Why the Future of AI Compute is in Space: 2026 Investment Guide

Preface: Terrestrial Computing Bottlenecks and the Policy Breakthrough

As Artificial Intelligence enters the era of large-scale model competition, computing demand is encountering an unprecedented depletion of "physical dividends." Tech giants are currently being pushed to the brink by the most primal physical constraints: power supply and cooling efficiency. A milestone in this shift is Microsoft’s recent announcement to restart the Three Mile Island nuclear plant, which had been decommissioned for over 20 years, specifically to address energy gaps.

According to Goldman Sachs forecasts, global data center power demand will surge by 160% by 2030. As land resources, environmental approvals, and energy replenishment become a "cage" for AI evolution, sharp-eyed pioneers have shifted their coordinates toward Low Earth Orbit (LEO). On December 18, 2025, the Executive Order "Ensuring American Space Superiority" was signed. This is not merely a geopolitical gambit; it represents the first set of "birth permits" issued by the White House for a "Space Silicon Valley." In 2026, space data centers will officially transition from a sci-fi concept into a trillion-dollar incremental track for the US stock market.

1. Escaping Earth: The Second-Order Dividends of Space Data Centers

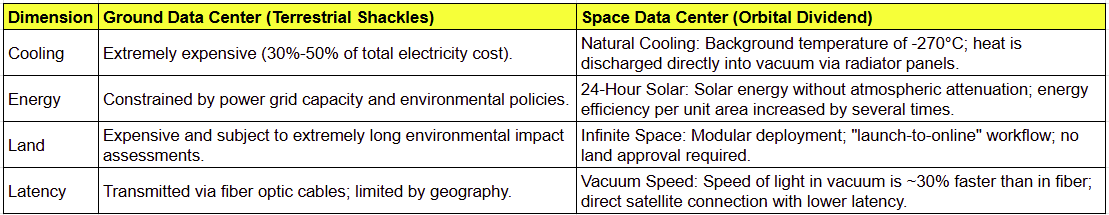

While launching servers into orbit appears costly, a "second-order thinking" approach reveals that the long-term dividends provided by the laws of physics will deliver a "dimensionality reduction strike" (disruptive advantage) to terrestrial operating efficiency.

- Cooling: From "Heavy Burden" to "Natural Dividend"

In terrestrial environments, approximately 30%–50% of data center power consumption is dedicated to fans and liquid cooling systems. In orbital space, the background temperature is near absolute zero, creating a massive natural cold storage. High heat generated by server operations can be discharged directly into the vacuum via radiator panels, effectively reducing cooling costs to zero.

- Energy: Chasing "Never-Setting" Power

Terrestrial power supplies are highly constrained by grid loads and increasingly stringent environmental policies. In contrast, orbital space offers 24-hour uninterrupted solar power. Without atmospheric obstruction or attenuation, energy efficiency per unit area is several times higher than on the ground, achieving true energy autonomy and purity.

- Land: Breaking "Terrestrial Shackles" with Administrative Efficiency

- Terrestrial Bottlenecks: Site selection for land-based data centers is not only expensive but faces agonizingly slow Environmental Impact Assessment (EIA) approvals and complex land acquisition processes. Furthermore, giant server farms often compete with local residents for limited water and electricity resources, driving up social costs.

- Space Advantages: Space offers infinite deployment capacity. Utilizing modular designs, these systems feature "launch-and-live" capabilities, completely bypassing tedious land-use permits. This flexible deployment model allows the expansion of computing facilities to break free from the constraints of geographic boundaries and administrative red tape.

- Latency: Physical Suppression via the Speed of Light in Vacuum

The laws of physics dictate that the speed of light in a vacuum is approximately 30% faster than in fiber optic cables. This means that through direct links with Low Earth Orbit (LEO) satellite networks like Starlink, space data centers may actually outperform traditional transoceanic subsea cables in latency when processing globalized real-time data.

2. 2026 Investment Map: A Deep Dive into Leading Targets Across Five Dimensions

In the "Space Silicon Valley" landscape, investors should focus on the complete closed-loop—from "Launch Payload" to "Application Monetization."

