Australian Dollar edges lower as US Dollar holds ground ahead of Fed policy

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Australian Dollar loses some ground as traders adopt caution ahead of Fed decision.

RBA’s Sarah Hunter stressed adopting a forward-looking stance due to monetary policy’s delayed effects.

The likelihood of multiple Fed rate cuts this year strengthens after upbeat US Retail Sales data.

The Australian Dollar (AUD) inches lower against the US Dollar (USD) on Wednesday after two days of gains. However, the downside of the AUD/USD pair could be limited as the US Dollar (USD) could struggle amid the rising likelihood of multiple Federal Reserve (Fed) interest rate cuts following upbeat US Retail Sales data.

US Retail Sales increased by 0.6% month-over-month in August, following the 0.6% increase (revised from 0.5%) recorded in July, and came in better than the market expectation of 0.2%. Retail Sales Control Group and Retail Sales ex Autos both rose 0.7%, against the expected 0.4% increase. The sales report showed resilient consumer spending despite sticky inflation and a softening labor market.

The United States (US) and China, Australia’s close trading partner, reached a commercial agreement on Monday to place TikTok under US ownership. Traders await further development on final approval anticipated during a Friday call between US President Donald Trump and Chinese President Xi Jinping.

Australian Dollar declines as US Dollar edges higher ahead of Fed decision

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is inching higher after a sharp decline and trading around 96.70 at the time of writing.

The CME FedWatch tool suggests that markets are fully priced in that the Fed will cut the interest rates by 25 basis points (bps) on Wednesday, the first reduction since December, with some still hoping for a greater 50 bps cut. The Fed’s Summary of Economic Projections (SEP), the ‘dot plot,’ will be eyed, where each member of the Federal Open Market Committee (FOMC) expects the federal funds rate in the near future.

Traders expect multiple Fed rate cuts after US Weekly Initial Jobless Claims climbed to their highest since October 2021, following last week’s weak Nonfarm Payrolls report, overshadowing a hotter-than-expected consumer inflation reading.

Morgan Stanley and Deutsche Bank now expect the US central bank to deliver three rate cuts this year, after recent data pointed to easing inflation pressures. In separate notes on Friday, the brokerages projected 25-basis-point reductions at each of the Fed’s remaining meetings in September, October, and December, according to Reuters.

The US Senate confirmed Stephen Miran by a 48-47 vote to fill the Federal Reserve Board seat vacated by Adriana Kugler last month. Miran will be the first executive-branch official to serve on the central bank’s board since 1935.

The National Bureau of Statistics (NBS) showed on Monday that China’s Retail Sales rose 3.4% year-over-year (YoY) in August vs. 3.8% expected and 3.7% in July. Chinese Industrial Production increased 5.2% YoY in the same period, compared to the 5.8% forecast and 5.7% seen previously.

The NBS said during its press conference on Monday that economic operation was generally steady in August, but domestic demand will expand and promote a rebound in prices. Some firms are having difficulties in operations as the external environment is very severe, NBS added.

Reserve Bank of Australia (RBA) Assistant Governor Sarah Hunter said on Tuesday that the central bank is “close to getting inflation to target.” Hunter noted that risks to the outlook are balanced and emphasized the need for a forward-looking approach given the delayed impact of monetary policy. She added that the RBA is closely monitoring the underlying strength of consumer spending and aims to keep the economy near full employment.

The Aussie Dollar finds support on the fading likelihood of further Reserve Bank of Australia (RBA) rate cuts. Swaps now price in an 86% likelihood of unchanged policy in September, bolstered by Australia’s strong July trade surplus, solid Q2 GDP, and hotter July inflation. Consumer Inflation Expectations also climbed in September, signaling stronger domestic demand and raising concerns about renewed inflationary pressures.

Australian Dollar pulls back from 11-month highs near 0.6700

AUD/USD is trading around 0.6680 on Wednesday. The technical analysis of the daily chart shows the pair moves upwards within an ascending channel pattern, strengthening the bullish bias. Additionally, the short-term price momentum is stronger as the pair remains above the nine-day Exponential Moving Average (EMA).

On the upside, the AUD/USD pair may surpass the 11-month high of 0.6689, recorded on September 17, followed by the psychological level of 0.6700 and the ascending channel’s upper boundary around 0.6710.

The AUD/USD pair may find its initial support at the nine-day EMA of 0.6634, followed by the ascending channel’s lower boundary around 0.6570. A break below the channel would weaken the bullish bias and lead the AUD/USD pair to test the 50-day EMA at 0.6541.

AUD/USD: Daily Chart

Australian Dollar Price Today

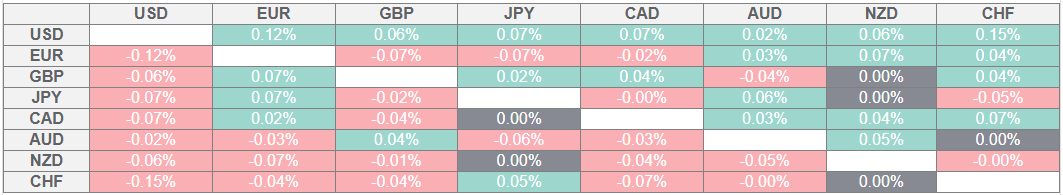

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.