GBP/USD trims gains after blowout NFPs temper Fed cut bets

- GBP/USD retreats after US Nonfarm Payrolls beat forecasts and unemployment dips to 4.3%.

- Fed cut odds trimmed sharply as markets scale back June easing despite softer sentiment data.

- Sterling gains capped by unrest around Keir Starmer and narrow Bank of England vote.

The Pound Sterling advances versus the Greenback during the North American session yet retreated from daily highs hit at 1.3712 following a stronger than expected jobs report in the US. At the time of writing, the GBP/USD trades at 1.3655, up 0.10%.

Sterling retreats from session highs as stronger US payrolls cool expectations for near-term Federal Reserve easing

Nonfarm Payrolls in January were stronger than expected, rising by 130K, exceeding forecasts of 70K, crushing December’s 48K downward revised from 50K, while the Unemployment Rate dipped from 4.4% to 4.3%, beneath estimates. Even though the data was solid, the recent University of Michigan Consumer Sentiment survey showed that American households had grown worried about the outlook of the jobs market.

The US Bureau of Labor Statistics (BLS) announced that the economy created fewer jobs in the 12 months through March, than previously expected.

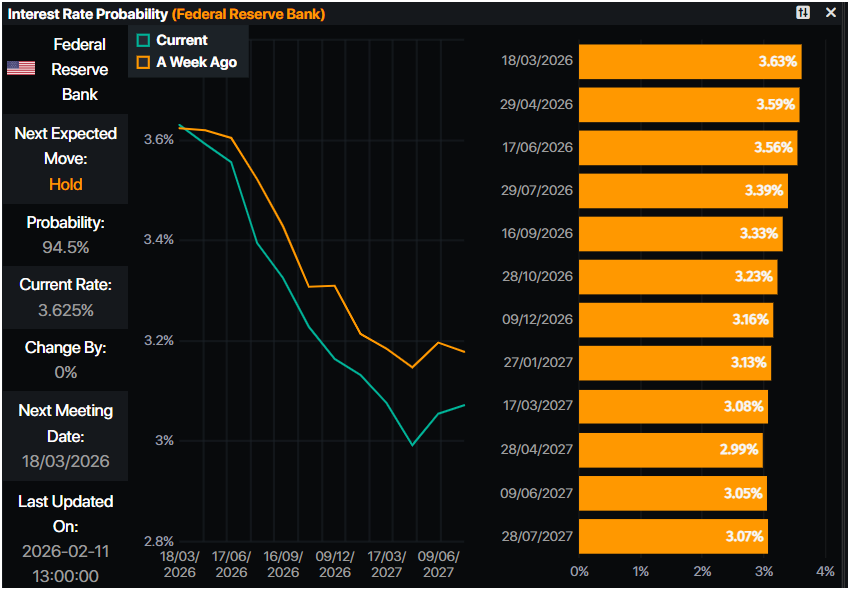

Money markets initially priced in a 100% chance for a Federal Reserve (Fed) rate cut in June 2026. As of writing, investors trimmed their bets, with the odds standing at a 68% for that date, while for March, there is a 95% for a hold, revealed Prime Market Terminal data.

Political unrest within the Labour Party in the United Kingdom is placing considerable pressure on Prime Minister Keir Starmer. He has stated that he remains committed to his role in leading efforts to transform Britain, explicitly rejecting calls from party members for his resignation.

Aside from this, last week’s Bank of England’s narrow 5-4 vote split to hold rates unchanged, was unexpected. This has ramped up the chances for rate cuts by the BoE at the March meeting.

Traders’ eyes shift to the release of UK’s GDP figures on Thursday, with traders expecting a modest deceleration of the economy. In the US, focus is on Initial Jobless Claims data, followed by the release of the Consumer Price Index (CPI) on Friday.

GBP/USD Price Analysis: Technical outlook

In the daily chart, GBP/USD trades at 1.3664. Daily simple moving averages slope higher and sit beneath price, preserving a constructive medium-term bias with dips well supported. The longer lookback average continues to grind upward, reinforcing trend strength. The FXS Fed Sentiment Index has eased from prior highs, a moderation that tempers immediate follow-through but does not negate the prevailing uptrend.

As long as the pair holds above the rising daily averages, the path of least resistance remains to the upside. A daily close below the key 50 -day Simple Moving Average near 1.3500 would weaken the structure and open room for a deeper retracement. A renewed upswing in the Fed Sentiment gauge would complement the technical backdrop and support an extension higher, past immediate resistance seen at 1.3700.

(The technical analysis of this story was written with the help of an AI tool.)

Pound Sterling Price This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.39% | -0.46% | -2.62% | -0.50% | -1.40% | -0.52% | -0.60% | |

| EUR | 0.39% | -0.06% | -2.33% | -0.11% | -1.01% | -0.13% | -0.22% | |

| GBP | 0.46% | 0.06% | -1.97% | -0.05% | -0.95% | -0.07% | -0.16% | |

| JPY | 2.62% | 2.33% | 1.97% | 2.26% | 1.33% | 2.25% | 2.04% | |

| CAD | 0.50% | 0.11% | 0.05% | -2.26% | -0.80% | -0.01% | -0.11% | |

| AUD | 1.40% | 1.01% | 0.95% | -1.33% | 0.80% | 0.88% | 0.80% | |

| NZD | 0.52% | 0.13% | 0.07% | -2.25% | 0.01% | -0.88% | -0.09% | |

| CHF | 0.60% | 0.22% | 0.16% | -2.04% | 0.11% | -0.80% | 0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).