Forex Today: US Dollar rally loses steam as focus shifts to inflation data

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- WTI declines below $63.00 as US-Iran talks loom

Here is what you need to know on Friday, September 26:

Following a two-day rally, the US Dollar (USD) Index stays in a consolidation phase below 98.50 in the European morning on Friday. In the second half of the day, the US Bureau of Economic Analysis (BEA) will publish the Personal Consumption Expenditures (PCE) Price Index data, the Federal Reserve's (Fed) preferred gauge of inflation, for August.

US Dollar Price This week

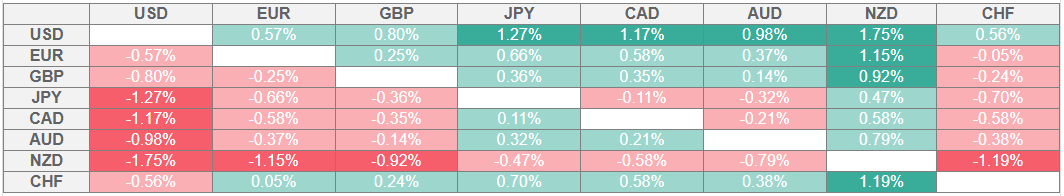

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The USD gathered strength against its peers in the American session on Thursday, boosted by upbeat macroeconomic data releases. Durable Goods Orders rose by 2.9% on a monthly basis in August and the BEA revised the annualized Gross Domestic Product (GDP) growth for the second quarter to 3.8% from 3.3% in the previous estimate. Additionally, weekly Initial Jobless Claims declined to 218,000 from 232,000 in the previous week. The USD Index gained more than 0.6% on a daily basis and touched its highest level since early September at 98.60 on Thursday.

Meanwhile, US President Donald Trump announced that they will impose a 100% tariff on imports of branded or patented pharmaceutical products from October 1, unless a pharmaceutical company is building a manufacturing plant in the US. Additionally, Trump said that they will be imposing a 50% tariff on all kitchen cabinets, bathroom vanities, and associated products, as well as a 25% tariff on trucks, starting from October 1. US stock index futures trade marginally higher in the European morning on Friday.

The data from Japan showed early Friday that the Tokyo Consumer Price Index rose 2.5% on a yearly basis in September. This print matched August's increase and came in line with the market expectation. Japan trade negotiator Ryosei Akazawa said on Friday that US chip and pharma tariff rates won't exceed those to any other country. Akazawa added that he will continue to analyze the impact of US tariff measures once they become clear. USD/JPY stays relatively quiet and trades below 150.00 in the European morning but it's up nearly 1.5% this week.

The broad-based USD strength forced EUR/USD to stay under bearish pressure on Thursday. After dropping to its weakest level in three weeks below 1.1650, the pair corrects higher but remains below 1.1700 in the European session on Friday.

GBP/USD lost nearly 0.8% on Thursday and touched its lowest level since the first week of August below 1.3330. The pair rebounds slightly early Friday and trades at around 1.3350.

Following Wednesday's correction, Gold found support on Thursday but failed to gather recovery momentum. XAU/USD struggles to find direction in the European morning and fluctuates in a narrow channel below $3,750.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.