My 3 Favorite Stocks to Buy Right Now

Key Points

The consumer staples sector is out of favor with investors.

I sold my holdings in Clorox and Hormel to capture tax losses, with plans to repurchase them both in early 2026.

I added to General Mills, leaning into the consumer staples downturn.

- 10 stocks we like better than General Mills ›

There are a lot of moving parts when you manage a portfolio and, sometimes, you have to make tough strategic decisions. That even includes your favorite stocks.

As 2025 draws to a close, I made some significant moves, including selling Hormel (NYSE: HRL) and Clorox (NYSE: CLX), and buying more shares of General Mills (NYSE: GIS). Here's why all three are favorites of mine right now.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Taxes made me do it

I sold shares of a real estate investment trust (REIT) in early 2025, leading to gains in my taxable account. I used the proceeds to put cash into a Roth retirement account and then repurchased shares in the same REIT. I did this because REIT dividends are taxed as earned income in a taxable account, but avoid all taxation if you own them in a Roth account. It was a strategic decision that will help to lower my taxes today and in the future.

However, the sale resulted in capital gains. To help offset those gains, I captured losses I had in Hormel and Clorox. This way, I won't owe any capital gains taxes on the REIT. I can't buy either of these stocks again for at least 30 days, or I'll run afoul of the wash sale rule, which would eliminate the tax benefit of the losses I harvested.

To maintain my exposure to consumer staples, I purchased additional shares of General Mills. I still had a profit on that investment, but the dividend yield had returned to the levels at which I first bought shares, back in mid-2018. Clearly, I like General Mills enough to buy it. My ultimate goal is to repurchase Hormel and Clorox in early 2026, once the wash sale rule is no longer an issue.

