Ray Dalio’s 2025 Portfolio: A Macro Masterclass in Diversified Precision

TradingKey - Ray Dalio's Bridgewater Associates had a striking diversified holding of 664 stocks valued at $21.55 billion in equity value through the period ended March 31, 2025. And at a turnover of 31% in Q1, the highest since well over a year, Dalio's strategy is far from static. While Pershing Square's Bill Ackman likes focused bets, Dalio's is a game of scale, diversification, and macro hedge accuracy.

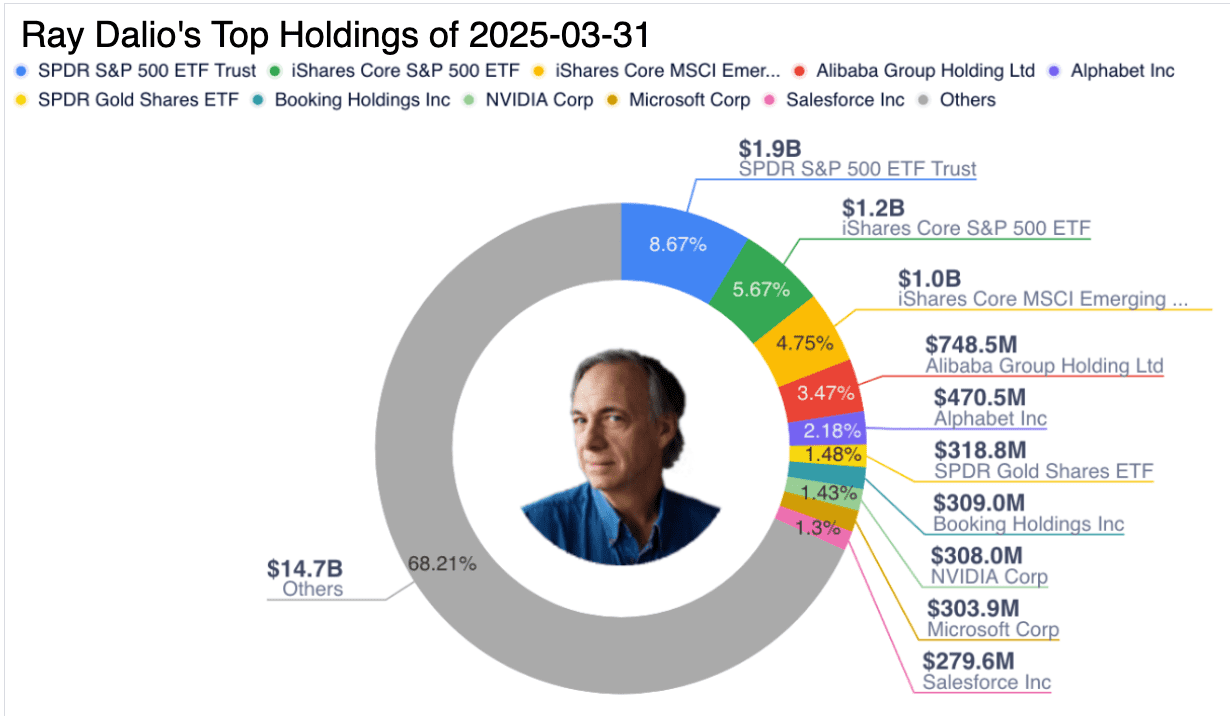

The portfolio increased 123 positions in Q1, prioritizing breadth rather than concentration. In spite of this sprawl, the top 10 holdings continue to reflect a considered, conviction-driven focus into ETF-heavy vehicles and leading global tech platforms. SPDR S&P 500 ETF Trust (SPY) continues to be the largest holding at 8.67% despite a staggering 59.4% reduction, indicating ongoing rebalancing on U.S. equity exposures.

