Internet Computer Price Forecast: ICP surges 30% as bullish momentum builds

- Internet Computer price extends rally and surges over 30% on Tuesday.

- Rising on-chain activity signals strengthening bullish sentiment.

- The technical outlook suggests further gains, targeting above $6.

Internet Computer (ICP) price extends its rally by 30%, trading above $5 at the time of writing on Tuesday, after a strong rally the previous week. Rising on-chain activity, growing network adoption, and improving market sentiment are fueling the uptrend, with bulls now setting their sights on the key $6 resistance level.

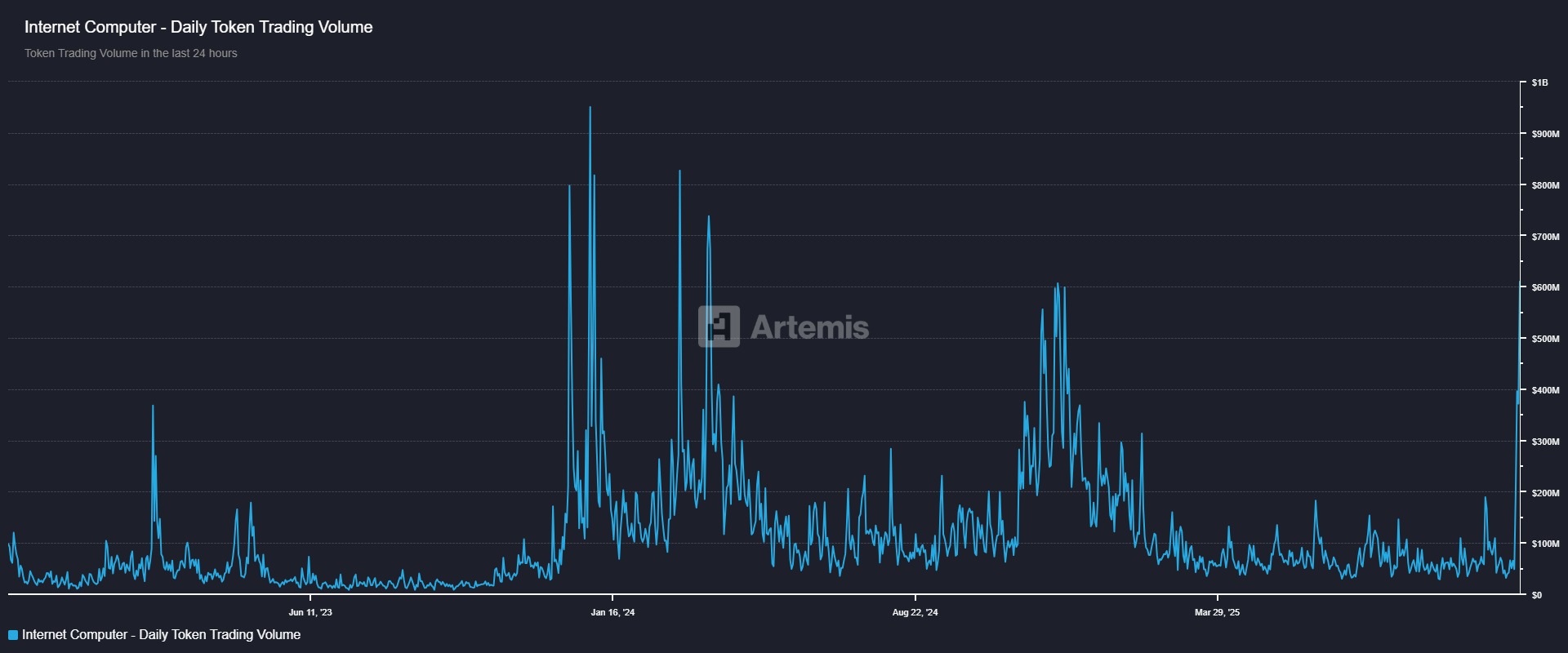

ICP’s trading volume hits 1.5-year high amid renewed market interest

Artemis’s daily token trading volume indicates that the ICP ecosystem’s daily aggregate trading volume reached $672 million on Tuesday, the highest year-to-date volume and levels not seen since May 2024. This volume rise indicates a surge in traders’ interest and liquidity in the Internet Computer chain, boosting its bullish outlook.

Santiment data shows that Internet Computer’s network growth index — a key metric tracking user adoption and project traction — surged to 1,910 on Sunday, marking its highest level since late July. Although it has since stabilized around 1,043, the elevated levels still highlight a broadly bullish outlook for ICP.

[14-1762246867633-1762246867634.13.05, 04 Nov, 2025].png)

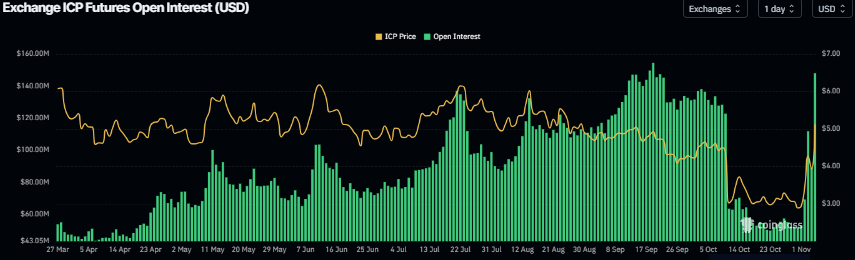

On the derivatives side, CoinGlass’ data show that the futures’ OI in ICP at exchanges reached $147.98 million on Tuesday, the highest level since mid-September. An increasing OI represents new or additional money entering the market and new buying, which could fuel the current ICP price rally.

Internet Computer Price Forecast: ICP bulls aiming for a level above $6

Internet Computer price broke above the descending trendline (drawn by connecting multiple highs since mid-August) on Sunday and found support around it the next day. At the time of writing on Tuesday, ICP rallied more than 30% trading above $5.17.

If ICP continues its upward trend, it could extend the rally toward the daily resistance level at $6.83.

The Relative Strength Index (RSI) on the daily chart is 70, pointing upward toward overbought territory, indicating strong bullish momentum. Additionally, the Moving Average Convergence Divergence (MACD) showed a bullish crossover last week, which remains intact, indicating the continuation of an upward trend.

On the other hand, if ICP faces a correction, it could extend the decline to find support around its 50-day Exponential Moving Average (EMA) at $3.85.