U.S. August PCE Preview: Four-Run PCE Bounce Challenges the Fed’s Three-Cut Plan

TradingKey - The U.S. Bureau of Economic Analysis (BEA) will release the August Personal Consumption Expenditures (PCE) Price Index on Friday, September 26, with markets closely watching how much tariff pass-through effects have influenced inflation.

Even though the August CPI report came in line with expectations and the Fed still projects two more rate cuts this year, a potential fourth consecutive month of accelerating inflation could undermine hopes for multiple rate cuts.

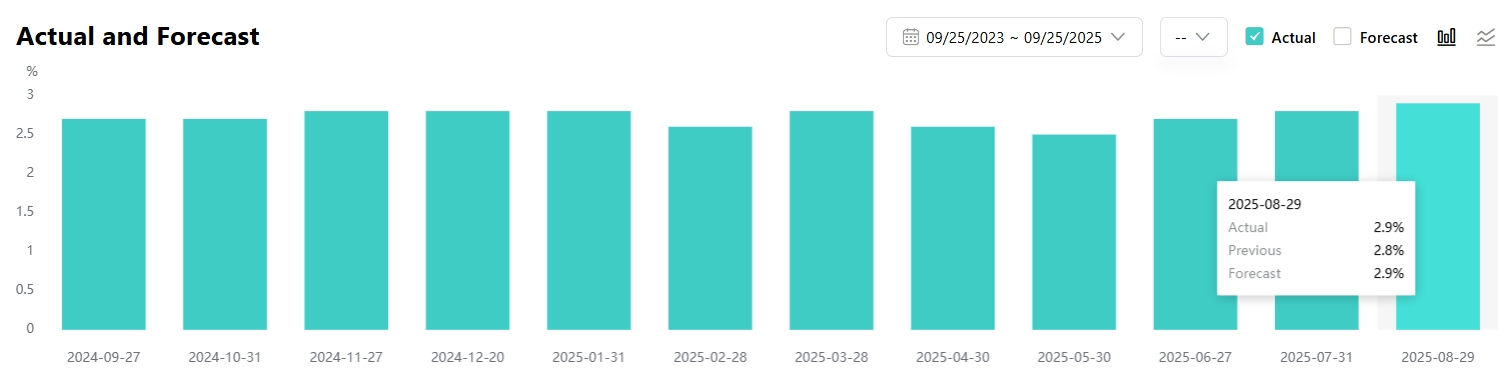

According to FactSet, economists expect:

Headline PCE MoM: +0.3%, up from +0.2% in July

Headline PCE YoY: +2.7%, up from +2.6%

Core PCE YoY: +3.0%, up from +2.9% — marking the fourth straight monthly increase

U.S. Core PCE Year-on-Year, Source: TradingKey

Jason Tang, Senior Economist at TradingKey, noted that PCE and CPI are highly correlated, and August CPI remained nearly unchanged from July, a slight rebound in August PCE is reasonable.

While the August CPI report broadly met expectations, persistent stickiness in goods and services prices shows the Fed’s battle against inflation is far from over.

In an article published on September 23, the Dallas Fed stated that over the 12 months through August, PCE inflation is projected at 2.7% — above the Fed’s 2% target since early 2021. The recent acceleration in core goods prices has been widely attributed to higher tariffs. If this is a one-time effect, it’s reasonable to expect this excess inflation to fade in the coming years.

However, the bank’s economists cautioned that even assuming housing inflation normalizes by next year and any excess in core goods is due to temporary tariff effects, the latest non-housing core services inflation may still exceed both the 2.0% target for core PCE and historical norms for relative price movements.

Moreover, while the overshoot is modest (0.3–0.4 percentage points), this component of inflation has shown little sign of decline over the past year, suggesting a risk that inflation may not converge back to 2.0%.

Preston Caldwell, Chief U.S. Economist at Morningstar, said that tariffs are injecting new momentum into inflation — first in goods prices, but likely with lagged spillover into other areas.

He added that firms are reluctant to raise prices now, but eventually they will be forced to.

Caldwell forecasts PCE inflation at 2.7% this year and rising to 3% next year.

Although the Fed cited rising downside risks in the labor market when restarting rate cuts in September, policymakers remain deeply concerned about tariff-driven inflation.

This week, officials including Beth Hammack (Cleveland Fed), Raphael Bostic (Atlanta Fed), and Alberto Musalem (St. Louis Fed) emphasized that inflation has deviated from target for over four years and is trending upward, urging caution in removing policy restraint.

On Tuesday, Fed Chair Jerome Powell said monetary policy still faces a dual challenge, with no risk-free path forward.

After his remarks, traders slightly trimmed bets on an October rate cut, despite the September dot plot supporting two more 25-bp cuts this year.

Josh Hirt, Economist at Vanguard, believes the Fed may deliver only one more rate cut in 2025, citing persistent price pressures and uncertainty around new inflationary impulses from tariffs.

“The inflationary picture is more worrisome than the market is treating it,” he said.

Natasha Gallagher, Chief Economist at Board, said Friday’s PCE report will be a “litmus test”:

If core PCE comes in below 2.8%, it would support equity gains and reinforce market optimism on easing

If it prints above 3.0%, it could force the Fed to reassess its policy stance

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.