Is There a Future for The Metals Company?

Key Points

The Metals Company plans to harvest polymetallic nodules from the Pacific Ocean.

Its future hinges on gaining regulatory approval to mine nodules commercially.

- 10 stocks we like better than TMC The Metals Company ›

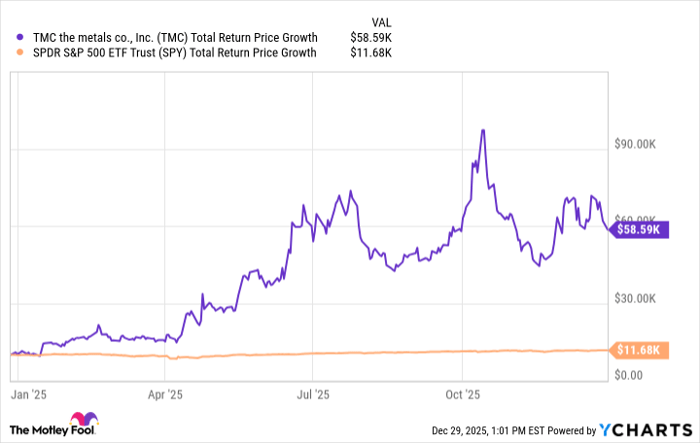

The Metals Company (NASDAQ: TMC) was one of the market's best-performing stocks in 2025. Indeed, if you had invested $10,000 in TMC last year, your shares would be worth about $58,600 today, assuming you held on to them.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

TMC Total Return Price data by YCharts

That's a huge gain, and not one you typically see from a mining stock. Add in TMC's pre-revenue status and its lack of a commercial license, and it's clear the hype behind this company has outrun its fundamentals.

Does TMC have a future, though? A monstrous gain like this predisposes investors to expect something momentous in the near term. And when you look at TMC's current situation, it's pretty obvious what that momentous "something" is.

TMC has a future if it can do this one thing

Everything about TMC boils down to a single outcome: gaining a commercial license for deep-sea mining. Right now, TMC does not have regulatory approval to send its robotic vacuums to harvest polymetallic nodules off the Pacific Ocean seafloor. Indeed, the company has been waiting for years for the International Seabed Authority (ISA) to finalize a rulebook under which it can gain such an approval.

The hope is that the ISA will create this rulebook and approve TMC's operations. That would allow the company to turn its multibillion-dollar treasure trove of nodules into sales before the company sinks under the weight of its own hefty operational costs.

Image source: The Metals Company.

On that note, TMC reported a $55.4 million operating loss in the third quarter of 2025, against a net loss of $184.5 million.

Some good news, however: TMC has been pursuing an alternative path to commercialization through the U.S.' National Oceanic and Atmospheric Administration (NOAA). The Trump administration has been supportive of deep-sea mining, and it could mean TMC moves into a commercial phase faster than anything the ISA could guarantee.

Still, there are a lot of unknowns, and TMC's future isn't guaranteed. Investors should tread carefully and size positions in TMC with more caution than exuberance.

Should you buy stock in TMC The Metals Company right now?

Before you buy stock in TMC The Metals Company, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and TMC The Metals Company wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $505,641!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,283!*

Now, it’s worth noting Stock Advisor’s total average return is 974% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 2, 2026.

Steven Porrello has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.