Should You Buy the "Magnificent Seven" Laggards in 2026?

Key Points

Several stocks in the Magnificent Seven underperformed the broader market in 2025.

Investors have been concerned about the valuations of AI stocks and sizeable AI-related capital expenditures.

However, many still believe the Magnificent Seven will benefit tremendously from the AI revolution.

- 10 stocks we like better than Apple ›

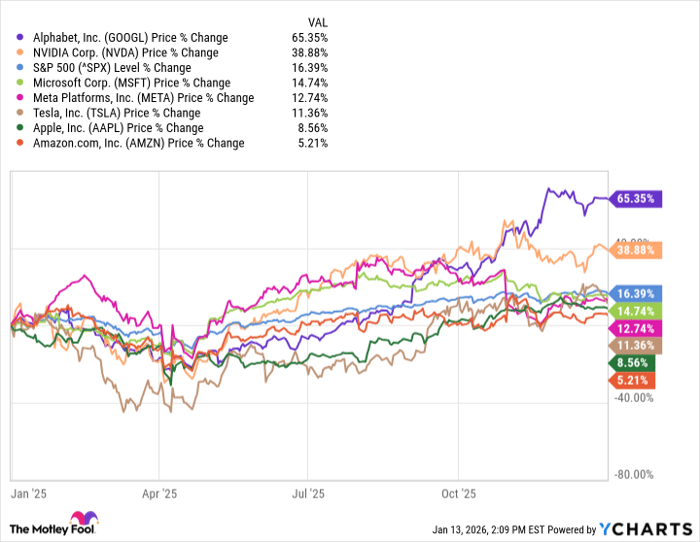

While the "Magnificent Seven" received considerable attention in 2025, only two of the seven stocks actually outperformed the broader benchmark, the S&P 500. Toward the end of the year, investors grew concerned about high valuations, other factors that could slow the development of artificial intelligence (AI), and the substantial amount of money companies were investing in AI infrastructure.

Investors often look to buy underperforming stocks, banking on a potential rebound. Should they look to buy the laggards of these seven leading tech stocks as 2026 kicks off?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Why the laggards struggled last year

Only two Magnificent Seven stocks -- Alphabet and Nvidia -- beat the broader market last year. Alphabet, the parent company of Google, overcame concerns over a U.S. Department of Justice lawsuit and competition from AI, while Nvidia powered through geopolitical concerns, including a complete halt to its business in China, as well as concerns about increasing competition.

Data by YCharts.

The two big underperformers last year were the consumer tech company Apple (NASDAQ: AAPL) and the large e-commerce and cloud player Amazon (NASDAQ: AMZN). Both were significantly affected by President Donald Trump's tariffs and trade war with China, which at times led to each country imposing extraordinarily high tariff rates against the other.

Apple manufactures most of its iPhones in China, but has also begun to diversify production to India and Vietnam. Trump imposed high tariffs on each of these countries. Many of Amazon's products are also manufactured abroad, particularly in China, where many third-party sellers are also based.

From a more company-specific perspective, investors were disappointed in Apple's lack of an AI strategy, while every other Magnificent Seven stock seemed to be motoring ahead with large AI capital expenditures (capex) and product plans. Conversely, investors got concerned about Amazon's plans to spend about $100 billion in capex last year, mostly for AI-related projects. Investors are unclear whether these large AI infrastructure investments will pay off, and over what time frame.

Are the AI laggards investable?

The good news for Apple is that not investing heavily in AI capex turned into an advantage toward the end of last year, when investors began to sour on such grand spending. The road for AI is unclear and may not be linear. There is significant demand, but the world may not have sufficient resources to support both the demand and the infrastructure projects.

This creates multiple paths by which Apple stock can win. If the market remains concerned about AI capex, Apple may outperform because it hasn't committed to as much spending yet.

There's also a good chance that the company will find an effective AI strategy, and the market will reward the stock. Wedbush tech analyst Dan Ives believes it will strike a big partnership with Google's large language model Gemini that could result in a significant licensing fee.

The Trump administration may provide more relief on tariffs this year or more exemptions, making it easier for companies like Amazon to operate. The company has been investing heavily in robotics and automation, particularly at its warehouses, and analysts see clear upside that the market may not be fully factoring in.

In a research note, Morgan Stanley analyst Brian Nowak wrote that the company could realize as much as $4 billion in annual cost savings by 2027, based on reports that it plans to launch 40 next-gen robotics warehouses by then. That could also be just the beginning of efficiencies created by automation.

Amazon is also the global leader in cloud market share, making it an obvious beneficiary of AI. The stock trades at 35 times its trailing-12-month earnings, which is well below its five-year average.

Ultimately, I think investors can buy the two Magnificent Seven laggards. There's also some degree of safety in these names, considering the amount of earnings and free cash flow they generate, and the fact that they are not solely reliant on AI.

Should you buy stock in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $487,089!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,139,053!*

Now, it’s worth noting Stock Advisor’s total average return is 970% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 14, 2026.

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.