If the Stock Market Crashes in 2026, There's 1 Vanguard ETF I'll Be Stocking Up On

Key Points

Nobody knows where the market is headed, but it's wise to start preparing for a downturn just in case.

ETFs require little effort on your part, but they can help you generate hundreds of thousands of dollars or more.

Staying invested for the long haul is key to surviving periods of volatility.

- 10 stocks we like better than Vanguard S&P 500 ETF ›

The stock market has been thriving in recent years, but some investors worry that the next downturn is around the corner. While nobody can say what stocks will do in the short term, a market slump is inevitable at some point.

If the market takes a turn for the worse in 2026, it will be more important than ever to ensure you're investing in quality stocks and funds. Shaky companies will struggle to rebound from a bear market or recession, while healthy organizations are far more likely to experience long-term growth. And there's one Vanguard ETF I will be stocking up on and holding for as long as possible.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

A powerhouse ETF that also offers stability

If you're looking for an exchange-traded fund (ETF) that can help you earn hundreds of thousands of dollars or more while still protecting your finances, the Vanguard S&P 500 ETF (NYSEMKT: VOO) is one of the most popular funds out there.

This ETF tracks the S&P 500 (SNPINDEX: ^GSPC), meaning it includes all of the stocks within the index and aims to mirror its performance over time. The S&P 500 contains stocks from 500 of the largest and strongest U.S. companies, many of which are industry leaders.

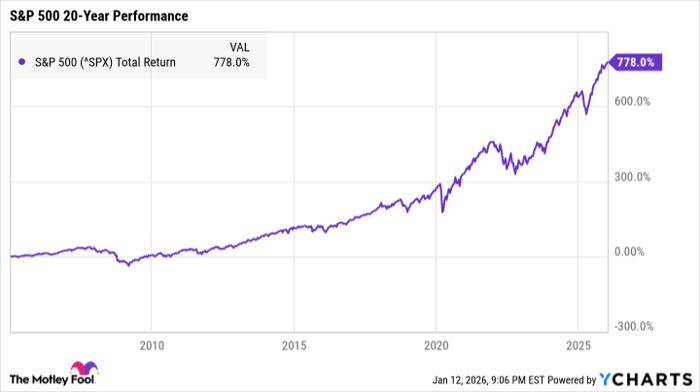

Investing in an S&P 500 ETF can be a fantastic way to limit risk during periods of volatility. The index itself has survived countless recessions, bear markets, corrections, and crashes throughout its history, going on to see positive total returns over decades.

^SPX data by YCharts

In fact, long-term investors have historically had a tough time losing money with this type of investment. Analysts at Crestmont Research examined the S&P 500's rolling total returns, and they found that every single 20-year period ended in positive gains.

This means that if you'd invested in an S&P 500-tracking fund at any point and held it for 20 years, you'd have made money. Of course, the market may experience significant volatility in that time. But by riding out the storm and staying invested for at least a decade or two, you're extremely likely to see positive total returns with an S&P 500 ETF.

Generating long-term wealth

If you'd invested $5,000 in the Vanguard S&P 500 ETF just 10 years ago, you'd have more than quadrupled your money with over $21,000 in total by today. But it's possible to earn even more by making small, consistent contributions.

Since its inception in 2010, this ETF has earned an average rate of return of close to 15% per year. Historically, though, the S&P 500 has earned a compound annual growth rate of around 10%. If you were to invest $200 per month, here's approximately how that would add up in both scenarios:

| Number of Years | Total Portfolio Value: 10% Avg. Annual Return | Total Portfolio Value: 15% Avg. Annual Return |

|---|---|---|

| 15 | $76,000 | $114,000 |

| 20 | $137,000 | $246,000 |

| 25 | $236,000 | $511,000 |

| 30 | $395,000 | $1,043,000 |

| 35 | $650,000 | $2,115,000 |

Data source: author's calculations via investor.gov.

If the Vanguard S&P 500 ETF continues earning returns in line with its 10-year average, it's possible to accumulate well over $1 million within a few decades. But even if it earns slightly lower average returns, you could still build a portfolio worth several hundred thousand dollars with minimal effort on your part.

Nobody knows what the market will do in 2026, but the Vanguard S&P 500 ETF is a powerful fund with a history of surviving rough patches. With enough time and consistency, you could earn more than you might think.

Should you buy stock in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $487,089!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,139,053!*

Now, it’s worth noting Stock Advisor’s total average return is 970% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 14, 2026.

Katie Brockman has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.