Pump.fun Price Forecast: PUMP could extend decline as platform revenue, volume plunge

- Pump.fun decreases 41% from its record high, as volatility ravages across the crypto market.

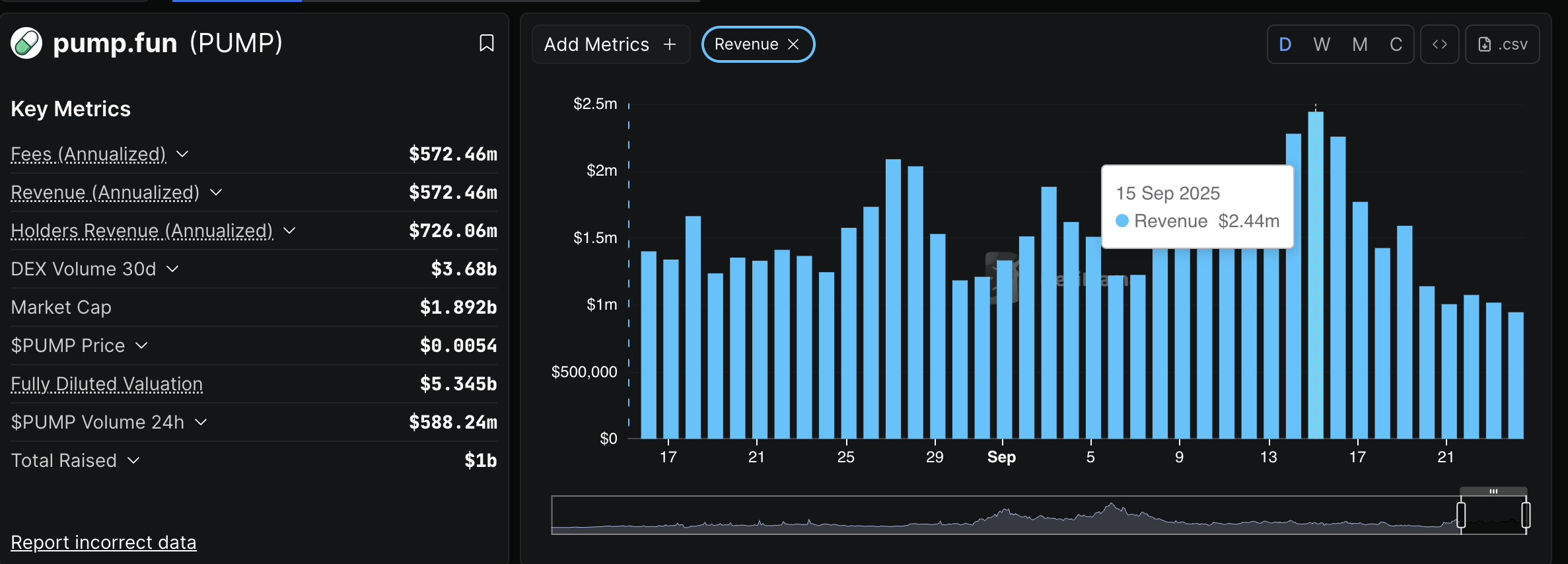

- Pump.fun meme coin launchpad revenue declines by more than half to $945k, from a $2.44 million September peak.