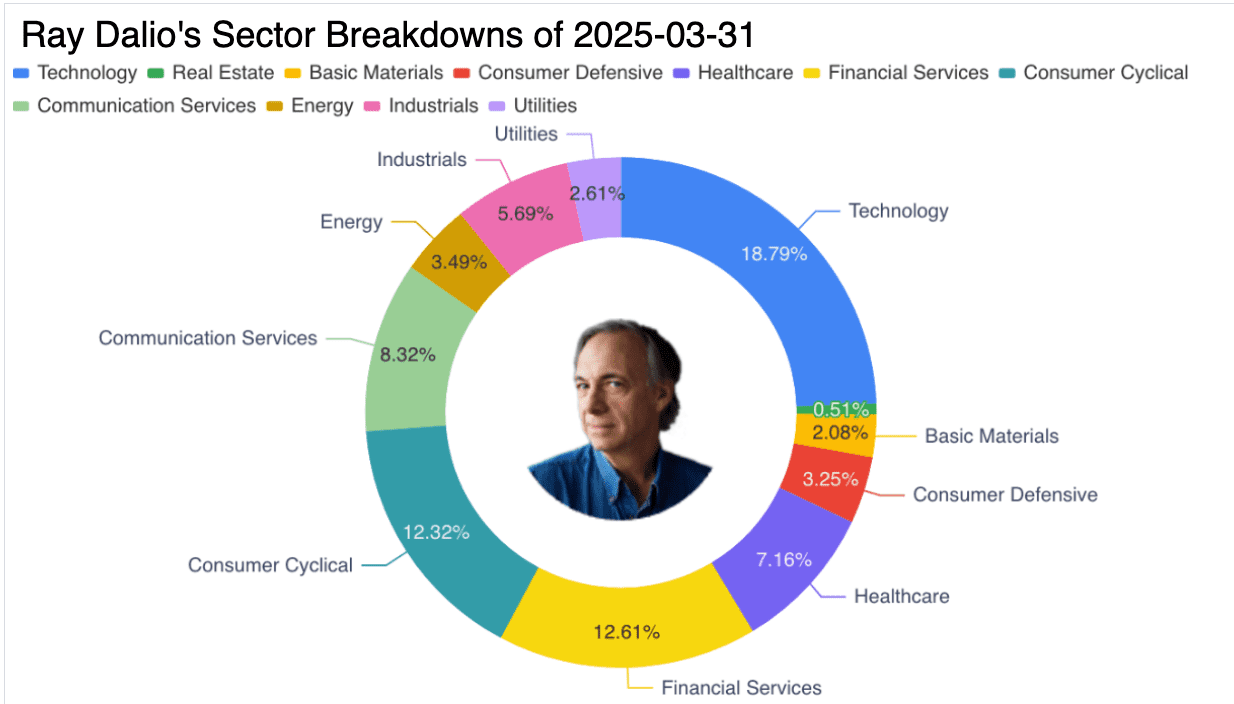

Sector Composition: Technology at the Helm, Finely Balanced

Technology is Dalio's most heavily weighted sector with 18.79%, followed closely by Financial Services (12.61%) and Consumer Cyclical (12.32%). Communication Services and Healthcare are distant behind at 8.32% and 7.16% respectively. Basic Materials, which contributes a mere 2.08% to the portfolio, illustrates a focused bet in Metals & Mining (1.58%) and Steel (0.37%), indicating even in small segments, Dalio has definitive views presented through focused industry exposure.

Consumer Defensive, Industrials, and Energy are fairly modest, all at less than 6%, indicating a thematic play on global hedges against risk rather than cyclical industry overweightings. Real Estate is barely showing at 0.51%, while Utilities hold a steady, low-weight presence at 2.61%, perhaps in a role of ballast against volatility.

