If a Stock Market Crash Is Coming in 2026, There's a Major Silver Lining for Investors

Key Points

The stock market can be unpredictable, but there are a few warning signs investors may want to watch.

Investing in the right places is key to surviving a bear market or recession.

While downturns are intimidating, they can also create new opportunities for investors.

- These 10 stocks could mint the next wave of millionaires ›

Stock prices are still surging, but with some prominent market indicators flashing warning signs, investors may need to start preparing for a downturn.

To be clear, no one knows exactly when the next slump will begin or how severe it will be. But downturns are a normal part of the stock market's cycle, so it's inevitable that we'll face another bear market or recession eventually. Rather than trying to avoid it, it's wise to plan ahead. Here's how.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Will the stock market crash in 2026?

The short answer is that nobody knows. But a couple of stock market indicators suggest a pullback could be on the table.

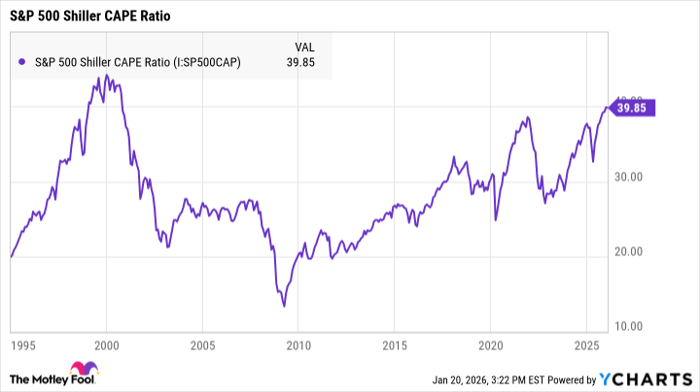

The Shiller CAPE ratio measures S&P 500 performance against the average inflation-adjusted earnings over the past 10 years, and it's often used to help determine whether the market is under- or overvalued. This metric has averaged between 20 and 25 over the last couple of decades, but as of this writing, it sits at close to 40.

Historically, a much higher-than-average ratio has been followed by a market pullback. The last time the CAPE ratio was close to this level was during the lead-up to the dot-com bubble burst in the early 2000s, when it neared 45.

S&P 500 Shiller CAPE Ratio data by YCharts

But the CAPE ratio isn't the only market indicator signalling a warning. The Buffett indicator -- popularized by legendary investor Warren Buffett -- is also a metric to watch.

The Buffett indicator measures the ratio between total U.S. market capitalization and GDP, and it was famously used by Warren Buffett to predict the onset of the dot-com bubble burst. A higher ratio signals that the market may be overvalued, and Buffett specifically noted that if it reaches 200%, investors are "playing with fire." As of this writing, the Buffett indicator metric is at just under 223%.

What does this mean for investors?

No stock market indicator will be 100% accurate, especially in the short term. The CAPE ratio and the Buffett indicator have been at above-average levels for a while now, and if you'd stopped investing as soon as they began climbing, you'd have missed out on significant gains.

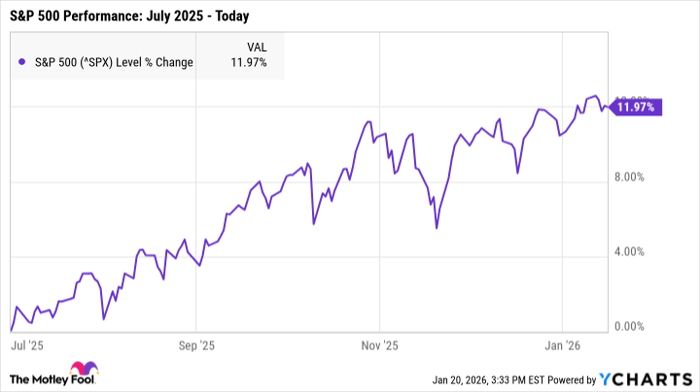

The Buffett indicator, for example, most recently exceeded 200% in July 2025. Since then, though, the S&P 500 has surged by close to 12%.

^SPX data by YCharts

In other words, while these market indicators can be alarming, that doesn't mean you should necessarily stop investing. It is smart, however, to be careful about where you buy.

The silver lining for investors

Market downturns are daunting, but they're also among the best buying opportunities for investors. Falling stock prices can make it far more affordable to load up on quality stocks, giving your wallet a break from the record-high prices we've seen in recent years.

Rather than waiting for a downturn to hit to decide where to buy, it's wise to plan ahead and come up with a list of stocks you're interested in now. That way, you'll be ready to pull the trigger as soon as prices drop. Proper research is key, though, to ensure you're buying stocks that are likely to withstand volatility and deliver positive long-term returns.

Weak companies are more likely to crash hard during a downturn, as we saw during the dot-com bubble burst. While many of those organizations' stock prices had been soaring, fundamental issues like weak business models made it impossible for them to survive.

Perhaps the best move you could make right now, then, is to ensure you're only investing in strong companies with healthy underlying fundamentals. No matter when the next downturn begins, quality stocks are far more likely to thrive over time.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 930%* — a market-crushing outperformance compared to 192% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

See the stocks »

*Stock Advisor returns as of January 22, 2026.

Katie Brockman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.