Forex Today: Pound Sterling drops on soft UK inflation data

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Here is what you need to know on Wednesday, October 22:

Pound Sterling (GBP) weakens against its major rivals early Wednesday as markets assess softer-than-expected inflation data from the UK. The economic calendar will not offer any data releases that could significantly influence major pairs' action midweek. Hence, investors will remain focused on headlines surrounding the US-China relations and the ongoing government shutdown.

The UK's Office for National Statistics (ONS) reported in the European morning on Wednesday that the annual inflation, as measured by the change in the Consumer Price Index (CPI), held steady at 3.8% in September. This reading came in below the market forecast of 4%. On a monthly basis, the CPI was unchanged after rising 0.3% in August. GBP/USD stays under modest bearish pressure after the CPI data and trades in negative territory below 1.3350. Reflecting the broad-based GBP weakness, EUR/GBP was last seen rising nearly 0.4% on the day at 0.8710.

Pound Sterling Price Today

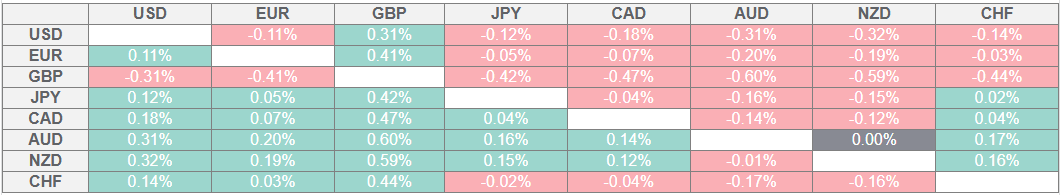

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the weakest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

After coming in within a touching distance of the record-high it set at $4,380 last Friday, Gold made a sharp correction on Tuesday and lost more than 5% on a daily basis. XAU/USD extended its slide during the Asian trading hours on Wednesday and fell toward $4,000 before regaining its traction. At the time of press, Gold was up 0.8% on the day at $4,155. The improving risk mood and the US Dollar's (USD) steady recovery seem to have triggered profit-taking.

The USD Index holds steady near 99.00 after rising about 0.4% on Tuesday. There are several Federal Reserve (Fed) officials scheduled to deliver speeches later in the day but they are unlikely to comment on the policy outlook since the Fed is in the blackout period ahead of next week's policy meeting. Meanwhile, US stock index futures trade marginally higher on the day. Following a meeting at the White House with President Donald Trump, some Republican senators noted that Trump wants to end the government shutdown and that he is willing to talk to Democrats about it.

The data from Canada showed on Tuesday that the annual CPI inflation climbed to 2.4% in September from 1.9% in August, surpassing the market expectation of 2.3%. After posting small losses on Tuesday, USD/CAD stays on the back foot early Wednesday and trades near 1.4000.

EUR/USD holds steady at around 1.1600 after closing in negative territory for the third consecutive trading day on Tuesday. European Central Bank (ECB) President Christine Lagarde will a keynote speech at Frankfurt Finance & Future Summit in Frankfurt later in the day.

According to a recently conducted Reuters poll, a majority of economists who took part in the survey expect the Bank of Japan (BoJ) to raise its key interest rate in either October or December. Reuters further noted that a nearly 96% of economists expect borrowing costs to increase at least 25 basis points (bps) by the end of March. In the meantime, Japanese Prime Minister Sanae Takaichi reportedly ordered a new package of economic measures aimed at easing the burden of inflation on households and companies. After gaining nearly 0.8% on Tuesday, USD/JPY stays relatively calm on Wednesday and trades below 152.00.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.