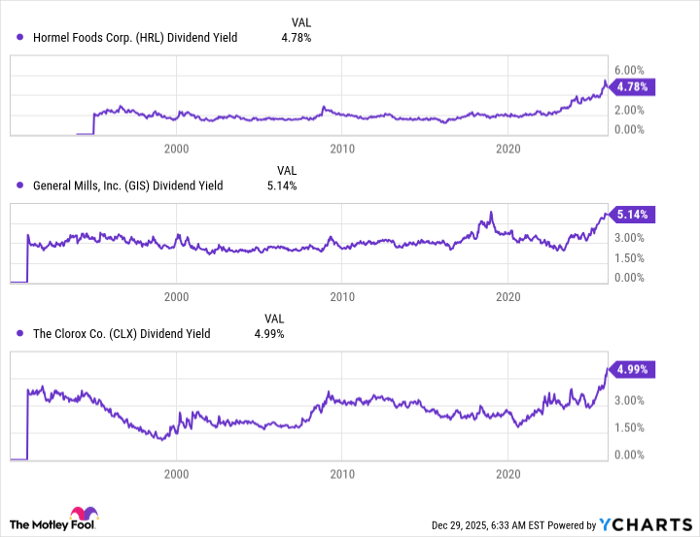

HRL Dividend Yield data by YCharts

These are three of my favorite stocks right now

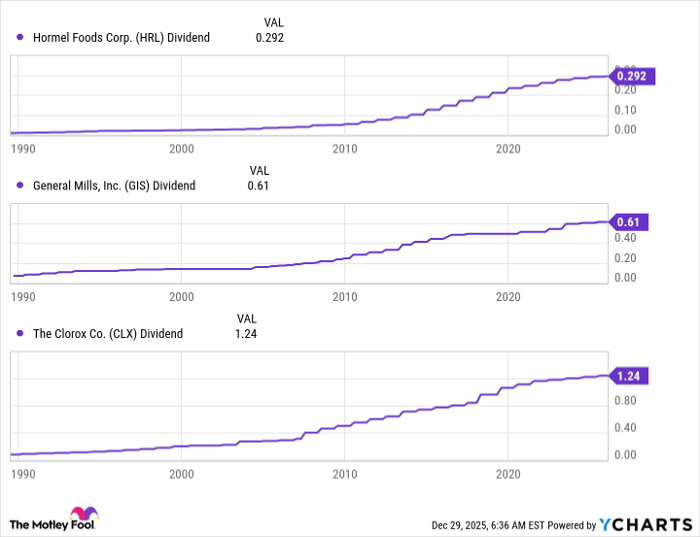

One of the big reasons I like this trio of consumer staples companies is that each one has a historically high yield. Earnings tend to be highly volatile, but dividends are generally quite consistent over time. Thus, you can use dividend yield as a rough gauge of valuation. Notably, Hormel is a Dividend King, Clorox's dividend streak is closing in on the 50-year mark, and General Mills' dividend has generally trended higher over time, though it hasn't been increased every single year.

HRL Dividend data by YCharts

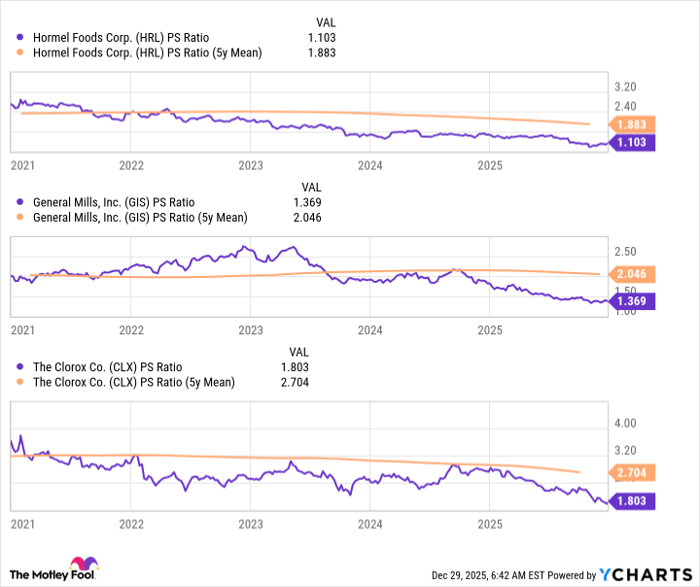

Simply put, these are highly reliable dividend stocks that Wall Street has marked down to a bargain based on their historically high yields. To support this view, each company's price-to-sales ratio is below its five-year average. Sales tend to be more consistent than earnings over time, so I generally favor the P/S ratio over the price-to-earnings ratio. That said, only Hormel's P/E ratio is above its five-year average.

HRL PS Ratio data by YCharts

To be fair, each of these consumer staples makers is facing down industrywide headwinds. Additionally, each company has its own idiosyncratic risks. However, they are all long-term survivors, as indicated by their strong dividend histories. Currently, Wall Street appears to be focused on the short-term trends of consumers tightening their belts (and purchasing lower-priced products) and a general shift toward healthier food options.

The fact that consumer tastes change and, sometimes, consumers are more price-conscious than usual, is a normal fact of life in the consumer staples sector. General Mills, Clorox, and Hormel are all working to adjust, focusing on areas such as innovation, cost management, and acquisitions to keep pace with shifting consumer trends. That's not unusual; it's the go-to playbook for consumer staples companies.

I'm leaning into consumer staples right now

Essentially, I believe the consumer staples sector is in the Wall Street doghouse because investors are thinking short-term. I'm trying to play the long game, which I call time arbitrage (I borrowed that term from someone else, but I've forgotten the source). I leaned in with General Mills. I'm hoping to take strategic advantage of the market's negative view of Clorox and Hormel for tax purposes. My guess is that I'll have plenty of time to buy them back in 2026, since the negative view here is unlikely to change in a month. All in, I'm very fond of all three, even though I've sold two of the stocks and only bought one.

Should you buy stock in General Mills right now?

Before you buy stock in General Mills, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and General Mills wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $505,749!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,149,658!*

Now, it’s worth noting Stock Advisor’s total average return is 979% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 31, 2025.

Reuben Gregg Brewer has positions in General Mills. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.