Copper Market Deficit Widens! World’s No. 2 Copper Mine Halts Production, Freeport Shares Plunge Nearly 17%

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

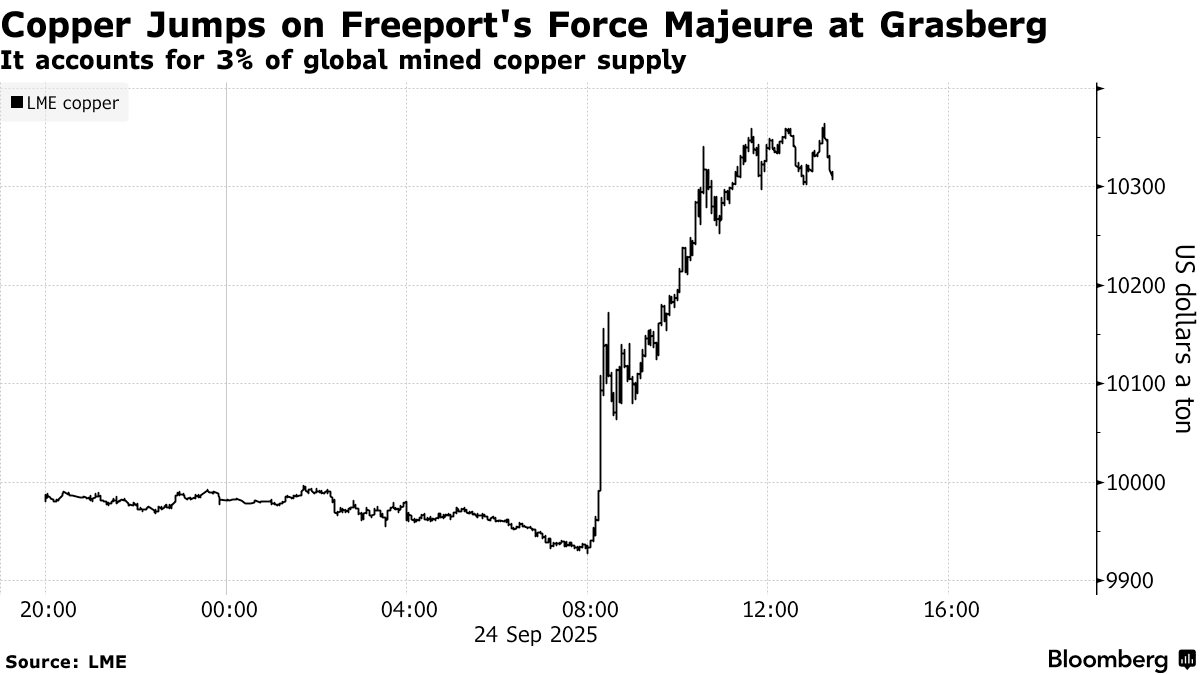

TradingKey - Freeport-McMoRan, operator of the world’s second-largest copper mine, declared a state of “force majeure” at its Grasberg mine in Indonesia on Wednesday (U.S. Eastern Time), following a deadly landslide that caused casualties. The announcement triggered a nearly 17% plunge in Freeport’s stock — its largest single-day drop in five years.

The Grasberg mine accounts for approximately 3% of global copper output. The disruption has forced the company to lower its copper and gold production guidance for the quarter and warned it may be unable to fulfill existing supply contracts.

London Metal Exchange (LME) copper prices surged above $10,300 per tonne, approaching the all-time high of $11,104.50 set in May 2024. The sharp market reaction underscores the already extremely tight global copper supply.

[Source: Bloomberg]

Ole Hansen, Head of Commodity Strategy at Saxo Bank, said the Freeport incident shows “how little it takes to tighten an already strained market,” especially with two major copper mines facing disruptions simultaneously.“Traders buy first and ask questions later,” he noted.

This year, key copper-producing regions have faced repeated shocks:

Ivanhoe Mines’ operations in the Democratic Republic of Congo were halted due to flooding after an earthquake

Mining operations at Chilean giants Teck Resources and Codelco were disrupted by port issues, plant failures, and safety incidents

These outages come on top of the permanent closure of Panama’s Cobre Panamá mine at the end of 2023, which removed about 1.5% of global copper supply from the market — widening the global supply-demand gap.

Helen Amos, Analyst at BMO Capital Markets, stated: “The copper market is clearly in a deficit.” She forecasts a 300,000-tonne supply shortfall in refined copper globally in 2025.

Bart Melek, Head of Commodity Strategy at TD Securities, added that if Grasberg’s recovery is slow, inventories will be further drawn down to meet demand, intensifying upward pressure on prices.

The recurring supply disruptions highlight a structural problem: a decade of underinvestment in copper mining. As demand for copper surges — driven by both the clean energy transition and the AI boom — new projects face long lead times and high capital costs, making it difficult to close the gap in the short term.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.