Key Holdings: U.S. Tech Giants, Alibaba, and ETFs

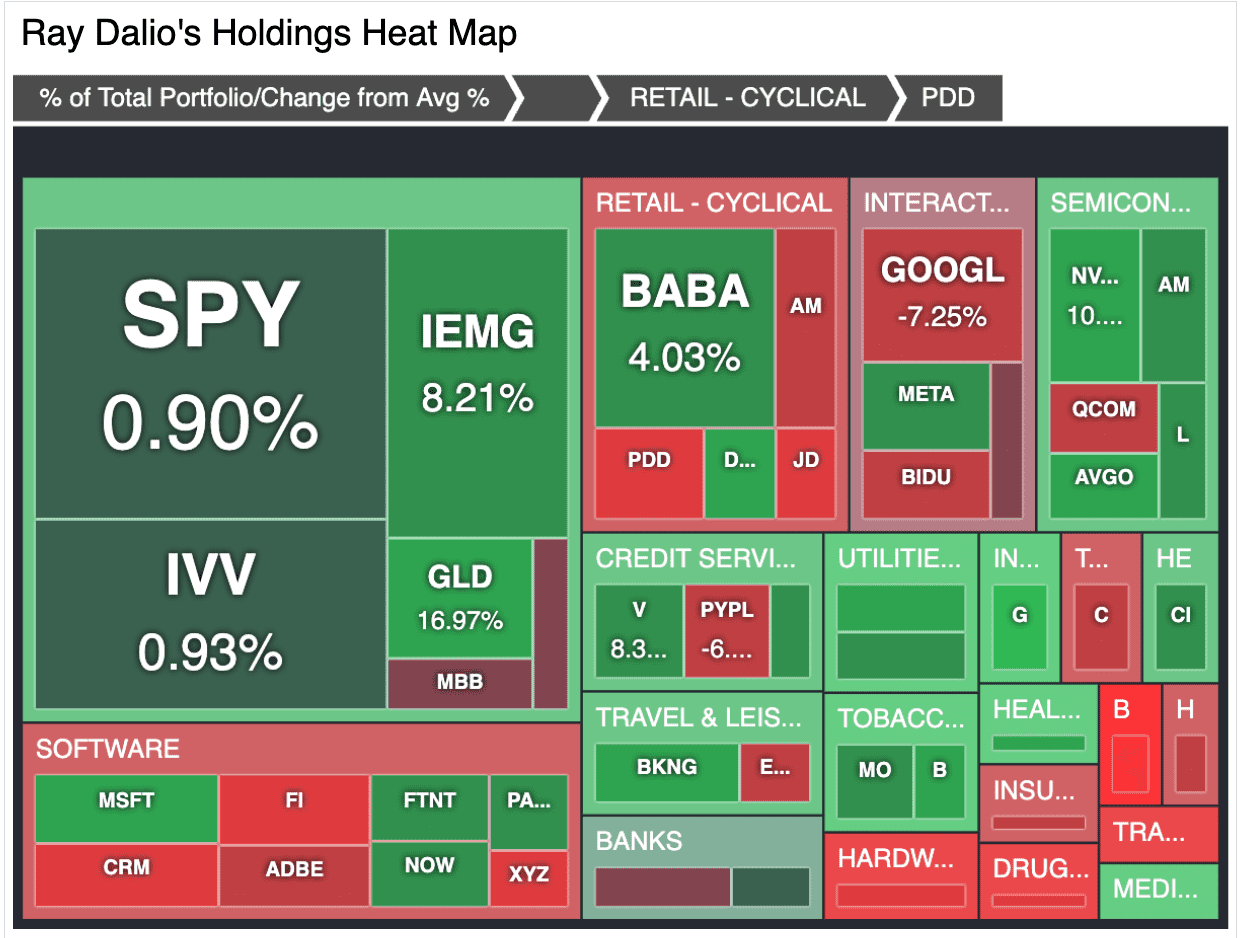

Dalio's top bets illustrate a combination of beta capture and opportunistic alpha. SPY and IVV (iShares Core S&P 500 ETF) account for well more than 14% of the portfolio, supporting a passive center. His conviction bet in Alibaba Group (BABA), now 3.47% of the portfolio after a 2,119% rise in shares, indicates increased optimism in Chinese e-commerce in spite of geopolitics and policy issues.

