Novo Nordisk’s First Oral Weight-Loss Drug Wins FDA Approval — How Long Can Eli Lilly Hold Its Lead?

TradingKey - In the battle for dominance in the weight-loss drug market against Eli Lilly, Novo Nordisk finally reaches a strategic turning point!

On Monday, December 22, The U.S. Food and Drug Administration (FDA) officially approved the oral tablet version of Novo Nordisk's Wegovy injection, making it the world's first approved oral GLP-1 weight-loss medication.

This breakthrough not only allowed Novo Nordisk to gain a market advantage ahead of the approval of Eli Lilly's oral weight-loss drug orforglipron, but also provided a much-needed boost to the company during its darkest period, marked by a halving of its stock price, loss of market share, and profit warnings.

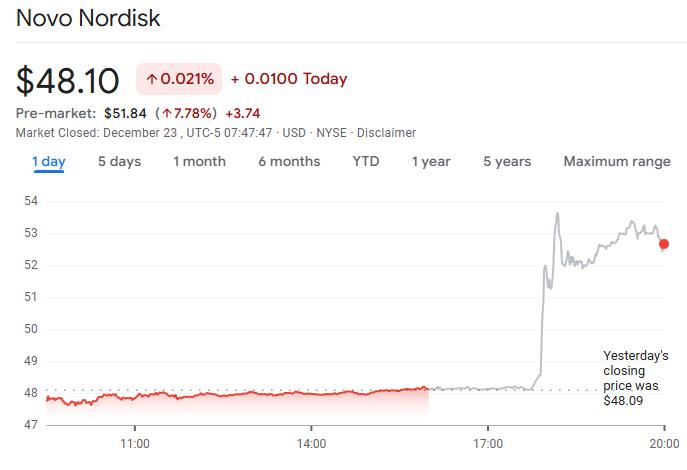

Following the approval announcement, Novo Nordisk's U.S.-listed shares rose over 7% in premarket trading.

A Crucial Battle to Regain Market Share

U.S. public health data indicates that approximately 40% of adults nationwide grapple with obesity, while a recent KFF poll reveals that about 12% of adults are currently using GLP-1 class drugs for weight management or chronic disease treatment. This vast patient population constitutes a core battlefield for pharmaceutical giants vying for market dominance.

For Novo Nordisk, 2025 is shaping up to be a challenging year, with the company's stock price having cumulatively fallen more than 44% this year.

Although it once held a first-mover advantage in the injectable weight-loss drug segment, its inability to cope with explosive demand growth led to market share erosion by competitors. Eli Lilly, with its injectable Zepbound, quickly overtook Novo Nordisk; this product has not only demonstrated superior efficacy to Novo Nordisk's Wegovy but also holds a leading position in weekly prescription volumes in the United States.

Against this backdrop, the FDA's approval of oral Wegovy is particularly crucial. Evan Seigerman, an analyst at BMO Capital Markets, noted in a report: "The approval of Novo Nordisk's GLP-1 weight-loss tablet is undoubtedly a much-needed victory for the company, especially as it has recently faced challenges in maintaining its dominant share of the incretin market."

Novo Nordisk is banking on the first-mover advantage of this oral pill to revitalize its sales performance in the U.S. market. Eli Lilly's next-generation oral weight-loss drug orforglipron could receive approval as early as the end of March, making this a critical window for Novo Nordisk.

David Moore, Executive Vice President of Novo Nordisk U.S. Operations, stated that a daily oral pill could increase interest in and usage of the medication. He disclosed that the company is manufacturing the pill in North Carolina, USA, and has been stockpiling supplies "for some time" to ensure "ample supply."

Facing the growing economic burden on global healthcare systems due to obesity, this oral therapy is expected to cover a broader range of treatment needs, offering a new solution for tens of millions of patients who have not yet received effective intervention, and is projected to drive the global weight-loss drug market to an annual size of $150 billion by the 2030s.

The Leap from Injectable to Oral

Some health experts indicate that the introduction of an oral formulation will benefit two specific patient groups: those with a psychological aversion to injections, and potential beneficiaries who do not consider their condition severe enough to warrant injectable treatment.

"There are people who are needle-phobic, people who develop 'injection fatigue,' and people who don't see themselves as sick and feel an injectable is too serious," said Zachariah Reitano, chief executive of telehealth company Ro.

"For all of them, a pill is a much easier on-ramp."

Novo Nordisk stated that the oral tablet contains 25 mg of semaglutide, which is identical to the active ingredient in injectable Wegovy and Ozempic. It will continue to be marketed under the brand name “Wegovy,” with sales of the new tablet slated to begin in the U.S. in early January.

Results from the OASIS 4 Phase 3 clinical trial provided a solid basis for the drug's clinical value. Data showed that patients taking a daily 25 mg dose achieved an average weight reduction of approximately 16.6% after a 64-week treatment period, demonstrating significant weight-loss efficacy.

A survey of healthcare practitioners' acceptance indicated high approval for the oral formulation among physicians. A recent FirstWord survey of endocrinologists and general practitioners in the U.S. and Europe found that 85% of respondents would, to some extent, prioritize prescribing oral Wegovy over its injectable counterpart.

Prior to the approval, Dave Moore, Executive Vice President of Novo Nordisk U.S. Operations, stated: “What we’ve learned through years of research is that having an oral option really kind of opens up, activates and motivates different segments to seek treatment. To have that conversation with their doctor to see if this is something that might be right for them.”

“That’s what we’re excited about — to be able to give people an option and make sure we have access and ease of access like we have been doing with our injections,” he continued.