Is Applied Digital Stock a Buy?

Key Points

AI requires high levels of computing capacity, increasing demand for neoclouds.

Applied Digital's facilities have been set up to support neocloud vendors.

The company took on debt to fund the buildout of its data centers, and isn't profitable.

- 10 stocks we like better than Applied Digital ›

Artificial intelligence (AI) technology promises to impact many industries, and it's already doing so in the data center sector. AI systems are housed in data centers, and demand for space in these facilities has exploded.

This trend is a boon for data center owners such as Applied Digital (NASDAQ: APLD). As a result, the company's stock is up nearly 500% over the past 12 months through the week ended Jan. 30, with shares hitting a 52-week high of $42.27 that same week.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Data centers fall under the AI infrastructure market, and forecasts predict this industry will see spectacular growth from $59 billion in 2025 to $356 billion by 2032. Could this mean it's now time to invest in Applied Digital? Taking a deeper dive into the company can answer that question.

Image source: Getty Images.

Applied Digital's AI opportunity

Founded in 2021, Applied Digital is pursuing a new market opportunity. AI's emergence led to the birth of cloud computing vendors known as neoclouds, a key customer category for the company.

Neoclouds specialize in the substantial computational capabilities and requisite hardware, referred to as "compute," vital to training and operating artificial intelligence models. The need for ever-increasing compute capacity requires advanced semiconductor chips, sophisticated liquid cooling systems, high-speed connections, and other costly equipment.

Moreover, AI energy demand is immense and growing. According to the U.S. Department of Energy, this trend could cause an electricity shortage by 2030. Applied Digital plans for these factors in its facilities, including ample energy capacity, and boasts that less than 10% of competitors can support AI's energy demands. This makes its data centers attractive to neoclouds.

The company has locations in North Dakota and other parts of the country. It's actively expanding as well, breaking ground on a new site in January, which is expected to go live in 2027.

A look into Applied Digital's financials

Applied Digital's tremendous sales growth indicates that its data centers are bringing in customers. In its fiscal second quarter (ended Nov. 30), sales reached $126.6 million, an impressive 250% increase from the prior year. The company's revenue growth looks likely to continue. Neocloud CoreWeave is one of its major customers, signing leases worth about $11 billion over a 15-year term.

In addition, Applied Digital is more than just a data center landlord. It's also a neocloud provider. It owns cloud computing operations that it's spinning off into a separate company called ChronoScale Corporation. ChronoScale will deliver AI compute to hyperscalers, the large tech conglomerates keen on computing power as they construct some of the biggest AI models on the planet. ChronoScale will compete directly with CoreWeave, and this part of Applied Digital's business is profitable. The division exited fiscal Q2 with sales of $18.4 million and operating income of $14.7 million.

However, overall, Applied Digital is losing money. Constructing and supporting data centers designed for AI is expensive. The company's fiscal Q2 cost of revenue totaled $100.6 million, up 344% year over year. After operating expenses, Applied Digital recorded an operating loss of $31 million. The sum is more than double the loss of $12.8 million incurred in 2024.

Moreover, the data center landlord needed to load up on debt to finance the construction of new AI-enabled facilities. It exited fiscal Q2 with debt exceeding $2.6 billion. This represents a massive increase over the $688 million in debt from the prior year.

To buy or not to buy Applied Digital stock

If Applied Digital continues to accumulate debt, the company could be headed for financial trouble, especially since this increases the interest it's paying, and its operations are already struggling to make a profit.

That said, if it can acquire additional clients locked into long-term leases, Applied Digital gains more predictable rental income. Once it gets past the initial high costs of establishing AI data centers, the company could transition into a profitable business over time.

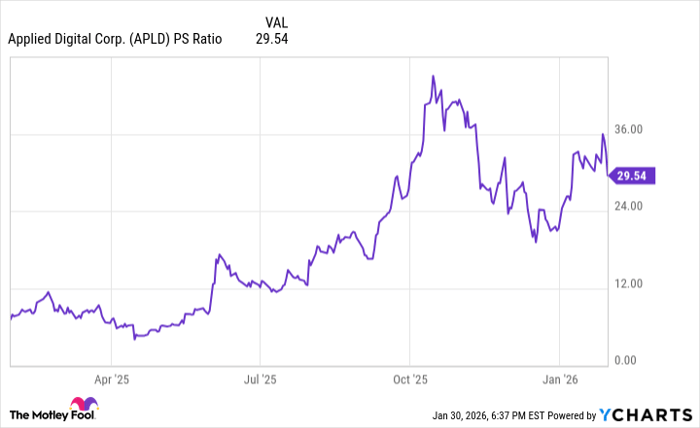

But before deciding whether to buy shares, another factor to consider is share price valuation. The price-to-sales (P/S) ratio, which measures how much investors are paying for every dollar of trailing-12-month revenue, can be used to assess its stock's value since Applied Digital isn't profitable.

APLD PS Ratio data by YCharts. PS Ratio = price-to-sales ratio.

The chart shows Applied Digital's sales multiple is on an upswing in 2026 and is higher than it's been for much of the past year, suggesting its valuation is on the expensive side. Therefore, now isn't the ideal time to buy. Instead, wait for the share price to drop before deciding to invest. Even then, Applied Digital's high debt and lack of profits make its stock only for investors with a high risk tolerance.

Should you buy stock in Applied Digital right now?

Before you buy stock in Applied Digital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Applied Digital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $446,319!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,137,827!*

Now, it’s worth noting Stock Advisor’s total average return is 932% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 3, 2026.

Robert Izquierdo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.