Avalanche Bulls Eye Trend Reversal, Though Muted Derivatives Signal Caution

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

Avalanche (AVAX) has staged an 8% breakout, consolidating above $14.00 after breaching a key multi-week resistance trendline.

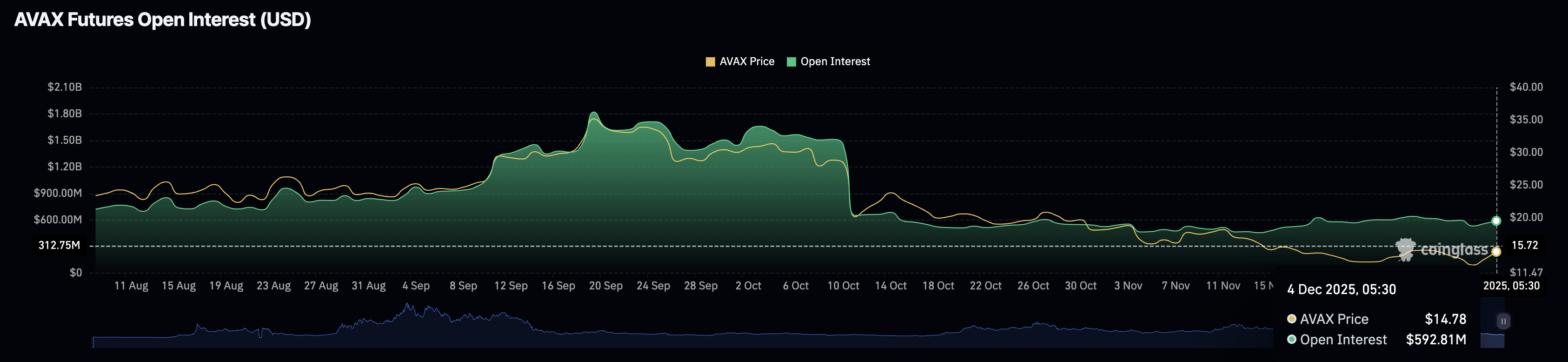

Despite the spot rally, futures open interest remains suppressed below $600 million, indicating traders are largely sidelined following the October deleveraging.

Bullish divergence in the RSI and a potential flip of the Supertrend at $15.89 suggest the momentum is shifting, with eyes now set on the 50-day EMA at $17.14.

Avalanche (AVAX) is consolidating gains north of the psychological $14.00 handle on Thursday, taking a breather following a distinct 8% surge. The token has strung together two consecutive sessions of green, successfully breaching a stubborn local resistance trendline on Wednesday—a technical victory that has tentatively put bulls back in the driver’s seat.

However, beneath the surface of this spot recovery, the derivatives landscape paints a picture of lingering skepticism. Futures open interest for AVAX remains capped below the $600 million threshold. This divergence between rising price and stagnant leverage suggests that while value buyers are stepping in, the retail "army" remains risk-averse, opting to sit on the sidelines rather than chase the rally with aggressive positioning.

Speculative Froth Has Evaporated

The lack of speculative conviction is palpable and directly traces back to the October 10 market capitulation. That washout saw AVAX futures open interest collapse from roughly $1.45 billion to $645.54 million, effectively draining the excess leverage from the system.

Market participation has yet to recover to those levels. As of press time, open interest stands at $592.81 million, only a marginal tick up from the previous day’s $562.17 million. This incremental rise signals a classic "wait-and-see" approach: traders are inching back into the market but are unwilling to deploy heavy capital until the breakout is validated by sustained volume.

On the fundamental horizon, the proposed Bitwise Avalanche ETF serves as a potential wildcard. Should the U.S. Securities and Exchange Commission (SEC) grant approval, it would open a regulated demand channel for traditional investors. However, until regulatory clarity emerges, this remains a prospective tailwind rather than an immediate catalyst for price action.

Technical Outlook: The Road to $17.14

From a chartist’s perspective, the technical structure is tilting constructive. By clearing the descending trendline connecting the highs of October 13 and November 11, AVAX has removed the immediate bearish stranglehold.

The focus now shifts to the Friday high of $14.77. Clearing this pivot point is crucial; doing so would expose the next major liquidity target at the 50-day Exponential Moving Average (EMA) near $17.14. Reclaiming this EMA is often viewed by institutional desks as a signal that the medium-term trend has shifted from correction to accumulation.

Oscillators are beginning to support this bullish thesis. The Relative Strength Index (RSI) is tracking at 46, rising steadily from oversold conditions. Crucially, the RSI formed a bullish divergence against the November 21 low of $12.57, a pattern that frequently precedes a durable reversal. Furthermore, a push through $15.89 would flip the Supertrend indicator to buy, reinforcing the view that momentum is swinging away from sellers.

Nevertheless, the breakout is not bulletproof. If AVAX faces rejection at the $14.77 resistance, the rally risks stalling. A failure here could drag prices back toward the $12.57 support floor, nullifying recent progress and forcing bulls to defend the range bottom once again. The market is currently trapped in a decision zone between $14.77 and $15.89—a breakout above this band is likely required to confirm a meaningful trend change.

Read more

The above content was completed with the assistance of AI and has been reviewed by an editor.