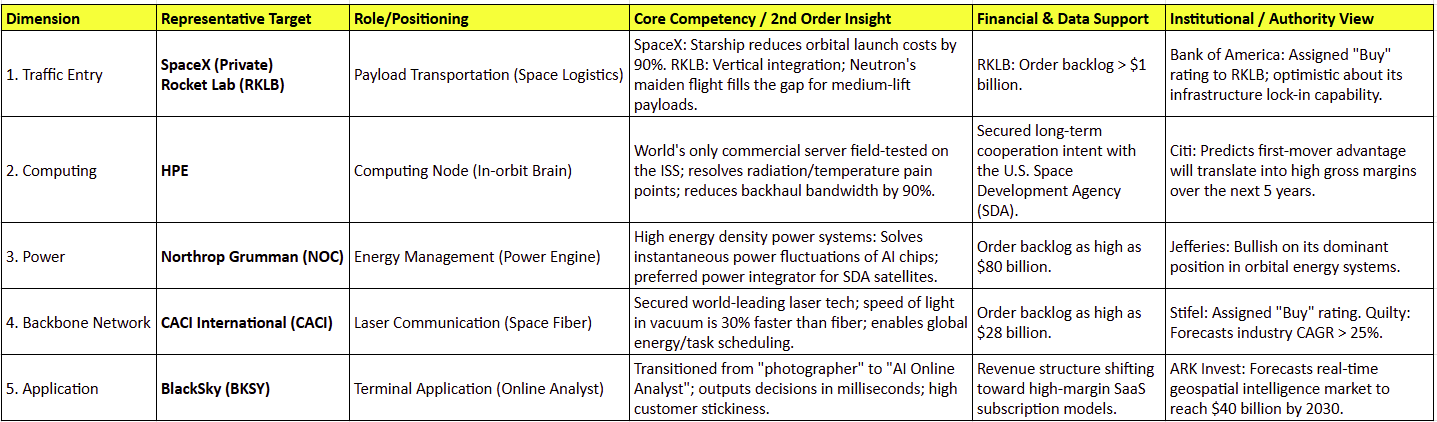

- Traffic Entry: The Absolute Premium of Payload Transportation

SpaceX (Private) & Rocket Lab (RKLB) Launch capability is not just transportation; it is the "traffic entry point" for this entire sector.

- SpaceX: Its core logic lies in utilizing Starship to reduce orbital insertion costs by 90%. Once the cost per kilogram drops below $200, space data centers will achieve superior cost-performance ratios compared to terrestrial ones. The anticipated SpaceX IPO is expected to be the catalyst for a valuation reset across the entire sector in 2026.

- Rocket Lab (RKLB): This is the most elastic "pure play" available in the secondary market.

- Core Moat: Possesses formidable vertical integration capabilities, manufacturing not only rockets but also satellite buses and components.

- Financial Support: Current order backlog has surpassed $1 billion.

- Key Catalyst: The 2026 maiden flight of the Neutron rocket will fill the gap for medium-lift payloads. RKLB is locking in the underlying architecture of space data centers through its integrated "Launch + Satellite Platform" solution.

- Computing Mothership: The Monopolist of In-Orbit Edge Computing

Hewlett Packard Enterprise (HPE) is no longer a traditional legacy hardware vendor; in the field of space computing, it is a leader with "exclusivity." Its Spaceborne Computer-2 is currently the world’s only commercial-grade computing system field-tested on the International Space Station (ISS). This system can process raw data directly in orbit, reducing backhaul bandwidth requirements by 90%. Following policy mandates for "in-orbit data processing," HPE has secured long-term intent from the Space Development Agency (SDA). Citi analysts predict its first-mover advantage will translate into high gross margins over the next five years.

- Power Heart: Energy Storage and Balancing Systems

AI chips are "power-hungry beasts" with extremely high instantaneous power consumption; orbital operations require exceptionally stable energy dispatch systems. As the "chief architect" of space energy systems, Northrop Grumman (NOC) has developed "ultra-high energy density" power systems specifically designed to handle the violent power fluctuations during AI model inference. Northrop dominates SDA satellite bidding with a backlog exceeding $80 billion. Unlike startups, its profits stem from stable national security strategic investments, making it the "defensive cornerstone" of this track.

- Backbone Network: Optical Inter-Satellite Links

If computing is the heart, the network is the nervous system. CACI International (CACI) has solved the "clustering" challenge of making hundreds of satellites work in synergy. Optical Inter-Satellite Links (OISL) make distributed computing possible. Through CACI’s technology, data can be transmitted in milliseconds from nodes in the "shadow zone" (no power) to nodes on the "sunlit side" (with power) for processing.

Stifel has issued a "Buy" rating, primarily because CACI is a core provider for the SDA's "Transport Layer." With a $28 billion backlog, CACI is capturing guaranteed "digital tolls" by setting the communication protocols.

- Application Monetization: Real-Time Geospatial Intelligence

All infrastructure must eventually culminate in the application layer. BlackSky (BKSY) is the most direct beneficiary of space computing. While traditional satellite companies are merely "photographers" (taking days to analyze returned images), BlackSky is leveraging in-orbit computing to transform into an "Online Analyst." It can complete AI decision-making the moment the satellite passes over a target, outputting conclusions directly to governments or hedge funds.

ARK Invest predicts this market will reach $40 billion by 2030. As the space data center network matures, BlackSky’s business is shifting from one-off sales to high-margin SaaS subscriptions, with a financial break-even "inflection point" expected in 2026.

3. Summary: Look to the Stars, Stay Grounded

Just as wealth shifted from dial-up to the "Cloud" 20 years ago, every time the boundaries of human productivity expand, a new generation of era-defining giants is born. Recent executive orders have only pushed the door open; AI’s greed for energy and physical space is driving capital to accelerate its migration to Low Earth Orbit. Investing is not just the monetization of knowledge—it is a vote on the trend of the future.

4. Risk Factors

- Technical Risk: Orbital environments are extreme. Hardware failure risks and data errors caused by "single-event upsets" require continuous validation.

- Policy Risk: Commercial space is highly restricted by geopolitics, defense budget approvals, and international treaties.

- Capital Risk: This sector has long R&D cycles. Some startup targets face risks of cash flow depletion and high shareholder dilution before achieving profitability.