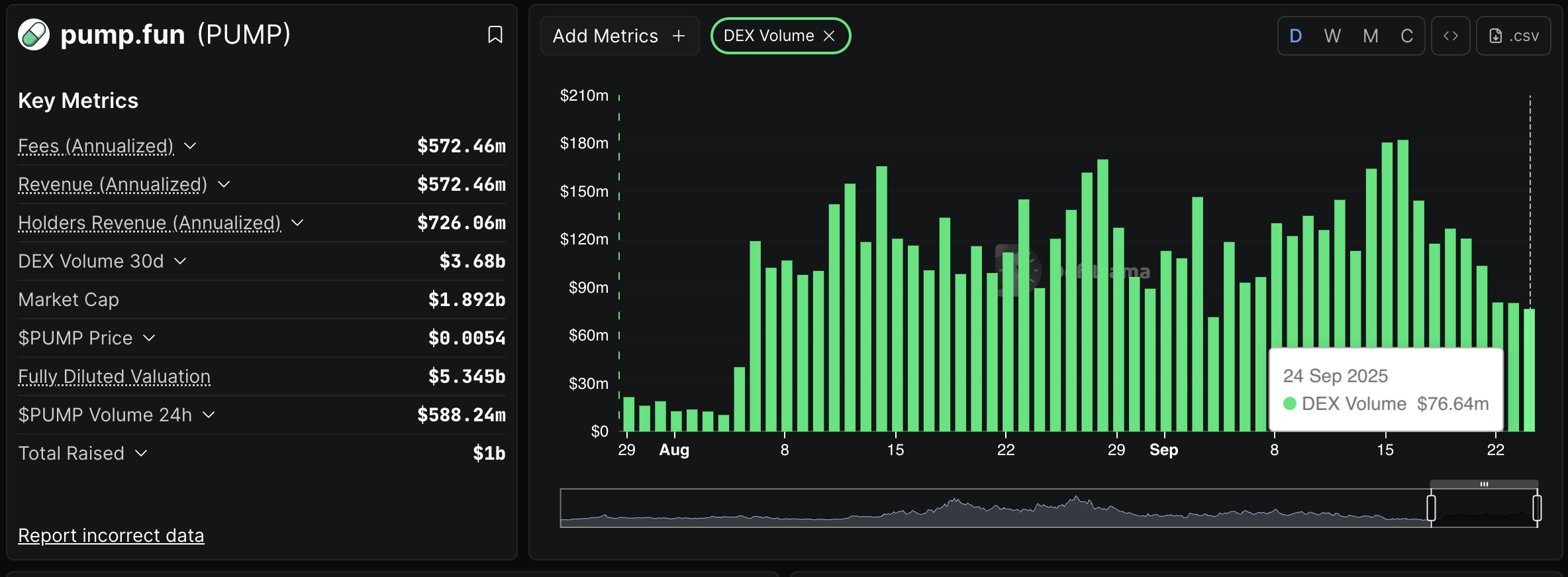

- Pump.fun's DEX volume is also on a steep decline, averaging $77 million amid widespread risk-off sentiment.

Pump.fun (PUMP) extends the decline from its record high of $0.0089, trading at $0.0053 at the time of writing on Thursday. The token native to the meme coin launchpad has trimmed most of the gains accrued in September, mirroring the risk-off sentiment prevailing in the broader cryptocurrency market.

Pump.fun platform revenue, volume slide

Pump.fun's dominance in the meme coin launchpad sector has largely hinged on the platform's revenue, which exceeded $7 million in January but declined in the following months through to August before picking up pace in September, following the launch of PUMP, the native token.

According to DefiLlama, Pump.fun's revenue increased to $2.44 million on September 15, a day after the price of PUMP hit a new record high of $0.0089. However, the trend has since been downhill, with the revenue count averaging $945,000 on Thursday. The decline comes amid a wider correction in the cryptocurrency market, driven by risk-off sentiment stemming from macroeconomic uncertainty in the United States (US).

Despite the Federal Reserve (Fed) lowering interest rates to the range of 4.00%-4.25%, citing the need to support a weaker labor market, other economic factors, such as inflation, cast doubts on the central bank's dovish outlook for the rest of the year.

Pump.fun revenue stats | Source: DefiLlama

The recent uptrend in Decentralized Exchange (DEX) trading volume, which peaked at $182 million on September 16, hit a sudden roadblock, paving the way for a steep decline to approximately $77 million on Thursday. This drop highlights slowing activity on the meme coin launchpad, often driven by sentiment and euphoria. If the trend persists in the coming days and weeks, it could become increasingly difficult to sustain the PUMP price recovery, further dampening investor interest.

Pump.fun DEX volume stats | Source: DefiLlama

Pump.fun is among the platforms that place great emphasis on token buybacks, with most of the revenue being channeled toward this initiative. Hence, declining revenue and volume could have a direct impact on PUMP's performance.

Technical outlook: Can PUMP defend key support?

PUMP offers short-term recovery signals on the 4-hour chart, supported by the Relative Strength Index (RSI) rising to 37 from near oversold conditions this week. If the RSI breaks above the dotted descending trendline and steadies toward the midline, it will indicate bullish momentum is building and support a recovery in the PUMP price.

PUMP/USDT 4-hour chart

Still, traders should be cautious, considering the 200-period Exponential Moving Average (EMA) at $0.0055 is likely to delay the uptrend. The 50-period EMA at $0.0062 is on the cusp of forming a Death Cross pattern if it closes below the 100-period EMA.

This is a bearish technical pattern that highlights negative sentiment, likely encouraging traders to reduce their exposure. Price action below the immediate support at around $0.0050, marked in green on the 4-hour chart above, could drive PUMP toward the next demand area at around $0.0040.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.