Silicon Valley Legend Jason Calacanis Just Said No One Will Even Remember Tesla's Cars. Investors Should Be Focusing on This $10 Trillion Artificial Intelligence (AI) Opportunity Instead.

Key Points

Tesla has been talking about building artificial intelligence (AI) services for years.

One of the company's most scrutinized endeavors is a humanoid robot called Optimus.

Calacanis says Optimus will be more revolutionary than Tesla's contributions to the automobile industry.

- These 10 stocks could mint the next wave of millionaires ›

Jason Calacanis is one of Silicon Valley's most interesting personalities. Unlike many of his peers, Calacanis didn't rise to fame as a partner at a prestigious venture capital (VC) firm or co-founding a world-renowned start-up.

Rather, the investor's roots were rather modest. In the early 2000s, Calacanis started his own blogging business. Just two years after its launch, AOL acquired the blog for a reported $25 million.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

During the past two decades, Calacanis has evolved from a relatively unknown entrepreneur to one of the most successful investors in modern day Silicon Valley. Although he's backed a number of unicorns, two of Calacanis' most famous moves were angel investments in both Uber Technologies and Robinhood Markets.

Given his track record, I think it's fair to say that Calacanis knows a thing or two about transformative technologies. Recently during an interview, the entrepreneur turned investor had the following to say about Tesla's (NASDAQ: TSLA) ambitions in the world of artificial intelligence (AI):

🦾"NO ONE IS GOING TO REMEMBER THAT @Tesla MADE A CAR, THEY WILL ONLY REMEMBER THE @Tesla_Optimus ROBOT AND @elonmusk IS GOING TO MAKE A BILLION OF THEM" @Jason 🦿

-- Matthew Donegan-Ryan (@MatthewDR) January 15, 2026

Jason Calacanis, who famously never name drops, reluctantly name drops that he visited the Optimus studio 2 Sundays... pic.twitter.com/Qv3HC73JAI

Those are some bold predictions. Considering Calacanis has a direct line to Elon Musk, something most analysts on Wall Street could only hope for, could he actually be right? Let's dig into why Optimus is imperative for Tesla's evolution from automobile manufacturer to AI hopeful.

What is Tesla Optimus?

Optimus is a general-purpose humanoid robot designed to complement humans in the labor force. Similar to the technology integrated into Tesla's vehicles, Optimus leverages computer vision, neural networks, and software to become autonomous in real-world settings.

Optimus is important for the next generation of Tesla. For now, the company remains a car and battery storage business -- constrained by consumer purchasing habits and highly regulated markets.

At scale, Optimus can drive Tesla beyond the sustainability market and into the world of physical artificial intelligence (AI) and robotics.

Image source: Tesla.

Why are humanoid robots important for the evolution of AI?

At the moment, AI is largely a digital frontier. Large language models (LLMs) such as ChatGPT have redefined how information is acquired and transferred across corporate workflows.

However, in the long run, AI has the ability to become completely integrated into society -- interacting with humans in a truly physical sense.

When it comes to smart devices, companies like Amazon and Alibaba have been using robotics in their warehouses and logistics centers for years. The natural extension beyond these heavier, more industrial-sized machines is to develop something akin to an actual factory worker.

This is where Optimus comes into play. Through extensive AI training and inference investments, Tesla can build a machine learning protocol that, in theory, makes Optimus capable of performing the same tasks as a human in just about any environment.

In the long run, robotics enthusiasts are calling for technology such as Optimus to be present in manufacturing, retail, hospitality, and even households -- assisting people with basic chores and administrative tasks.

Is Tesla the best AI stock to buy?

Musk himself has said that Optimus could potentially be a $10 trillion business -- far surpassing anything the electric vehicle (EV) segment could ever hope to achieve. Although this figure may seem outlandish, it actually could make sense.

If humanoid robots are able to have an accretive impact on the global labor force, companies could be looking at enormous levels of recurring cost savings and unprecedented efficiency. While these ideas might make pouring into Tesla stock tempting right now, there are some caveats smart investors should know about.

First, everything discussed about Optimus in this analysis is both blue-sky and theoretical. There is no guarantee that Tesla will execute on this mission. Moreover, it will take years -- more likely decades -- for Tesla to reach a critical scale of production for Optimus even if the technology proves valuable.

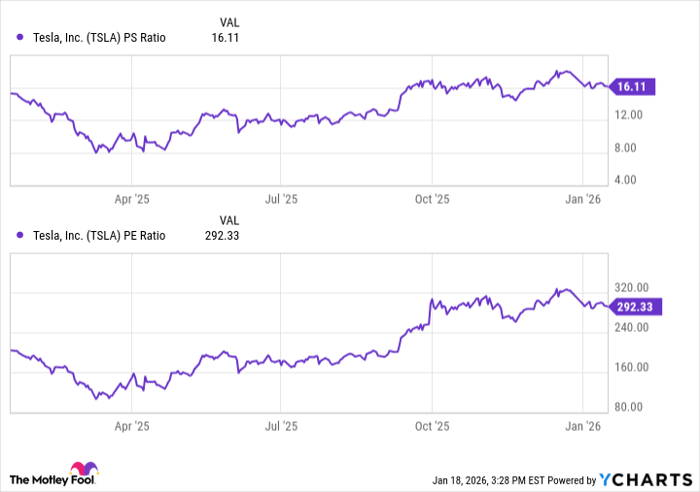

In addition, growth investors are pricing Tesla stock close to perfection right now.

TSLA PS Ratio data by YCharts

During the past year, Tesla has experienced significant valuation expansion. And yet, the company's core business -- sales of EVs -- is in decline. The profile above suggests that investors are overwhelmingly bullish on the upside that AI will have on the company. In reality, Tesla has delivered virtually nothing on this front yet.

To me, Optimus remains a moonshot. While I find Calacanis' rhetoric interesting, I won't go as far as to say it's encouraging. There are a lot of unknowns about Tesla's future in the AI landscape. For this reason, I do not see Tesla as the best AI opportunity in the market right now.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $461,865!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,932!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $470,587!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, available when you join Stock Advisor, and there may not be another chance like this anytime soon.

See the 3 stocks »

*Stock Advisor returns as of January 22, 2026.

Adam Spatacco has positions in Amazon and Tesla. The Motley Fool has positions in and recommends Amazon, Tesla, and Uber Technologies. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.