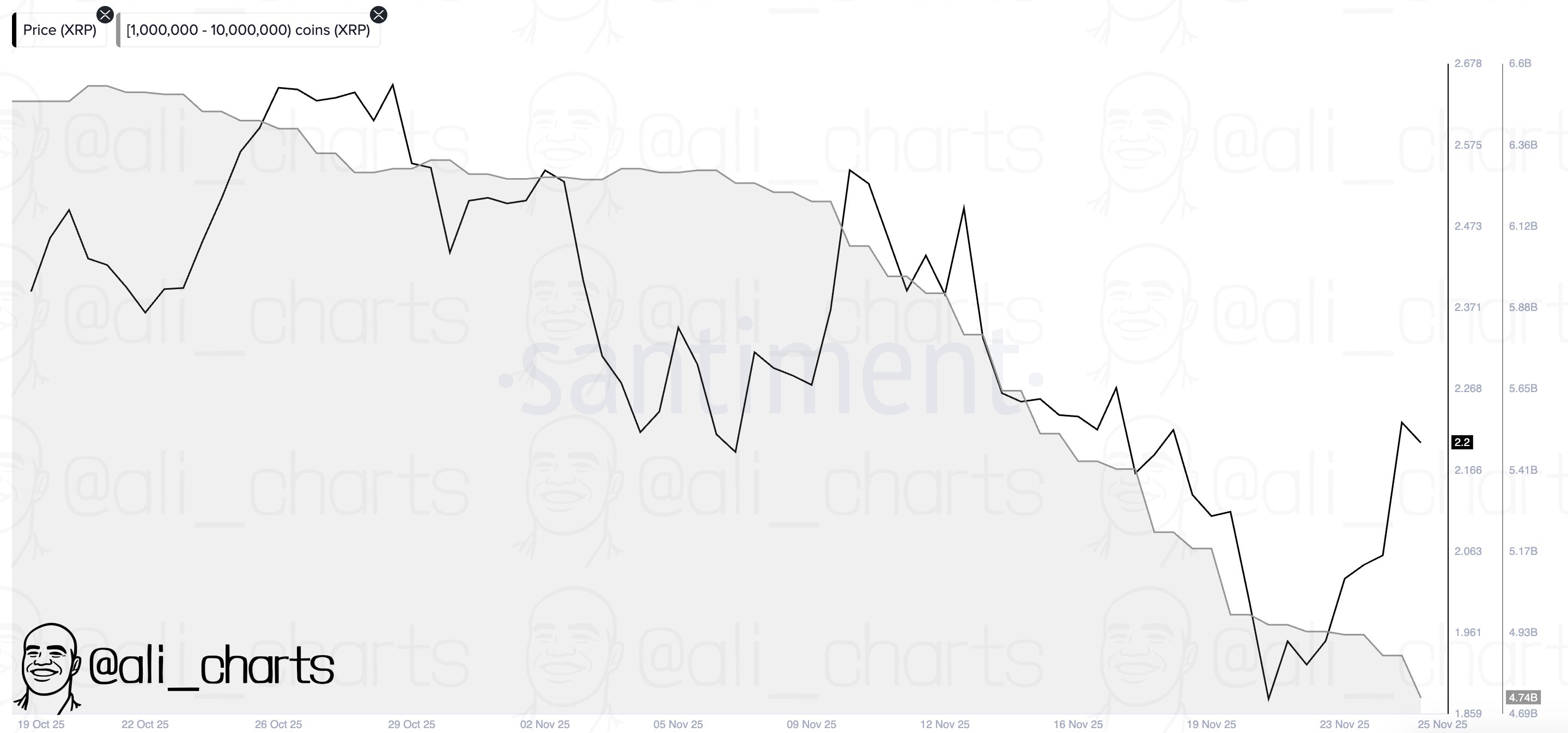

Something that could make the latter scenario more likely is profit-taking from the whales. As Martinez has highlighted in another X post, the large XRP holders carrying between 1 million and 10 million tokens participated in distribution during the asset’s latest recovery surge.

As displayed in the chart, XRP whales reduced their supply by more than 180 million tokens (worth $391 million at the latest exchange rate) alongside its 17% price rally. This selloff was only a continuation of the trend from earlier in the month, and could be a potential sign that the sentiment among big-money traders hasn’t changed despite the rebound.

XRP Price

At the time of writing, XRP is floating around $2.17, down 1.5% over the last 24 hours.