The Top Stocks to Buy With $50,000 for 2026

Key Points

Taiwan Semiconductor is a key supplier in the AI buildout.

Amazon's financial success largely depends on the performance of its cloud computing wing.

Alphabet is emerging as a generative AI leader.

- 10 stocks we like better than Taiwan Semiconductor Manufacturing ›

If you've got $50,000 that you're looking to invest during 2026, I've got a few stocks that you should consider. Even if you don't have that much to deploy, smaller investments in these three stocks would allow retail investors to benefit from where the market looks to be heading. Taiwan Semiconductor (NYSE: TSM), Amazon (NASDAQ: AMZN), and Alphabet (NASDAQ: GOOG) all have strong chances to outperform in 2026.

Image source: Getty Images.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Taiwan Semiconductor

Taiwan Semiconductor is a key provider of the high-end chips being deployed in the artificial intelligence (AI) infrastructure buildout. Without its foundry capabilities, we wouldn't have the AI tech that we know today.

The investment thesis for Taiwan Semiconductor is fairly simple: Over time, the world will use more chips and more advanced ones. The truth of that premise is fairly obvious if you look at the trends in the tech sector's spending forecasts.

All of the AI hyperscalers set new records on capital expenditures in 2025, and all of them have said they expect to break those capex records in 2026. This money is being used to purchase land, build data centers, and fill them with the cutting-edge computing hardware required to handle generative AI workloads. Because it is the world's largest third-party foundry operator, Taiwan Semiconductor is manufacturing a major share of the chips going into those data centers, and that hardware isn't cheap.

Every time a new data center is constructed, TSMC gets a slice of the spending. With the data center buildout expected to accelerate in 2026 and beyond, Taiwan Semiconductor makes for a strong investment.

Amazon

Amazon is one of those companies constructing data centers for its cloud computing unit, Amazon Web Services (AWS). AWS is the most popular cloud computing option. It's also a major client of Taiwan Semiconductor through some of the chips that it purchases.

AWS provides 66% of Amazon's total operating profits, so as AWS goes, so goes Amazon.

Fortunately for Amazon shareholders, AWS grew revenue at a 20% clip during Q3 -- its fastest rate in several years. With AWS growing rapidly and established as a critical partner for many AI-focused businesses, I think Amazon will be a great stock to invest in during 2026.

Alphabet

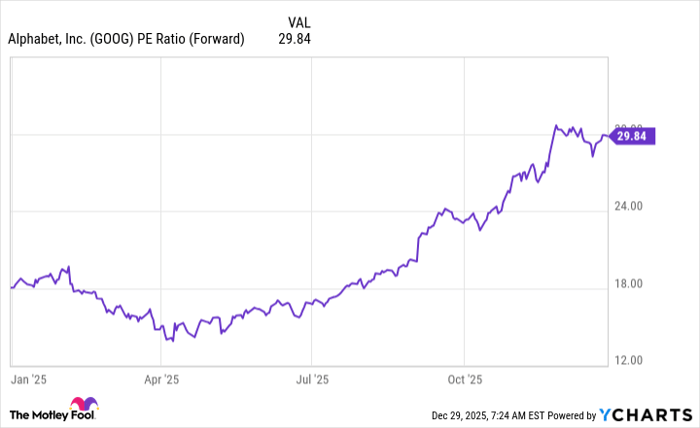

Alphabet shares had an incredible 2025, rising by around 65%. That performance isn't likely to be repeated in 2026, as part of it came as the result of the stock starting the year undervalued due to a cluster of concerns.

GOOG PE Ratio (Forward) data by YCharts.

Now, it's trading at 30 times forward earnings, a valuation in line with its peers. This means the bulk of Alphabet's stock performance from here will be driven by its business growth, which is trending upward. In Q3, Alphabet reported a strong performance across the board. Revenue rose 16% year over year, and diluted earnings per share (EPS) increased by 35%.

Even Google Search, the most mature part of Alphabet's business, experienced revenue growth of 15%. This indicates how strong the advertising market is, and as long as that market stays healthy, I have no reason to doubt that Alphabet will be a profitable stock pick in 2026.

Furthermore, Alphabet has emerged as a leader in the AI realm, thanks to its popular large language model, Gemini. If Alphabet can continue to push boundaries and innovate, it will have a unique cost advantage. Alphabet can afford to keep prices on its models low to beat the competition, which may allow it to become the dominant AI model over the long term. We won't have a clear answer about how that will play out anytime soon, but it's a trend to keep an eye on.

Though it won't repeat 2025's performance in 2026, Alphabet still looks like one of the top stocks to buy right now.

Should you buy stock in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $505,641!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,283!*

Now, it’s worth noting Stock Advisor’s total average return is 974% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 3, 2026.

Keithen Drury has positions in Alphabet, Amazon, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Amazon, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.