NZD/USD Price Forecast: Maintains its bullish stance despite rejection at 0.5980

The NZD has failed to breach 0.5980 resistance against the USD, but downside attempts remain limited so far.

Hopes of a dovish turn by the Fed are boosting risk appetite and bleeding the USD.

NZD is trading within a triangle pattern with a potential bullish outcome.

The New Zealand Dollar has failed on its attempt to break the 0.5980 resistance area (September 11 high) earlier on Tuesday, but maintains its broader bullish trend intact amid the risk-on mood, with investors bracing for a Fed monetary easing on Wednesday.

The US Dollar is trading lower across the board. The USD Index, which measures the value of the Greenback against the most traded currencies, hit a fresh two-month low at 97.05 earlier today. Hopes that the Fed will deliver a “dovish cut”, trimming rates by 25 bps and hinting at more easing to come, have boosted risk appetite.

Technical Analysis: NZD/USD trades within an ascending triangle

The broader trend shows a sequence of higher highs and higher lows from early September. Immediate price action shows an ascending triangle pattern. Triangles are continuation figures and, in the current context, the potential outcome is bullish.

To the upside, above the mentioned 0.5980, the next target would be the August 13 high, right below the 0.6000 psychological level, ahead of the July 28 high, at the 0.6030 area.

Immediate support is in the area between the triangle bottom, now at 0.5960, and the September 15 low at 0.5950. Further down, key support is at 0.5915, the September 1 high and September 11 low.

US Dollar Price Today

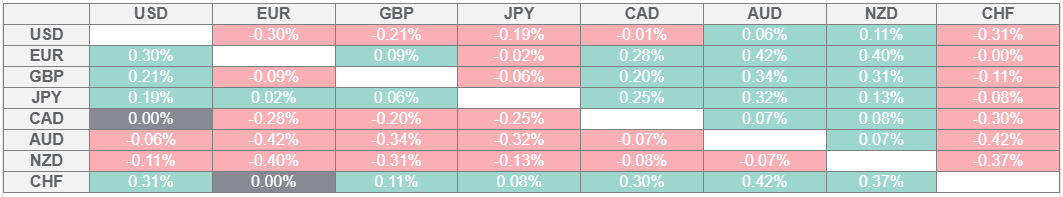

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

crushing

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.