Is Micron the Next Nvidia?

Key Points

Nvidia's valuation has soared throughout the artificial intelligence (AI) revolution thanks to its leading position in the GPU market.

Hyperscalers are accelerating their capex budgets, but not all of this spend is going toward GPUs anymore.

Growing AI workloads is fueling new demand for memory and storage chips.

- 10 stocks we like better than Micron Technology ›

When OpenAI publicly launched ChatGPT on Nov. 30, 2022, Nvidia's (NASDAQ: NVDA) market cap was just $345 billion. Today, Nvidia is the most valuable company in the world -- worth a staggering $4.6 trillion.

The catalyst behind Nvidia's meteoric ascent was its first-mover advantage in high-performance chipsets, called graphics processing units (GPUs). Three years into the artificial intelligence (AI) revolution, however, a new gold rush is forming.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Generative AI workloads are no longer constrained purely by raw compute and capacity needs. The new bottleneck weighing on the AI infrastructure economy is memory. Below, I'll break down why Micron Technology (NASDAQ: MU) is the chip stock you'll want on your radar as demand for high-bandwidth memory (HBM) begins to surge.

Image source: Micron Technology.

The AI memory chip market is about to go parabolic

Back in December, Goldman Sachs published a report indicating that AI hyperscalers could spend roughly $500 billion on capital expenditures (capex) in 2026. Considering Meta Platforms is guiding to spend up to $135 billion on AI capex this year, I think Goldman's forecast is already looking conservative.

On the surface, rising AI infrastructure costs might lead you in the direction of Nvidia, Advanced Micro Devices, or Broadcom as data centers continue to feature the newest GPUs, accelerators, and networking equipment. While these ideas aren't off base, there's another pocket of the chip realm that is about to go parabolic.

Next-generation products featuring agentic AI, autonomous systems, and robotics are fueling AI model training and inference deployments. From a budgeting standpoint, this means developers cannot afford to over-index spending on general-purpose chips alone.

Rather, expanding AI workloads requires enhanced memory and storage solutions. According to TrendForce, prices for dynamic random access memory (DRAM) and NAND chips could increase by as much as 60% and 38%, respectively, over the coming months.

These dynamics allow Micron to command enormous pricing power as customers race to procure HBM solutions to complement their existing chip stacks.

Could Micron be the new Nvidia?

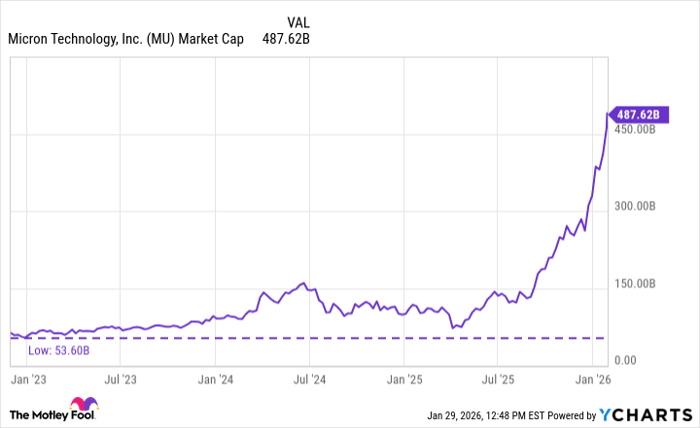

Three years into the AI revolution, Micron's market cap has surged almost tenfold. However, investors can see that most of the company's valuation expansion has occurred over just the last six months.

MU Market Cap data by YCharts

Even after such a meteoric rise, Micron's valuation is absurdly reasonable -- sporting a forward price-to-earnings (P/E) multiple of just 14. Companies that dominate adjacent pockets of the AI chip and data center market trade at forward P/E ratios that are double or even triple that of Micron.

Given its current market cap relative to where Nvidia traded at ChatGPT's launch, I can't help but draw a comparison between the two companies. With that said, perspective is important, and it's crucial to understand that Micron stock has already experienced a historic run-up.

This is all to say that Micron may not surge 10x from here and become the "next Nvidia." However, given the secular tailwinds fueling its growth, I do think Micron is on the cusp of having an "Nvidia moment" and could experience another breakout.

Should you buy stock in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $450,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,171,666!*

Now, it’s worth noting Stock Advisor’s total average return is 942% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 2, 2026.

Adam Spatacco has positions in Meta Platforms and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Goldman Sachs Group, Meta Platforms, Micron Technology, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.