3 Reasons to Buy Target Stock Like There's No Tomorrow

Key Points

Target's results have been disappointing, but the business remains solid.

Management and the board of directors haven't ignored the problems the company faces.

The retail sector has always had to deal with mercurial consumer buying preferences.

- 10 stocks we like better than Target ›

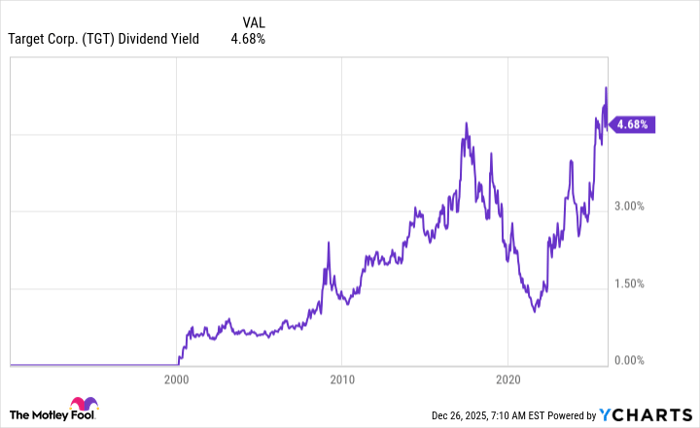

Target (NYSE: TGT) is one of the largest retailers in the United States. It is a Dividend King and has a lofty 4.7% dividend yield. If you have a contrarian bent, you might want to buy this out-of-favor retailer today. If you wait until some future tomorrow, you might miss out on the opportunity.

Here are three reasons why you shouldn't get too caught up in today's bad news.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

1. Target's situation isn't as bad as it looks

Target is a giant retailer with nearly 2,000 stores across the United States. In the third quarter alone, it generated $25 billion in revenue. This is a very substantial business.

Image source: Getty Images.

That said, revenue was off by 1.5% year over year, and same-store sales were down 2.7%. Those aren't great numbers, but they don't indicate that shoppers have totally abandoned the company. It is more of an indication that Target is out of step with current consumer trends (more on this below).

Meanwhile, the trailing 12-month dividend payout ratio is approximately 50%. There's no question that Target is not hitting on all cylinders right now, but the car is still running. Sure, it's running a little rough, but that's different from a car that's rusting out in the backyard.

2. Target is moving to fix what ails it

The point is really that Target's engine needs some fine-tuning, not a complete overhaul or replacement. To that end, the board of directors has taken action. It recently brought in a new CEO to breathe some fresh air into the company's approach. The management team, meanwhile, has announced an all-hands-on-deck call, with a team created to help focus the turnaround effort.

This is what you would expect a company to do when it faces hard times. Note that even well-run companies face hard times, eventually. The best companies find a way to deal with the inevitable headwinds they face. If history is any guide, Target will weather the current storm. That's highlighted by the over five decades worth of annual dividend increases this Dividend King has provided to its shareholders.

A company can't build a dividend history like that by accident. It requires a strong business plan that gets executed well in both good times and bad. Now is a bad time, and the company is making the types of choices you would expect a good company to make.

3. Target's approach is likely to come back into favor again

One of Target's biggest problems right now is likely the shift in consumer buying habits. Rising costs have customers tightening their purse strings. That's a significant benefit for companies focused on selling at low prices, like Walmart and Dollar General. However, Target's approach is to offer a more upscale shopping experience.

A nicer shopping experience costs more to create. Nicer products cost more to buy. It isn't that Target is a high-end retailer, but for consumers who are trying to pinch pennies, trading down to value retailers is an easy budgeting solution. Target will likely lean into value, but it can't avoid its more premium image.

Data by YCharts.

This isn't the first time something like this has happened; the leadership in the retail industry often shifts based on consumer buying trends. It is highly likely that, eventually, consumers will return to Target's stores in a move to trade back up to a more desirable shopping experience.

Target is a turnaround story

There is no way to sugarcoat it: Target is struggling compared to its closest peers. It recognizes that fact and is working on a turnaround. There is no overnight fix. And yet, if you wait too long, you may find you have missed the opportunity to buy a Dividend King while it has a historically high yield. You'll need to have a contrarian bent to buy Target, but if you do, history suggests it could be the type of stock you want to load up on while other investors are running for the exits.

Should you buy stock in Target right now?

Before you buy stock in Target, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Target wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $504,994!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,156,218!*

Now, it’s worth noting Stock Advisor’s total average return is 986% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 26, 2025.

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Target and Walmart. The Motley Fool has a disclosure policy.