Canada CPI expected to edge higher in August ahead of BoC rate cut decision

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Canadian inflation is seen picking up pace in August.

The headline Consumer Price Index is expected to remain below the target.

The Canadian Dollar continues to trade within a consolidation range.

Statistics Canada will publish August’s inflation figures on Tuesday. The numbers will give the Bank of Canada (BoC) a fresh read on price pressure as the central bank weighs its next move on interest rates. The BoC is expected to trim the interest rate by 25 basis points to 2.50% on Wednesday.

Economists expect the headline Consumer Price Index (CPI) to slightly surpass the BoC’s 2.0% target in August, following a 1.7% annual gain in July. On a monthly basis, prices are still forecast to climb 0.1%.

The BoC will also be watching its preferred “core” measure, which strips out the more volatile food and energy components. In July, that gauge rose 2.6% from a year earlier and edged 0.1% higher from June.

While there are signs inflation is cooling, analysts remain wary. The threat of US tariffs pushing up domestic prices looms large, adding uncertainty to the outlook. For the time being, both markets and policymakers are likely to exercise caution.

What can we expect from Canada’s inflation rate?

The Bank of Canada kept its benchmark rate at 2.75% on July 30, a decision that lined up with market expectations.

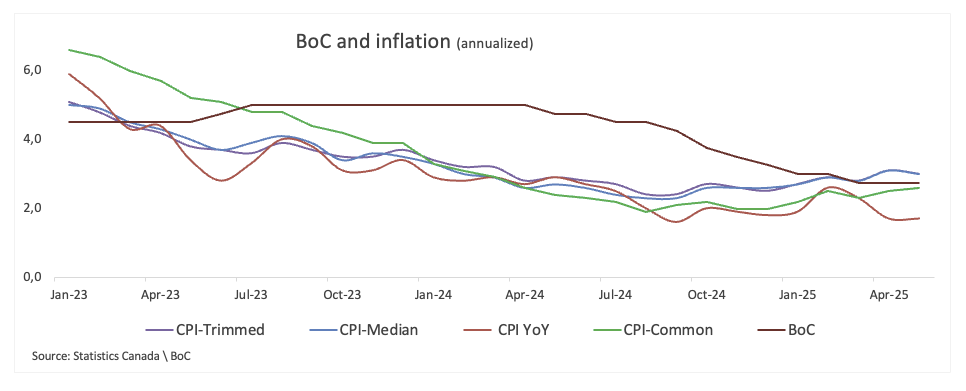

Governor Tiff Macklem explained that the pause reflected lingering stickiness in inflation. The bank’s preferred core gauges, the trim mean and trim median, have been hovering near 3%, with a wider set of indicators also ticking higher. That shift, he admitted, has caught policymakers’ eyes and will be monitored closely in the months ahead.

Still, Macklem was keen to stress that not all of the recent price pressure will last. A firmer Canadian Dollar, slower wage growth, and an economy running below potential should all help ease inflation over time.

For markets, the headline CPI print will be the immediate focus. But at the BoC, attention will remain squarely on the details: the trim, median and common measures. The first two have picked up speed, feeding concern inside the bank, while the common gauge has stayed more restrained.

When is the Canada CPI data due, and how could it affect USD/CAD?

Markets will be watching closely on Tuesday at 12:30 GMT, when Statistics Canada publishes the inflation report for the month of August. Traders are alert to the risk that price pressures could flare up again.

A stronger-than-expected reading would reinforce concerns that tariff-related costs are beginning to filter through to consumers. That could make the Bank of Canada more cautious in its policy stance, a scenario that would likely lend short-term support to the Canadian Dollar (CAD), while keeping attention fixed on trade developments.

According to FXStreet’s Senior Analyst, Pablo Piovano, the Canadian Dollar (CAD) has been trading in a consolidative range against the US Dollar (USD) in the last few days, with USD/CAD orbiting the 1.3850 zone. He notes that renewed selling could see the pair drift back toward the August floor in the 1.3730-1.3720 band. Further support sits at the weekly base at 1.3575 (July 23) and the June valley at 1.3556 (July 3), before reaching the year’s bottom at 1.3538 (June 16).

On the topside, resistance is pegged at the August top at 1.3924 (August 22), followed by the 1.4000 round level, with the May ceiling at 1.4015 (May 13) being reinforced by the 200-day Simple Moving Average (SMA).

From a broader perspective, Piovano argues that the bearish bias stays intact as long as spot trades beneath its 200-day SMA.

That said, momentum signals remain mixed: the Relative Strength Index (RSI) has eased toward 55, hinting at waning upside momentum, while the Average Directional Index (ADX) near 18 suggests that the broader trend is only slowly building strength.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.