Alphabet (2.18%) lost 15.99% and reflected a conservative approach to the theme of large-cap U.S. tech in the face of AI monetization challenges. However, Dalio remains most exposed to the theme through NVIDIA (1.43%), Microsoft (1.41%), and Salesforce (1.30%). Booking Holdings (1.43%) and SPDR Gold Shares (1.48%) complete the list, reflecting a blend of consumer cyclical rebound and hard-asset hedging.

Performance Track Record: Outperforming the S&P through Vitenas

Bridgewater's theoretical portfolio return since March 31, 2025, is quite divergent from the S&P 500. While the S&P has straggled with flat to slightly negative returns, Dalio's portfolio skyrocketed almost 40% in Q2 before falling into a steady ~30% outperformance range. This is an indication that Dalio's move into international, commodities, and defensively geared names is playing the role of ballast, and in a few instances, a tailwind, during a turbulent market cycle.

This outperformance, in particular since the beginning of April 2025, is consistent with gold strength, emerging markets, and selective technology names, affirming the multi-asset, global macro underpinnings of Bridgewater's approach.

Macro Themes and Strategic Alignment

Dalio's allocations reflect fundamental macro beliefs:

- Inflation hedging in gold (GLD) and commodities

- Resurgence in emerging markets through IEMG (4.75%) and Alibaba

- Technological selectivity, preferring established platforms such as NVIDIA, Microsoft, and Booking over speculative small-cap gems

- ETF core exposure, offering liquid, broad market access while releasing capital to implement tactical tilts

In trimming SPY quite heavily, however, Dalio is not getting rid of U.S. exposure, just repositioning. In contrast, noteworthy fresh exposures in ServiceNow (NOW), Baidu (BIDU), and JD.com represent a contrarian bent: hitting AI scale-ups and Chinese tech turnaround plays in a doubtful world.

Conclusion: A Tactical Overdrive in a Global Macro Portfolio

Ray Dalio's 2025 portfolio is a study in global macro execution on a grand scale. With 664 names, one might expect diversification to be achieved through dilution but instead is accomplished through precision, aligning ETFs, emerging market wagers, AI-connected U.S. tech, and hedges in the form of gold and metals.

Through high turnover and pointed reallocations, Dalio's data-driven, disciplined system persists in extracting alpha in an environment where most active managers trail behind. To investors observing Dalio in 2025, the message is unmistakable: macro continues to count, and disciplined breadth can shine even brighter in chaotic times.

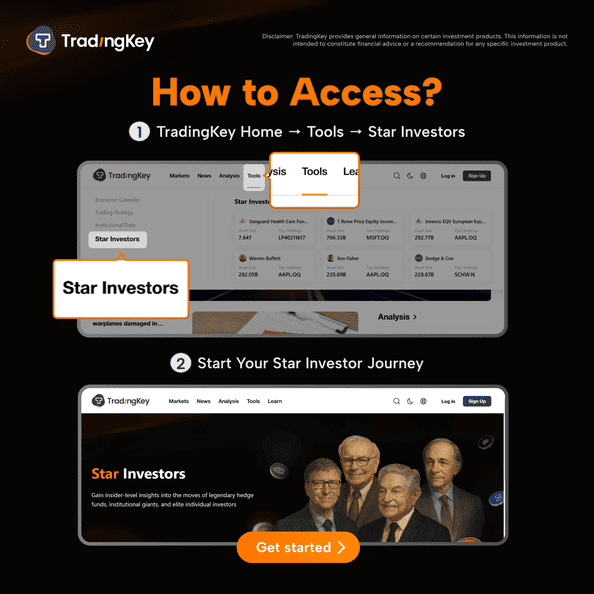

Get started now