Australian Dollar moves little following previous losses of more than half a percent

Australian Dollar weakened as the US Dollar gained support from stronger-than-expected US economic data.

The AUD struggles amid risk aversion after President Trump announced plans to impose a 100% tariff on pharmaceutical imports.

Traders will likely observe Personal Consumption Expenditures Price Index data, the Fed’s preferred inflation gauge, due later in the day.

The Australian Dollar (AUD) holds ground against the US Dollar (USD) on Friday after two days of losses. The AUD/USD pair depreciated as the Greenback received support from the stronger-than-expected economic data from the United States (US).

The AUD also receives downward pressure from risk aversion after the US President Donald Trump shared plans to impose a 100% tariff on imports of branded or patented pharmaceutical products from October 1, unless a pharmaceutical company is building a manufacturing plant in the US, per Reuters.

Australia’s Monthly Consumer Price Index (CPI), which climbed by 3.0% year-over-year in August, following a 2.8% increase reported in July. The ASX 30 Day Interbank Cash Rate Futures indicate that markets now price just a 4% chance of a September rate cut. According to Reuters, prospects for a Reserve Bank of Australia (RBA) rate reduction at its November meeting faded to 50% from almost 70% before the data.

Australian Dollar steadies as US Dollar holds ground ahead of PCE Price Index data

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is holding ground and trading around 98.40 at the time of writing. Traders will likely observe Personal Consumption Expenditures (PCE) Price Index data, the Federal Reserve’s preferred inflation gauge, due later on Friday.

The US Gross Domestic Product (GDP) Annualized grew 3.8% in the second quarter (Q2), coming in above the previous estimate and the estimation of 3.3%. Meanwhile, the GDP Price Index rose 2.1% in the same period, as compared to the expected and previous 2.0% growth.

US Initial Jobless Claims declined to 218K last week from 232K previously, coming in below market expectations of 235K.

Kansas City Fed President Jeffrey Schmid said the rate cut was needed to help ensure that the job market remains in a good place.

Chicago Fed President Austan Goolsbee noted that he was not eager to do a lot more policy easing while inflation is above target and moving the wrong way.

Fed Governor Stephen Miran, the Fed's newest policymaker, preferred a more aggressive 0.50% cut to prevent labor market collapse.

San Francisco Fed President Mary Daly said on Wednesday that further rate reductions are likely to be needed, as the central bank works to restore price stability and provide necessary support to the labor market.

US S&P Global Composite PMI ticked down to 53.6 from 54.6 in August, pointing to a private sector that seems to be struggling to strengthen further. Manufacturing PMI eased to 52.0 from 53, signalling waning momentum in the sector. The Services PMI slipped to 53.9 from 54.5, suggesting that demand may be easing.

Fed Chair Jerome Powell said on Tuesday that a weaker labor market is outweighing concerns about stubborn inflation, leading to an interest rate cut at its September meeting last week. However, Powell further stated that he is comfortable with the current policy path, though he indicated the possibility of further cuts should the FOMC see the need to be more accommodative.

The White House announced that Australian Prime Minister Anthony Albanese and US President Donald Trump will hold their first in-person meeting in Washington, D.C. on October 20 to discuss the Aukus nuclear submarine pact.

Australia’s preliminary S&P Global Composite PMI fell to 52.1 in September, from 55.5 prior, marking the lowest reading in three months. Manufacturing and services both noted slowing growth amid weaker new business inflows and lower goods orders at the fastest pace in eight months. The preliminary S&P Global Services PMI showed a modest slowdown to 52 in September, from 55.8 in August. Meanwhile, the Manufacturing PMI fell to 51.6 from 53.0 previously.

RBA Governor Michele Bullock said earlier this week that labor market conditions have eased slightly, with unemployment ticking higher. Bullock noted that recent rate cuts should support household and business spending, while stressing that the RBA must stay vigilant to changing conditions and be ready to respond if needed.

Australian Dollar stays muted below 50-day EMA around 0.6550

AUD/USD is trading around 0.6530 on Friday. Technical analysis on the daily chart shows that the pair is positioned below the nine-day Exponential Moving Average (EMA), suggesting the short-term price momentum is weaker. Additionally, the 14-day Relative Strength Index (RSI) moves below the 50 level, suggesting that bearish bias is active.

On the downside, the AUD/USD pair may find its initial support at the monthly low at 0.6483, recorded on September 2. A break below this level would prompt the pair to navigate the region around the three-month low at 0.6414, which was recorded on August 21.

The initial resistance lies at the 50-day EMA of 0.6550, followed by the nine-day EMA at 0.6581. A break above these levels would improve the short- and medium-term price momentum and lead the AUD/USD pair to approach the 11-month high of 0.6707, recorded on September 17.

AUD/USD: Daily Chart

Australian Dollar Price Today

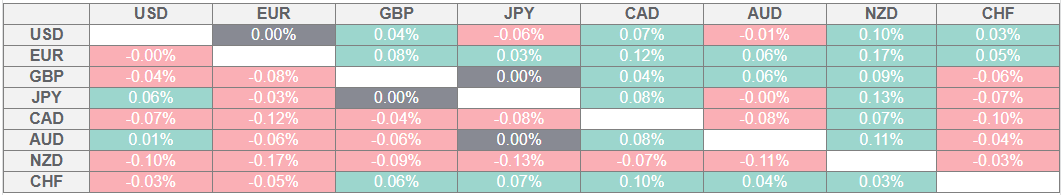

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.