XAU/USD slides from $4,375 to $4,114 amid pre-CPI profit-taking and renewed Greenback strength.

Traders trim exposure before key inflation print and next week’s Federal Reserve meeting.

Trump–Xi meeting hopes ease trade tensions, dampening safe-haven demand for Gold.

Gold plummets more than 5.50% on Tuesday as traders seem to book profits ahead of the release of September’s Consumer Price Index (CPI) data in the US, and the Greenback recovers some ground. XAU/USD trades at $4,114 after diving from a daily high of $4,375.

Bullion tumbles over $200 from record high amid firm USD

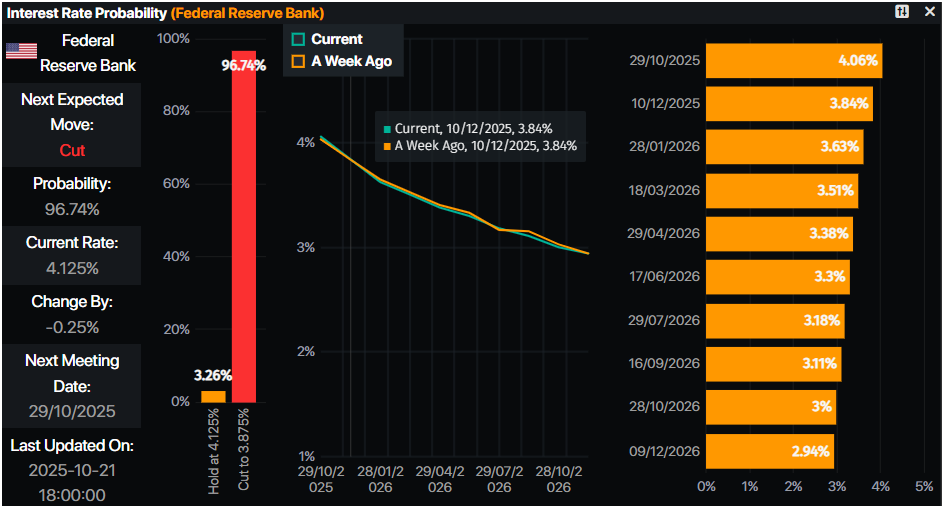

The yellow metal is sustaining its biggest drop since August 2020 after hitting a record high of $4,380 on Monday. Expectations that the Federal Reserve (Fed) will continue to ease policy at the final two policy meetings this year increased following Fed Chair Jerome Powell's speech last week, in which he acknowledged that the labor market is weakening.

The US Dollar Index (DXY), which tracks the performance of the US currency against a basket of six others, surges over 0.36% to 98.94. Consequently, the advancement of the DXY makes Bullion more expensive for foreign buyers.

This week, traders are eyeing the release of US CPI on October 24. Along with this, investors’ eyes are on the Fed’s monetary policy meeting next week.

Geopolitics are also playing a role in Gold’s pullback after US President Donald Trump said that he would meet China’s President Xi Jinping next week to de-escalate the trade war.

Daily market movers: Gold traders eye Trump comments, US-China talks

The US 10-year Treasury note yield is down two basis points at 3.961%. US real yields — which correlate inversely to Gold prices — are also falling to 1.70%, sliding over two basis points.

The US government shutdown began its 21st day, and there are no signs of a reopening despite remarks by Kevin Hassett, the White House Economic Adviser, who said that the government might re-open “sometime this week.”

Besides the release of US CPI figures during the week, traders will eye S&P Global Purchasing Managers Indices (PMI) for October.

Trade talks between Washington and Beijing will resume in Malaysia with the November 10 trade truce deadline looming. Trump has listed his top demands of China, including stopping illegal fentanyl shipments and resuming soybean purchases.

Market participants had priced in a 96% chance of the US central bank cutting rates and 50 bps for the rest of 2025.

Source: Prime Market Terminal

Technical outlook: Gold price remains bullish despite retreat

Gold's price uptrend remains in place amid the ongoing pullback, which is offering buyers a better entry price. The first support lies at $4,100, followed by the previous record high turned support at around $4,059. If XAU/USD spot prices fall below the latter, the next stop would be the 20-day Simple Moving Average (SMA) at $4,000.

On the other hand, if buyers push Gold above $4,200, this opens the path to challenge $4,250 and the $4,300 figure ahead of the record high at $4,380.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.